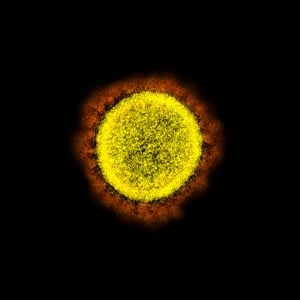

UK-based digital bank Revolut, which was most recently valued at $5.5 billion, has reportedly laid off around 60 workers, as the COVID-19 outbreak appears to have negatively impacted the firm.

UK-based digital bank Revolut, which was most recently valued at $5.5 billion, has reportedly laid off around 60 workers, as the COVID-19 outbreak appears to have negatively impacted the firm.

Nikolay Storonsky, the Russian CEO at Revolut, announced the layoffs on May 11, 2020, according to sources familiar with the matter.

In statements shared with FN, a Revolut representative stated:

“Like every business, we have had to make cost savings, where possible, since the lockdown. We have made every effort to protect every job, with initiatives such as salary sacrifice, but despite these efforts have now had to announce redundancy of around 60 roles across our 2,200 strong workforce globally. We are doing everything we can to support people in finding new roles where possible.”

Last month, Revolut’s management attempted to reduce operational costs, and maintain its cash reserves, by offering employees company shares, while cutting monthly salaries.

The digital bank had described it as a new “salary swap” scheme. Revolut co-founders, Storonsky and Vladyslav Yatsenko, have already decided to give up their salaries for 2020.

Storonsky said he’ll be writing a personal letter of recommendation for all staff that have been relieved of their duties, so that they have a good chance at securing a new job.

Revolut has announced layoffs at a time when the banking challenger has been facing pressure to meet certain performance targets.

Revolut’s ambitious management is planning to record profits this year, even though the Coronavirus crisis has led to many businesses shutting down or significantly scaling back their operations.

Eight senior management professionals had also left the company back in April.

Revolut managed to acquire $500 million in capital earlier this year via a round led by Technology Crossover Ventures.

As reported by the Financial Times, Revolut may be planning to acquire competing Fintech businesses that may have been impacted by the pandemic.

As CI recently reported, Revolut has taken the next step in becoming a full-fledged bank with its launch in Lithuania.