How might hyper-personalization improve your products?

Behavioral economics is the field of study which acknowledges that people are irrational beings; as explained by economist Richard Thaler in his book, Misbehaving, humans don’t behave the same way as theoretical decision-makers he calls ‘Econs’, who always make the most rational decisions possible. Human decisions are greatly influenced by an individual’s current situation, past experiences, preconceived notions, and level of understanding. In short, we are predictably irrational.

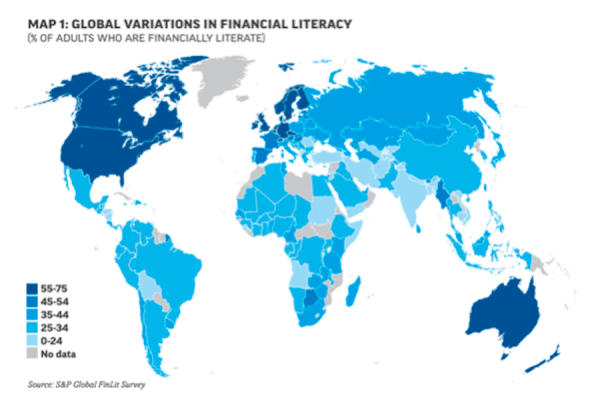

In addition to being irrational, most people struggle to understand financial products and services. According to Standard & Poor’s financial literacy survey (PDF file), only 33% of the world is financially literate.

The study concluded the following: among the four topics that define financial literacy, inflation and numeracy (in the context of interest rate calculations) are the most understood. Worldwide, half the adult population understands these concepts. Knowledge of risk diversification is the lowest, with only 35 percent of adults correctly answering that survey question. Risk diversification also figures into some of the largest disparities among countries. Financial literacy rates differ in important ways when it comes to characteristics such as gender, education level, income, and age. Worldwide, 35 percent of men are financially literate, compared with 30 percent of women. While women are less likely to provide correct answers to the financial literacy questions, they are also more likely to indicate that they “don’t know” the answer, a finding consistently observed in other studies as well (Lusardi and Mitchell, 2014).

You can see the breakdown of S&P’s analysis in the following image.

There are two approaches to improving financial literacy –

(A) making it easy for people to understand concepts when needed

(B) do the job for them but give them full control as needed

The first approach is straightforward education, so let us explain more about Approach B. One way to address users’ lack of financial knowledge is to eliminate (or at least minimize) their need to learn new information. This is possible if the products we build can make the best financial decisions on behalf of the user with the right set of guiding principles such as ‘do unto others as you would have them do unto you’. If this is our goal, the products we build must be fully aware, conscious, fair, transparent to all users, and above all always making decisions in the best interest of each individual. Financial inclusion and fairness are broad enough topics that deserve their own space; more to come on this.

Now let’s address the topic on hand through the lens of the approach detailed above: How might we improve financial decision-making knowing that people tend to both behave irrationally and lack financial literacy? Most importantly, it’s not the individuals who are at fault.

According to https://gwtoday.gwu.edu/new-study-highlights-disparity-black-financial-literacy,

“The gap in financial knowledge between African Americans and whites can be partially attributed to underlying demographic differences between the two groups. However, the differences cannot account for the entire gap as financial literacy is still lower for African Americans compared to whites in each demographic subgroup reported in this study.

The report also states that it is important to increase efforts to promote financial education in school and the workplace to help bridge some of the gaps in financial literacy and ultimately financial wellness.”

Contextual inference and hyper-personalization:

When someone is reading a headline something along the lines of ‘Mortgage rates fell from 3.5% to 3.25% in most states this week’, how should they process this information?

There are three basic conclusions a person can reach when processing any information:

- This information applies to me, and I must do something about it. (This conclusion often results in taking action or seeking further help.)

- This may apply to me, but I don’t need to do anything about it right now. (This conclusion results in procrastination; the person may or may not take action at a later time.)

- This doesn’t apply to me, and I don’t need to spend any more time on it. (This conclusion simply results in no action.)

