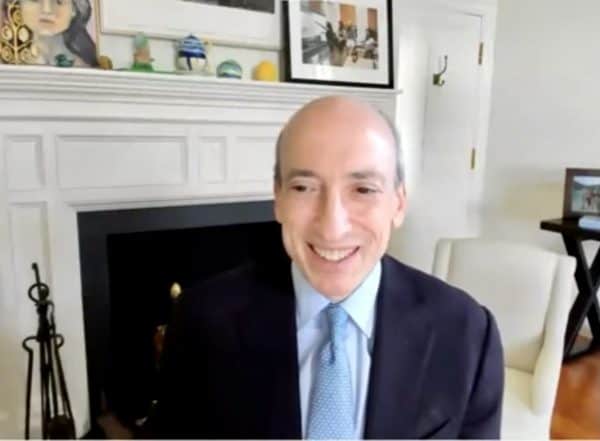

In remarks for the Penn Law Capital Markets Association Annual Conference, SEC Chairman Gary Gensler sent a clear warning to crypto exchanges and other marketplaces that trade in crypto. Gensler explicitly stated that he has asked staff to review how the Securities and Exchange Commission can get these platforms “registered and regulated” under existing securities law.

Gensler, has been pounding the regulation drum regarding crypto ever since he took over the Commission. It is just a matter of time before the SEC cranks up the rhetoric and moves from words to actions for platforms creating markets in digital assets.

Once again, Gensler said most digital assets should be considered securities. Be they centralized or decentralized (DeFi) “these platforms likely are trading securities,” stated Gensler, adding that a typical trading platform has dozens of tokens on it. “In fact, many have well in excess of 100 tokens.”

Gensler notes that the crypto market is fairly concentrated with the top five platforms making “up 99 percent of all trading, and just two platforms make up 80 percent of trading.” Crypto to fiat transactions is dominated (80%) by just five platforms.

In effect, Gensler appears to want crypto exchanges to become regulated exchanges -like the NSYE or Nasdaq – not a fast, nor simple process. It took BSTX, a collaboration with tZERO and BOX Digital Markets LLC, years to be approved as a regulated securities exchange that is blockchain enhanced. Depending on how heavy the SEC moves, crypto exchanges could find trading impacted or, if fortunate, crypto exchanges could be given a grace period to adhere to existing securities regulation.

Platforms, Stablecoins, and Crypto Tokens

To quote Chairman Gensler:

“Some have asked if the current exemptions for so-called alternative trading systems (ATSs) could be generally available to crypto platforms. ATSs for the equity and fixed income markets, though, are generally used by institutional investors. This is quite different than crypto-asset platforms, which have millions and sometimes tens of millions of retail customers directly buying and selling on the platform without going through a broker. Thus, I’ve asked staff to consider whether and how the protections that are afforded to other investors on exchanges with which retail investors interact should apply to crypto platforms.

Second, crypto platforms currently list both crypto commodity tokens and crypto security tokens, including crypto tokens that are investment contracts and/or notes. Currently, the venues that the SEC oversees solely trade securities. Thus, I’ve asked staff to consider how best to register and regulate platforms where the trading of securities and non-securities is intertwined. In particular, I’ve asked staff to work with the Commodity Futures Trading Commission (CFTC) on how we jointly might address such platforms that might trade both crypto-based security tokens and some commodity tokens, using our respective authorities.

The third area is around crypto custody. Unlike traditional exchanges, currently, centralized crypto trading platforms generally take custody of their customers’ assets. Last year, more than $14 billion of value was stolen. I’ve asked staff how to work with platforms to get them registered and regulated and best ensure the protection of customers’ assets, in particular whether it would be appropriate to segregate out custody.”

This is not to mention his concern about crypto being utilized for illicit activity

Gensler also discusses the stablecoin market, another sector of digital assets of which he is no fan. Gensler states that stablecoins are similar to bank deposits or money market funds (a security), while potentially undermining financial stability, impacting monetary policy. Gensler adds there are “conflicts of interest” and “integrity questions” when it comes to stablecoins.

In regards to tokens in general – digital assets issued to raise funds from the public that may have some utility. Again, Gensler declares they are securities and thus fall under existing securities law, meaning an exemption or registration, and trading on an approved securities marketplace.

Gensler warns:

“Without prejudging any one token, most crypto tokens are investment contracts under the Howey Test. Even before the Howey test, in the first several years of our federal securities laws, some entrepreneurs were notified that they had to register their offerings of chinchillas, whiskey warehouse receipts, oyster beds, and live silver foxes as securities offerings, as “the purported sale of the…property was merely camouflage and not the substance of the transaction.”

Most likely, the SEC is already working with some of the largest platforms to get them to toe the securities compliance line. This may take some time but is better than the alternative of regulation by enforcement. Congress, has talked a lot, but done little in crafting a legislative path for digital assets beyond securities law created more than 70 years ago. It appears that this $2 trillion market may soon receive a wake-up call from the Commission. While Bitcoin and Ethereum may dodge the SEC bullet, other alt-coins may not be so lucky.

“There’s no reason to treat the crypto market differently just because different technology is used,” says Gensler.