Regulated Digital Bank ZA Bank Now Supports Stablecoins

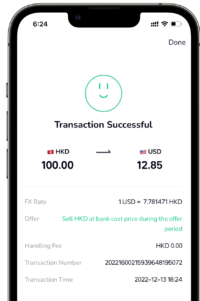

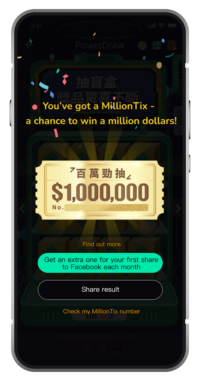

ZA Bank, one of the first regulated digital banks in Hong Kong, is now supporting stablecoins. Stablecoins are digital assets tied to another asset. Typically, this means fiat currency like the US dollar or Euro, but they can also be tied to other assets like… Read More

Read more in: Asia, Blockchain & Digital Assets | Tagged banking, digital bank, hong kong, stablecoins, za bank