For years, there has been a discussion regarding the initial public offering (IPO) conundrum. Back in the day, smaller investors could join alongside institutional money to capture wealth in an IPO. Today, too frequently, that is simply not the case. The big money has been made by HNW investors and venture capitalists long before a listing on an exchange. An IPO has become more of an exit opportunity for the rich to cash in as retail gets caught holding the bag when the music stops.

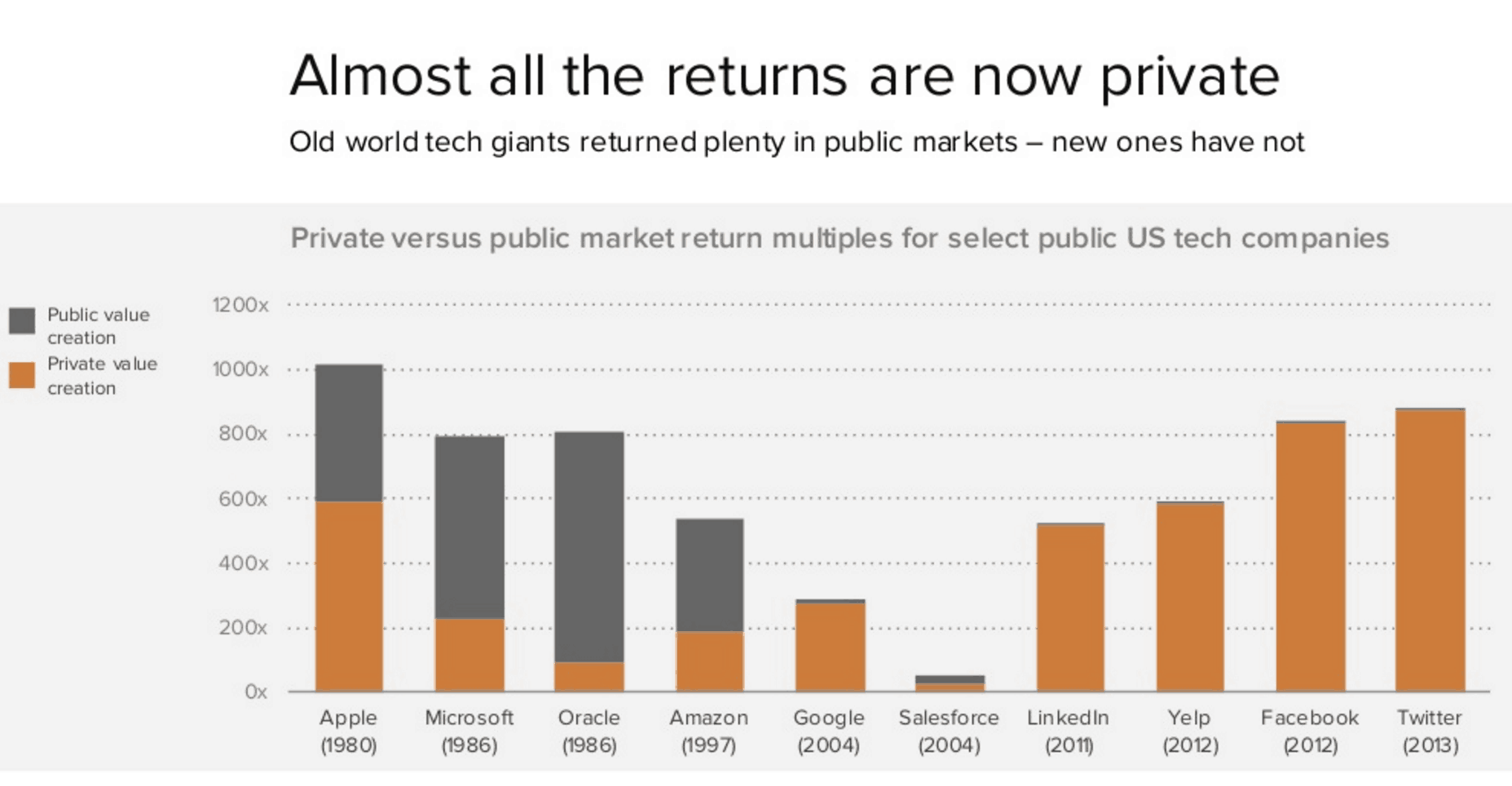

Several years ago, Andreessen Horowitz produced a powerful graph visually depicting the phenomenon.

Recent examples of IPOs like Uber (NASDAQ:UBER) and Lyft (NASDAQ:LYFT) have highlighted the fact that the IPO trap appears to be ongoing.

Uber recently IPOed at a per share price of $45. Today, it trades around 10% lower than its offering price meaning the valuation of the entire company took a significant hit. At one point, Uber traded at just $36/share but has since recovered a bit.

Lyft priced its IPO at $72/share. Today it trades at less than sixty bucks representing a material loss for anyone who was willing to purchase the shares at the offering price.

So what’s going on? Are markets broken?

Nope. Not at all.

Smart money learned long ago how to jump ahead of the investor queue to drive returns higher. Big money is constantly surveying the early stage landscape to cherry pick the best investments to generate outsized returns. While not every investment is a home run the few winners can offset any of the dogs by quite a lot. The market is working perfectly it is just skewed to give preference to the opportunity to the already rich.

