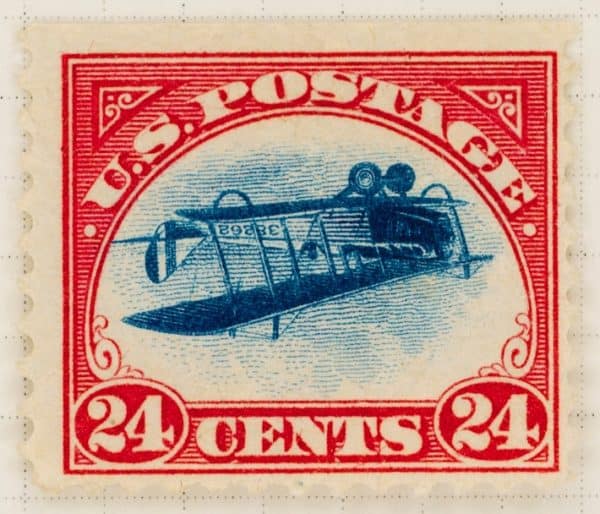

Here’s a question for all of you. Between coins, tokens, stamps, tickets, vouchers, and chips, which of these qualifies as a “security” under U.S. Securities laws? It’s actually a trick question, they all do!

Well, technically speaking, they all could potentially qualify as securities. The answer actually lies in evaluating the details of how the respective asset is created, marketed and sold to purchasers. Recently the SEC has released some substantive guidance on how to actually analyze those details which deserves a deeper analysis.

______________________

BACKGROUND

On April 3, the SEC took a big step forward in clarifying its position regarding digital assets by putting forward two separate releases. The first of these releases was a No-Action Letter (the “NAL”) pertaining to the issuance of tokens by TurnKey Jet, Inc. (“TKJ”). The second release was the announcement of “Framework for ‘Investment Contract’ Analysis of Digital Assets” (the “Framework”) to help determine whether a digital asset is a security and therefore subject to U.S. federal securities laws. Combined these two releases define some much-needed guide rails in analyzing whether a particular digital asset qualifies as a security. However, some industry professionals (including myself) believe that certain of the included substantive factors may be a bit over encompassing.

In any case, anyone who is looking to issue, and even those who have already issued, digital assets need to read and fully understand the guidance provided in these two releases to make sure they stay on the right side of the SEC.

ANALYSIS OF TURNKEY JET NO-ACTION LETTER

The TKJ NAL was issued by the SEC’s Division of Corporation Finance and represents the SEC’s first official No-Action letter pertaining to the issuance of digital assets. Without getting into a ton of detail as to the specifics of the subject offering (details can be found in the original request letter), the proposed offering essentially boiled down to the issuance and sale of certain tokens of TKJ which: (a) would be acquired/held/transferred within a closed network; (b) would each have a face value of $1; and (c) could later be used/redeemed for air charter services provided by providers within the network.

The TKJ NAL was issued by the SEC’s Division of Corporation Finance and represents the SEC’s first official No-Action letter pertaining to the issuance of digital assets. Without getting into a ton of detail as to the specifics of the subject offering (details can be found in the original request letter), the proposed offering essentially boiled down to the issuance and sale of certain tokens of TKJ which: (a) would be acquired/held/transferred within a closed network; (b) would each have a face value of $1; and (c) could later be used/redeemed for air charter services provided by providers within the network.

TKJ’s counsel put together a detailed argument as to why the subject tokens should not be deemed securities by analyzing the factors of the Howey Test (as discussed below), and those in certain other applicable cases as noted in the original request letter, against the specific details of the subject proposed token offering.

