Mintos, a top marketplace for debt investors in Europe, has recently conducted research amongst their audience seeking to gain insight into the impact of the COVID-19 pandemic. According to Mintos, the majority of crowdlending investors (65%) remain optimistic even in light of the ongoing crisis.

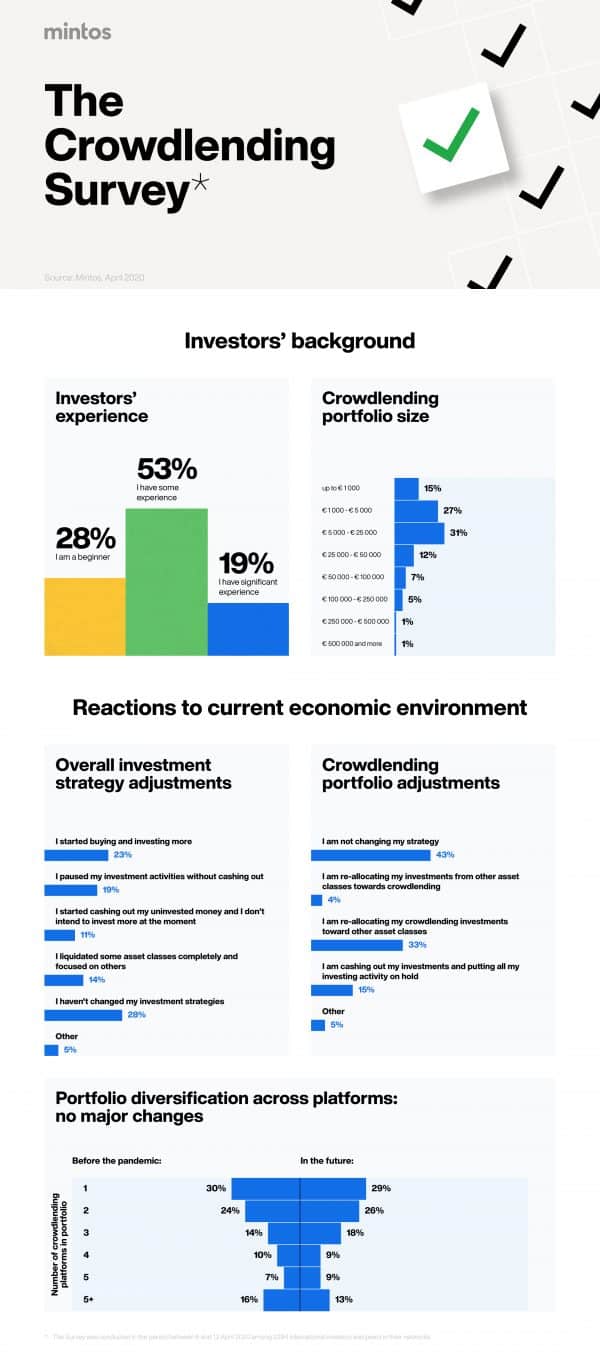

Mintos surveyed 2200 international retail investors that have invested € 5 000 to € 25 000 in loans on various peer to peer lending platforms. The survey was conducted in the period between 6 and 13 April 2020. According to Mintos, 65% of surveyed individuals had “optimistic responses” and either were increasing the amount invested or had decided not to change their investment strategy.

Currently, 43% of investors are not changing their crowdlending investment strategies with just 11% of investors cashing out and holding off future investments. 33% of investors are said to be reallocating their investments to other asset classes, and 4% are reallocating their investments within crowdlending.

The youngs (18 to 34 years old) amongst us are more optimistic with 55% increasing the amount invested in the crowdlending sector.

Investors with larger portfolios tended to invest on a greater number of platforms. Whereas 83% of investors with 1 or 2 platforms in their portfolio had € 25 000 or less invested in crowdlending, 41% of investors with investments between € 250 000 and € 500 000, and 39% of investors with investments of more than € 500 000 had 5+ platforms in their portfolio. Just 2% of investors surveyed said that they didn’t have any crowdlending platform in their portfolio before the pandemic.

Regarding other asset classes that are of interest to these same investors are stocks and ETFs, understandably.

While some platforms and central governments have offered moratoriums on debt payments, 65% of investors understand the need for these measures – an interesting statistic.

Martins Sulte, CEO and Co-Founder at Mintos, issued a comment on the survey pointing to the fact that just 11% of investors acted defensively to the Coronavirus and 19% pushed pause looking to better understand the future before making new investment decisions:

Martins Sulte, CEO and Co-Founder at Mintos, issued a comment on the survey pointing to the fact that just 11% of investors acted defensively to the Coronavirus and 19% pushed pause looking to better understand the future before making new investment decisions:

“In the meantime, more than half of investors surveyed kept their positions, either without changes to their strategies or with more optimistic adjustments, based on individual risk preferences,” said Sulte. “Optimistically increasing, cautiously decreasing, or pragmatically re-allocating their investments, investors have shown they are serious about the crowdlending market. For these investors, loans as an asset class stand shoulder to shoulder with stocks and ETFs. We see that for 72% of all investors who did asset investment re-allocation as a result of the pandemic, stocks and ETFs prove to be the two main traditional asset classes that investors consider for investing.”

Launched in 2015, Mintos seeks to provide individual investors with an easy and transparent way to invest in loans originated by a variety of alternative lending companies from around the world. The Fintech has set its sights beyond online lending and recently announced it has submitted an application for both an investment firm license and an electronic money (e-money) institution license with the Latvian regulator Financial and Capital Market Commission (FCMC).