For promising young firms going public makes absolutely no sense at all. The cost is high and the value is low.

Crowdfund Insider recently reported on Fintech Unicorn Transferwise raising almost $300 million at a valuation of $3.5 billion. A year and a half earlier, Transferwise was valued at less than half of that.

Taavet Hinrikus, TransferWise’s co-founder and chairman, admitted that “back in the old days” they would be public by now. The new reality is that going public is not necessary – until you are compelled to do it.

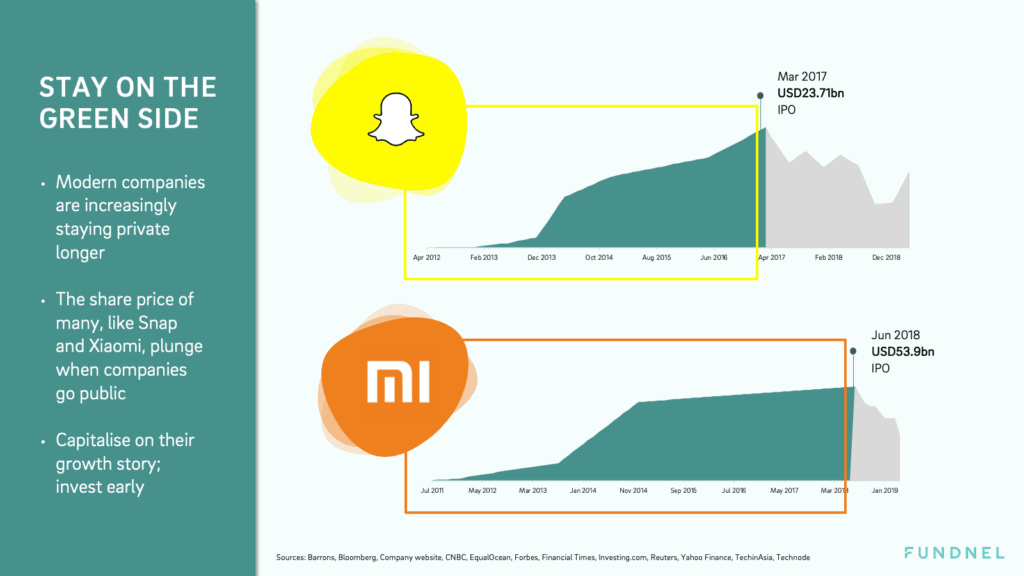

Last week, Crowdfund Insider saw an interesting email from Singapore based crowdfunding platform Fundnel. Fundnel stated that the recent round of IPOs unveiled a truth about the capital market: “private investors gained a hefty share of the pie, leaving little for their public counterparts.” Companies are staying private longer as there is plenty of private capital available.

“This consequentially lowers the desirability of the costly and lengthy process of an IPO,” said Fundnel. They recommended investors to capitalize on the “green side” of the valuation curve by investing early in promising young firms.

We asked Fundnel, why IPOs have become more of an exit than an entry point? Kelvin Lee, co-founder and CEO of Fundnel had this to say:

We asked Fundnel, why IPOs have become more of an exit than an entry point? Kelvin Lee, co-founder and CEO of Fundnel had this to say:

“The amount of dry powder held by private equity continues to soar year-on-year, with an increasing amount of capital being injected by financial institutions, corporations, and individuals, flushing the private market with liquidity. With more than sufficient capital to go around, private companies no longer feel pressured to launch an IPO for the sole purpose of raising funds. Consequentially, valuation optimization and price discovery happens from the first institutional investor round (Series A) to pre-IPO rounds; public market investors that enter at the point of IPO are less likely to experience a price appreciation comparable to that of private market investors.”

Recent IPO experience appears to prove Lee’s point out.

On Fundnel, their investors gain access to the private markets, an ecosystem which has been thriving in the past two decades that was once restricted only to institutional funds or deep-pocketed investors. Fundnel incorporates a process to screen opportunities up front for smaller investors:

“Apart from access to private companies, we also provide an avenue for subsequent liquidity, facilitating private company shareholders to sell their holdings. This is an alternative liquidity mechanism in lieu of an IPO or M&A — the first in Southeast Asia,” added Lee.

At least in the US, the rule upon regulation strategy foisted upon the populace by regulators and politicians has had a dramatic effect. IPOs have become more of an exit than an entry point for smart investors.

Late last year, the Atlantic pointed out that in 1997 there were 8884 public companies listed on US exchanges. Today, that number has been slashed in half. The article is aptly titled the Death of the IPO.

Yes, there are exceptions to the rule: Beyond Meat (NASDAQ:BYND), is one rare example that jumped in value following its public offering of shares.

Yes, there are exceptions to the rule: Beyond Meat (NASDAQ:BYND), is one rare example that jumped in value following its public offering of shares.

And a few weeks of trading does not make a company, but the fact remains – the biggest gains are made by investors who got in early.

It is this valuation imbalance that has created an opening for online capital formation platforms to help make these investments available to a far wider audience than before. Crowdfunding platforms like Fundnel, and others, can help smaller investors participate in early-stage investments without having to wait until much of the value has been squeezed out.

Of course, in the US you have to be an accredited investor; a regulation that has been outdated since inception and well overdue for a regulatory correction.