While I encourage everyone to read the entirety of the arguments presented by TKJ’s counsel in the original request letter (if for no other reason than because I had to), spoiler alert, the SEC ultimately accepted the presented arguments and determined the subject tokens were NOT securities. In making that determination it relied primarily on the following factors (as noted in the NAL):

- No funds from the sale of the subject tokens would be used to pay for the development of the platform/network where the tokens would be acquired/traded;

- The platform/network where the tokens would be acquired/traded would be fully developed and operational prior to the offering/sale of the subject tokens and the cost of creating platform/network;

- The subject tokens would be immediately usable for their intended functionality (i.e. purchasing air charter services) at the time they are sold;

- Acquisitions/transfers of the subject tokens would be expressly limited to permitted members of the company’s platform/network (i.e. no external acquisition/trading);

- Each subject token would at all times be sold at a fixed $1 and represent an obligation to supply an equal $1 of services;

- If the company were to offer to repurchase any of the subject tokens, it would only do so at a discount to the face value of the subject tokens (unless a court otherwise ordered the liquidation of the subject tokens); and

- Each token would be marketed/sold in a manner that emphasizes its functionality and not the potential for the increase in its market value.

In reading above it should be clear that what the SEC is attempting to isolate are some of the primary factors it believes makes the subject tokens strictly “utility” based as opposed to investment based.

Generally speaking, based on the NAL the SEC is taking the view that a token (or whatever digital asset) is not a security if the token is primarily intended to have a consumptive value (i.e. be used/traded for goods/services), if the token is marketed/sold based on its utility and not as an investment, and if the framework on which the subject token lives is private and fully paid for (or at least paid for with outside funds) and operational prior to the offering and sale of the subject tokens.

I intentionally generalized the above statements to make it easier to see that pattern.

It should be noted that while the NAL provides some strong guidelines as to what the SEC will look at in determining whether a particular digital asset is a utility or investment based, and such guidance is good to finally have, the NAL (like all No-Action Letters) is not binding law and may not be relied upon by anyone other than TKJ.

Put another way, just because a particular issuer thinks that their respective digital asset is in technical compliance with the handful of factors discussed above does not mean that the SEC will ultimately make the same determination with respect to the offering/sale of such digital asset.

Each offering must be evaluated on a case by case basis and must be looked at not only in light of the above-described factors but all other available guidance. This would include all of the additional guidance put forward in the Framework discussed below.

ANALYSIS OF THE FRAMEWORK

As noted above, the Framework was released concurrently with the release of the NAL. The Framework, which was created by the SEC’s Strategic Hub for Innovation and Financial Technology (i.e. “FinHub”), is specifically intended to be a “framework for analyzing whether a digital asset is offered and sold as an investment contract, and, therefore, is a security.”

As stated in the introduction:

A threshold issue is whether the digital asset is a “security” under [U.S. securities laws]. The term “security” includes an “investment contract,” as well as other instruments such as stocks, bonds, and transferable shares. A digital asset should be analyzed to determine whether it has the characteristics of any product that meets the definition of “security” under the federal securities laws. In this guidance, we provide a framework for analyzing whether a digital asset has the characteristics of one particular type of security – an “investment contract.” Both the Commission and the federal courts frequently use the “investment contract” analysis to determine whether unique or novel instruments or arrangements, such as digital assets, are securities subject to the federal securities laws.

More specifically, the Framework walks readers through the application of the so-called “Howey Test” (SEC v. W.J. Howey Co., 328 U.S. 293 (1946)) to the offering and sale of digital assets and the identification of certain factors to consider when trying to determine whether the offering and sale of a particular digital asset satisfies such test; thus requiring compliance with U.S. securities laws. For clarity purposes, it should be noted that the Framework does not (and does not intend to) provide any bright-line rules.

More specifically, the Framework walks readers through the application of the so-called “Howey Test” (SEC v. W.J. Howey Co., 328 U.S. 293 (1946)) to the offering and sale of digital assets and the identification of certain factors to consider when trying to determine whether the offering and sale of a particular digital asset satisfies such test; thus requiring compliance with U.S. securities laws. For clarity purposes, it should be noted that the Framework does not (and does not intend to) provide any bright-line rules.

Noting specifically that a securities analysis needs to be performed on a case by case basis on the specific facts and circumstances surrounding the particular offering/sale of digital assets, the Framework is set up as a series of factors to consider in analyzing the respective prongs of the Howey Test in light of the subject offering/sale.