In any of these circumstances, a reader could misunderstand or misinterpret the information because they are lacking important context to frame the ways in which the information applies to them. Take the above example regarding mortgage rates: the reader may not fully understand the difference between interest rate vs. annual percentage rate (APR). They may end up drawing premature conclusions without understanding the implications of closing costs, fixed vs. variable rate, and other important terms. Now, imagine building products that can interpret these financial articles and provide each reader with a hyper-personalized comprehensive view so that they can make fully-informed decisions.

Hyper-personalization of web content in the above scenario could have the same effect on a reader’s understanding as personalized corrective lenses have on eyesight. Hyper-personalized content could enable a new wave of dynamic web technologies that adapt based on each user’s context, history, and preferences. For example, the article discussed above could be pre-interpreted for the user based on knowledge of the user’s holistic financial picture. The content could then offer personalized insights and automatically curate itself to prioritize personally relevant information.

Hyper-personalization of web content in the above scenario could have the same effect on a reader’s understanding as personalized corrective lenses have on eyesight. Hyper-personalized content could enable a new wave of dynamic web technologies that adapt based on each user’s context, history, and preferences. For example, the article discussed above could be pre-interpreted for the user based on knowledge of the user’s holistic financial picture. The content could then offer personalized insights and automatically curate itself to prioritize personally relevant information.

It’s important for content creators and publishers to contextualize essential information with meaningful background information; this helps people process what they are reading and make fully-informed decisions.

In a world where users’ financial data is decentralized i.e. information is not stored within the walled gardens of any one financial services company and that users can provide permissions to trusted sources whenever they want will accelerate the hyper-personalization of content. In this ideal world, the user’s financial information could be assembled simply by a single tap/touch/voice command and entities such as content providers, publishers, and third-party applications can leverage the appropriate financial data to contextualize the content to users. This context awareness is critical in bridging the gap between the need to educate people on finance vs. doing it on their behalf. In short, the decentralization of data and financial applications (DeFi) partly makes the hyper-personalization of content come to reality.

Hyper-personalization is little more than a buzzword today. The years to come will bring about the advent of open banking, enhancements in computing infrastructure, improvements in web technologies such as semantic web, and advancements in artificial intelligence, enabling hyper-personalization to be realized at scale offering solutions to make sound financial judgments.

Ram Alagianambi is the Lead Director of Product Management at LendingClub. He is an expert in product management, engineering & tech, and business development. He has been leading, founding product & tech groups in startups and organizations of various sizes across different industries, business models, and domains such as fin-tech, data, cloud, mobile, eCommerce, SAAS, marketplaces. He has a strong track record of advising successful startups that have been acquired and are making an impact on society. Beyond his startup advising, he also lectures and conducts workshops across different geographies.

Ram Alagianambi is the Lead Director of Product Management at LendingClub. He is an expert in product management, engineering & tech, and business development. He has been leading, founding product & tech groups in startups and organizations of various sizes across different industries, business models, and domains such as fin-tech, data, cloud, mobile, eCommerce, SAAS, marketplaces. He has a strong track record of advising successful startups that have been acquired and are making an impact on society. Beyond his startup advising, he also lectures and conducts workshops across different geographies.

Arun Sikka is the Vice President, Lending Risk Management and Credit Strategy at LendingClub. He is a credit expert with 15 years of experience in credit risk domain including underwriting and collections. His experience spreads across three countries and multiple banking products including Personal Loans/Line of Credit, Credit Cards, Auto Loans, Mortgages/HELOC and Small Business. Arun is passionate about leveraging analytics, developing frameworks and driving data driven decisions that creates business value for organizations of all scale and maturity and has led the risk team of major Canadian Banks (BMO and RBC) through various digital transformations including launching online small business loan application, digital line of credit and chequing account opening through mobile.

Arun Sikka is the Vice President, Lending Risk Management and Credit Strategy at LendingClub. He is a credit expert with 15 years of experience in credit risk domain including underwriting and collections. His experience spreads across three countries and multiple banking products including Personal Loans/Line of Credit, Credit Cards, Auto Loans, Mortgages/HELOC and Small Business. Arun is passionate about leveraging analytics, developing frameworks and driving data driven decisions that creates business value for organizations of all scale and maturity and has led the risk team of major Canadian Banks (BMO and RBC) through various digital transformations including launching online small business loan application, digital line of credit and chequing account opening through mobile.