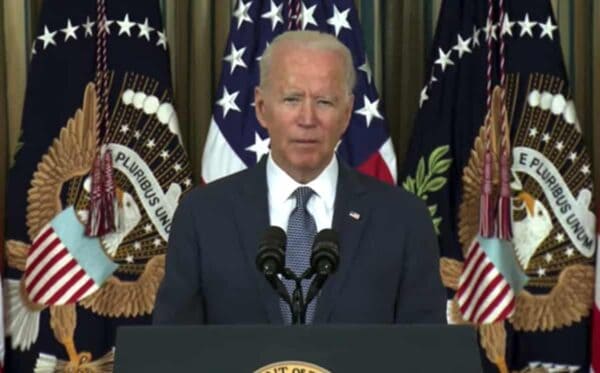

Earlier today, President Joe Biden signed the Executive Order that included a litany of policy objectives that are ostensibly designed to improve competition. While some aspects may fall short, one area that may please Open Banking (or Open Finance) advocates is the inclusion of easier bank switching for consumers.

The Executive Order fact sheet states:

“Excessive consolidation raises costs for consumers, restricts credit for small businesses, and harms low-income communities. Branch closures can reduce the amount of small business lending by about 10% and leads to higher interest rates. Even where a customer has multiple options, it is hard to switch banks partly because customers cannot easily take their financial transaction history data to a new bank. That increases the cost of the new bank extending you credit.”

The order “Encourages the Consumer Financial Protection Bureau (CFPB) to issue rules allowing customers to download their banking data and take it with them. ”

One of the key aspects of Open Banking is that consumers own their data and NOT the financial services firms. This means the data is only accessible to firms that are approved by the individual. Today in the US, banks and other firms may sell that information to other institutions.

Siamac Rezaiezadeh, Director of Product Marketing at GoCardless, lauded the move by the White House to potentially encourage open banking. GoCardless is a global payments firm that seeks to remove the friction in the transfer process for businesses.

“This is the first step along the path to a truly competitive, open banking ecosystem in the US. The government has now recognized that customer banking data is precisely that — the property of the customer. Before, a more laissez-faire approach to open banking in the US meant that many banks had no incentive to provide third parties with access to customer data. This led to ‘closed banking’ and runs counter to the principles of innovation and competition that open banking is built upon,” said Rezaiezadeh. “What this Exec Order means is, in the near-term, more competitive retail banking in the US by making it easier for customers to switch providers. However, we hope that it will also spur innovation which will make it easier for third party providers to access customer data via APIs. This will enable even greater competition and really push the US down the path of open banking.”

Plaid, one of the largest Open Banking firms in the US, added their approval of the policy for easing the process of changing banks.

John Pitts, Global Head of Policy at Plaid, said that when consumers have the ability to control their own financial data, they get more choices, lower prices, and better service:

“This executive order lays the groundwork for Open Finance in the US, which will help fintechs, banks, and credit unions innovate and compete to offer the best value to consumers, and keep America globally competitive as the world moves to digital finance.”

Jane Barratt, Chief Advocacy Officer at MX – another Open Banking firm that raised $300 million in a Series C funding round this pas January, joined in support of the move by the Biden Administration.

“Today, President Biden issued an executive order encouraging the Consumer Financial Protection Bureau (CFPB) to issue rules allowing customers to download their banking data and take it with them. We applaud the Biden Administration’s efforts and look forward to our continued work with the CFPB to ensure consumers can access and use their financial data,” said Barratt. “We would like all Americans, regardless of where they choose to bank, make payments, or borrow, to have access to modern connectivity that safeguards their data and their deposits. This means secure access to all of their financial data, and the ability to share it with providers of their choice, ensuring the best solutions for them and their families.”

Barratt said that it is important to “establish a consumer data right that assigns ownership to the consumer” something that is already law in the UK. Barratt believes there are enormous benefits to the whole ecosystem – including increased security, decreased risk.

“The transparency provided with secure data sharing means that institutions of all sizes will have insights into the business impacts of their customers’ data sharing activities – and be able to better expand services to suit. In turn, sparking new companies to emerge and compete and bringing further optionality to the consumer for their financial decisions.”

Of course, the devil is always in the details and it is not yet entirely clear as to what the Executive Order will mean for consumer control of their own financial data and compliance by both old finance and new.