By way of background, there are typically four main prongs to the Howey Test: (1) there is an investment of money; (2) the investment is made in a “common enterprise;” (3) the investment is made with a reasonable expectation of profits; and (4) expected profits are, or are expected to be, predominantly derived from the efforts of others. For clarity, in the Framework prongs 3 and 4 are originally combined (as many analysts do) but are later analyzed separately.

Prongs 1 and 2 Assumed Satisfied.

With respect to the first two prongs, it is basically assumed in the Framework that in any offering/sale of digital assets these two prongs will be satisfied.

In particular, with respect to the first prong it states in the Framework “the first prong of the Howey test is typically satisfied in an offer and sale of a digital asset because the digital asset is purchased or otherwise acquired in exchange for value, whether in the form of real (or fiat) currency, another digital asset, or other type of consideration.”

Similarly, with respect to the second prong, the Framework simply states that “[i]n evaluating digital assets, we have found that a “common enterprise” typically exists.” The footnote further clarifies this statement by providing: “[b]ased on our experiences to date, investments in digital assets have constituted investments in a common enterprise because the fortunes of digital asset purchasers have been linked to each other or to the success of the promoter’s efforts.”

With the first two prongs being basically assumed to be satisfied, the majority of the Framework centers around providing guidance as to if/when prongs 3 and 4 will be satisfied with respect to a particular offering/sale of digital assets. I discuss these prongs, and the relevant factors provided in the Framework, in more below.

Is there a Reasonable Expectation of Profits?

As stated in the Framework:

An evaluation of the digital asset should also consider whether there is a reasonable expectation of profits. Profits can be, among other things, capital appreciation resulting from the development of the initial investment or business enterprise or a participation in earnings resulting from the use of purchasers’ funds. Price appreciation resulting solely from external market forces (such as general inflationary trends or the economy) impacting the supply and demand for an underlying asset generally is not considered “profit” under the Howey test.

The Framework goes on to lay out the following factors to consider in determining whether a “Reasonable Expectation of Profits” exists with respect to a particular offering/sale of digital assets:

- The subject digital asset gives the holder rights: (a) to share in the enterprise’s income or profits (through distribution, dividend or otherwise); and/or (b) to realize gain from capital appreciation of the subject digital asset (from appreciation based on future sales/trading or otherwise);

- The subject digital asset is transferable or traded on or through a secondary market or platform (or is expected to be in the future);

- A purchaser would reasonably expect that the issuing company’s efforts will result in capital appreciation of the subject digital asset (particularly where the subject digital asset/network is still in the development stage);

- The subject digital asset is offered broadly to potential purchasers as compared to being targeted to expected users of the goods or services of the issuing company;

- The subject digital asset is offered and purchased in quantities indicative of investment (as opposed to quantities indicative of consumption);

- There is little apparent correlation between either: (a) the purchase/offering price of the subject digital asset and the market price of the particular goods/services that can be acquired in exchange for such digital asset (if any); and/or (b) the typical trading/purchase volume of the subject digital assets and the typical volume of the particular goods/services that can be acquired in exchange for such digital asset (if any);

- The issuing company has raised an amount of funds in excess of what may be needed to establish the subject digital asset and/or the network on which it will exist;

- The issuing company is able to benefit from the offering/sale of the subject digital asset as the holder of some of the same digital assets (or other assets of the same class/right);

- The issuing company continues to expend funds (whether from its profits or from proceeds of additional sales) to enhance the functionality or value of the subject digital asset and/or the network on which it exists;

- The subject digital asset is marketed (directly or indirectly) using any of the following:

-

- The general expertise of issuing company (or any of its officers, employees, agents, etc.) and/or its ability to build or grow the value of the subject digital asset and/or the network on which it it exists;

-

- Terms that indicate (or otherwise imply) the subject digital assets is an investment and/or that the solicited purchasers/holders are investors;

-

- Terms that indicate (or otherwise imply) that the intended use of the proceeds from the sale of the subject digital asset will be used, in whole or in part, to develop subject digital asset and/or the network on which it exists;

-

- Any representation based on the future (as opposed to the present) functionality of subject digital asset and/or the network on which it exists (and/or the prospect that the issuing company will deliver such functionality);

-

- The promise (implied or explicit) that the issuing company will build a new/improved business or operation as opposed to delivering currently available goods/services;

-

- The promise (implied or explicit) or implication that: (a) a market for the trading of the subject digital asset is, or will be, available (particularly where the issuing company implicitly or explicitly promises to create or otherwise support such trading market) and/or (b) that the subject digital asset will be readily transferable; and/or

-

- Any emphasis on the potential appreciation of the subject digital asset and/or the potential profitability of the issuing company and/or the network on which the subject digital asset will exist.

As stated in the Framework, no one of the above factors is necessarily determinative alone but the more of the above which are present in connection with a particular offering/sale of digital assets the more likely it is that there is (or will otherwise be deemed to be) a reasonable expectation of profit; thus satisfying prong 3 of the Howey Test.

Are the Expected Profits To Be Derived From The Efforts Of Others?

As you can tell by the lead into this section, prong 4 of the Howey Test is dependent on there first being a reasonable expectation of profits (i.e. prong 3 is satisfied). If no reasonable expectation of profits exists with respect to a particular offering/sale of digital assets then further analysis of prong 4 is not necessary. This is why prongs 3 and 4 are often referred to collectively rather than individually. That being said, assuming a reasonable expectation of profits exists with respect to a particular offering/sale of digital assets it must be further considered whether those expected profits are, or are expected to be, predominantly derived from the efforts of others.

As you can tell by the lead into this section, prong 4 of the Howey Test is dependent on there first being a reasonable expectation of profits (i.e. prong 3 is satisfied). If no reasonable expectation of profits exists with respect to a particular offering/sale of digital assets then further analysis of prong 4 is not necessary. This is why prongs 3 and 4 are often referred to collectively rather than individually. That being said, assuming a reasonable expectation of profits exists with respect to a particular offering/sale of digital assets it must be further considered whether those expected profits are, or are expected to be, predominantly derived from the efforts of others.

As noted in the Framework, the foregoing analysis centers around the following two questions: (1) “[d]oes the purchaser reasonably expect to rely on the efforts of [the issuing company]?;” and and (2) “[a]re those efforts “the undeniably significant ones, those essential managerial efforts which affect the failure or success of the enterprise,” as opposed to efforts that are more ministerial in nature?”

To aid in making this analysis the Framework provides the following factors to consider:

- The issuing company is responsible for the development, improvement (or enhancement), operation, or promotion of the network on which the subject digital asset will exist (particularly if purchasers of the subject digital asset expect the issuing company (or its agents) to be performing or overseeing tasks that are necessary for such digital asset/network to achieve or retain its intended purpose or functionality);

- Where: (a) the subject digital asset and/or the network on which the subject digital asset will exist is still in development or otherwise not fully functional at the time of the subject offer/sale; and/or (b) purchasers would reasonably expect the issuing company to further develop (directly or indirectly) the functionality of subject digital asset and/or the network on which the subject digital asset will exist (particularly where the issuing company promises further development in order for the subject digital asset to attain or grow in value);

- There are essential tasks or responsibilities performed and expected to be performed by the issuing company (or its agents), rather than an unaffiliated, dispersed community of network users (i.e. a “decentralized” network);

- The issuing company (directly or indirectly) creates, or otherwise supports, a market for/the price of the subject digital asset; particularly where the issuing company: (a) controls the creation and issuance of the subject digital asset; and/or (2) takes other actions to support a market price of the subject digital asset (e.g. limiting supply or ensuring scarcity through buybacks, “burning,” or other activities);

- The issuing company has a lead or central role in the direction of the ongoing development of subject digital asset and/or the network on which the subject digital asset exists; (particularly where the issuing company plays a lead or central role in deciding governance issues, code updates, or validation of transactions that occur with respect to the subject digital asset);

- The issuing company has a continuing managerial role in making decisions about, or otherwise exercising judgment concerning, any of the rights the subject digital asset represents and/or the network on which the subject digital asset will exist including (among other things):

-

- Determining whether and how to compensate persons providing services to the subject network or to the entity or entities charged with oversight of the subject network;

-

- Determining whether and where the subject digital asset will trade (particularly when the liquidity of the subject digital asset is promised/implied or is otherwise expected by the purchaser);

-

- Determining who (whether internally or externally) will receive additional subject digital assets and under what conditions;

-

- Making or contributing to managerial level business decisions (in particular as to how to deploy funds raised from sales of the subject digital asset);

-

- Playing a leading role in the validation or confirmation of transactions on the subject network or in some other way having responsibility for the ongoing security of the subject network;

-

- Making other managerial judgments or decisions that will directly or indirectly impact the success of the value of the subject digital asset and/or the subject network;

- Purchasers of the subject digital asset would reasonably expect the issuing company to undertake efforts to promote its own interests and/or enhance the value of the subject digital asset represents and/or the network on which the subject digital asset will, particularly where:

-

- the issuing company has the ability to realize capital appreciation from the value of the subject digital asset (e.g. where the issuing company retains a retains a stake or interest in the subject digital asset or other asset of the same class);

-

- the issuing company distributes the subject digital asset as compensation to management and/or the issuing company ‘s compensation is tied (in whole or in part) to the price of the subject digital asset in the secondary market;

-

- the issuing company owns or controls (directly or indirectly) ownership of intellectual property rights of the subject digital asset and/or the subject network; and/or

-

- the issuing company monetizes the value of the subject digital asset (especially where the subject digital asset has limited or no functionality).

Again no one of the above factors is necessarily determinative alone but the more of the above which are present in connection with a particular offering/sale of digital assets the more likely it is that any expected profits are (or will otherwise be deemed to be) expected to be derived predominately from the efforts of others; thus satisfying prong 4 of the Howey Test.

Additional Factors

In addition to the above-discussed factors, it should be noted that the Framework also provides for certain additional factors with respect to prongs 3 and 4 to be considered in determining if and when a digital asset, which was previously sold as a security, may no longer be a security.

While good to have, these factors are beyond the intended scope of this post. Further, as these factors apply to a very limited subset of digital assets in existence today (i.e. those originally sold as securities and no longer considered securities), if any, they are not all that useful at this time.

I should also add that I find the fact that the SEC took the time to issue guidance with respect to digital assets which were previously sold as a security and not provide any specific guidance with respect to digital assets which were NOT previously sold as a security but should have somewhat telling.

This may be my interpretation, but I read the absence of specific guidance in this context indicative of the fact that the SEC will view new offerings and existing offerings in the same manner.

Put another way, there is nothing in the Framework that would lead the reader to believe that an issuer who has already issued/sold digital assets should not perform the respective analysis and/or otherwise be subject to bringing itself into compliance with applicable U.S. securities laws.

CONCLUSION

As I have said many times before, in order for the crypto/digital asset industry to reach its full potential the players need clarity as to the application (or non-application where applicable) of U.S. securities laws.

While based on previous SEC guidance it was implied that a particular crypto/digital asset could theoretically exist which would not be considered a security, until now there has been no solid guidance on what factors might be considered by the SEC in that analysis. The factors presented in both the NAL and the Framework, while not exhaustive, really help set the guardrails for analyzing whether the offering/sale of a particular digital asset should be subject to compliance with U.S. securities laws.

Now I should add that the above-discussed factors can easily come off as over encompassing or overreaching to some and I don’t entirely disagree. Particularly when it comes to a couple of the factors above which, in my opinion, the SEC appears to lend particular strength to; whether the subject digital asset/network is fully functional at the time of sale and/or whether any proceeds from the sale of the subject digital assets will be used to fund the development of the subject digital asset/network.

In reading between the lines of the NAL and Framework a bit it feels like the SEC may weigh these factors a bit more heavily than others which I don’t necessarily agree with.

In fact, I am not even certain they should be factors at all. I don’t really see any reason why a particular digital asset, if otherwise being strictly utility in nature (i.e. satisfying all of the other factors present in the NAL and otherwise not meeting the other factors relevant to the Howey Test analysis), should be otherwise considered a security simply because the particular digital asset/network isn’t fully functional at the time of sale and/or because funds from the subject offering will be used (in whole or in part) to finish such development.

In the case of TKJ for example, if the SEC determined that the tokens to be issued by TKJ were strictly “utility,” as it appears they did, the fact that the underlying network was or wasn’t functional at the time of the sale of the tokens shouldn’t have made a difference.

Taking it out of the context of securities all together, assuming a company took advance orders for let’s say brake pads and then used the proceeds received from the advanced sale of those brake pads to fund the creation of the new brake pad warehouse and the respective worker’s salaries (yes it’s the plot of Tommy Boy, so what?). Are the brake pads now considered securities? Clearly not, so I don’t see why these particular factors would help push a decision one way or another.

Notwithstanding the above, it is good to finally have some definitive guidance to refer to when evaluating digital asset offerings and there are a couple of takeaways for industry participants.

First and foremost, the guidance put forth in the NAL and the Framework is expressly NOT exhaustive. There are any of a number of additional factors or considerations that may sway the SEC in one direction or another when it comes to a particular offering.

Moreover, as noted above none of the included factors are, or will be, determinative alone and should be viewed in totality with all of the other applicable factors on a case by case based on the specific facts and circumstances surrounding the particular offering/sale of digital assets.

Second, as noted above, I read the Framework to apply equally to new issuers and to issuers who have already issued digital assets which would otherwise qualify as securities given the stated factors.

The SEC has made it clear through recent actions that it is going after issuers of digital assets who have issued/sold such digital assets in violation of applicable securities laws.

As such, any issue who issued/sold digital assets in an offering which was not otherwise compliant with U.S. securities laws, whether based on prior guidance or otherwise, should be reviewing this new guidance to see if they need to bring themselves into compliance with applicable U.S. securities laws.

Finally, and almost more importantly, the guidance put forth in the NAL and the Framework is NOT intended, nor should be taken, as a roadmap to try to structure an offering in a way that will not be subject to U.S. securities laws.

In fact, I highly recommend that anyone issuing, or looking to issue, digital assets assume from day one that the subject digital asset will be deemed a security and that the offering will otherwise be subject to applicable U.S. securities laws.

Yes, it is possible to qualify for an exemption like TKJ. However, just because a particular digital asset/offering looks and smells like that of TKJ, does not mean that the SEC will view it the same way. Accordingly, unless and until you have a no-action letter (or other binding guidance) from the SEC with respect to your particular offering you should NOT assume it will be treated the same as in the NAL just because you intentionally structure it to match the factors stated above.

Anyone looking to sell or issue digital assets in the U.S., or who has otherwise previously issued/sold digital assets in the U.S. a non-compliant offering, needs to consult with a securities attorney, plain and simple.

An analysis of the factors included in the NAL and the Framework requires professional legal assistance as does any resulting compliance with respect to applicable U.S. securities laws. There are a ton of pitfalls awaiting the unwary and orange jumpsuits await those looking to try to circumvent the laws.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate, and general corporate law. Anthony drafted the bill to allow for an intrastate crowdfunding exemption in Illinois that eventually became law.

Anthony Zeoli is a Senior Contributor for Crowdfund Insider. He is a Partner at the law firm of Freeborn in the Corporate Practice Group. He is an experienced transactional attorney with a national practice specializing in the areas of securities, commercial finance, real estate, and general corporate law. Anthony drafted the bill to allow for an intrastate crowdfunding exemption in Illinois that eventually became law.