My friend Dan Lear and I wrote the attached letter to Congress to try to encapsulate in one place our various public policy suggestions to help startups.

What you will find in the letter are 13 very specific and detailed public policy initiatives that Congress could act on today. I know, we haven’t talked about patent trolls or immigration. Those too are big issues that a lot of other organizations have spent a lot of time on. But I think you will find in the letter actionable items that are meaningful and significant to startups across America.

Please help us promote these ideas.

From Startups Across America

Dear Congress:

The Great Recession is slowly fading from memory but America still needs jobs. Research has shown that small businesses and startups (fast growing small businesses) are the source of almost all of America’s new jobs.(1) Unfortunately, existing federal law and regulation makes entrepreneurs’ efforts to found, run, and grow startups harder not easier.

Starting a company is hard. Entrepreneurs must identify a good idea, capitalize on it faster and more efficiently than competitors, find money to grow the business rapidly, develop and demonstrate competence in a wide range of disciplines: finance, leadership, management, product development, operations, law, etc . . . . and do many other things as well (even sweep the floor).

Aside from the normal difficulties of starting a business, additional and needless legal and regulatory hurdles hamper entrepreneurs’ ability to found, build and scale these important job engines.

This is where you can help!

Through some straightforward statutory modifications and regulatory changes in a few important areas:

- Angel Investment,

- Crowdfunding,

- General Solicitation, and

- Tax, you can significantly improve the entrepreneurship landscape and make it even easier for startups and entrepreneurs to create jobs.

Regarding Angel Investment:

Preserve Broad Access to Angel Investment. Many of America’s best known companies got their start or early support through an early stage investment strategy known as “angel investment.”

Preserve Broad Access to Angel Investment. Many of America’s best known companies got their start or early support through an early stage investment strategy known as “angel investment.”

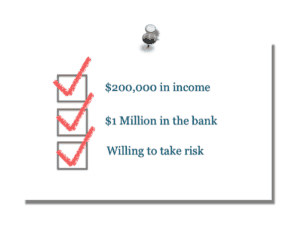

Angel investors provide smaller amounts of business investment to companies in early stages to help the company with capital demands and to jumpstart growth. Though angel investing can be risky it is a crucial part of the unique and dynamic US startup ecosystem. But the SEC might make disastrous changes to regulations governing angel investing.

Angel investors must be “accredited” by the SEC. In 1982, the SEC set rules defining who qualified as an “accredited” investor. Now the SEC is considering updating the financial thresholds in a way that would disqualify more than half of the population that currently qualifies as “accredited.”

This would significantly reduce the amount of capital available for angel investment and, in so doing, almost certainly reduce the amount of angel investments made.

What you can do: Please pass a law or instruct the SEC to not increase the financial thresholds to be an accredited investor. The US startup ecosystem needs broad access to angel investment; keeping the accredited investor thresholds low will insure this.

Reduce Regulatory Restrictions on Angel Investments. Beyond retaining the current regulations for angel investment you can also make angel investment easier by making the following changes.

What you can do:

- Please Reduce, don’t increase, the financial thresholds to qualify as an accredited investor.

- Repeal Section 413 of the DoddFrank Act, which precludes counting home equity toward the $1 million net worth “accredited investor” test.

- Allow “sophisticated” investors to invest despite not meeting the financial thresholds.

- Allow individuals to invest up to 5% of their net worth or annual income per year in startups despite not otherwise meeting the “accredited investor” thresholds.

Allow Intrastate Crowdfunding. States across the country are passing intrastate crowdfunding laws that empower local communities to build their own local startup ecosystems and small businesses instead of looking to Wall Street or Silicon Valley for resources. These state laws are not subject to the federal crowdfunding law because the companies raising the money are incorporated in those states and raising money solely from investors in those states, in accordance with the specific exemption from federal law for intrastate offerings that Congress enacted in the Securities Act of 1933.

However, the SEC has recently issued interpretive guidance on the intrastate exemption that says that if the company uses the internet to promote/discuss its offering then the offering is not an intrastate offering even if a company is incorporated in a particular state and all investors are in that state.(2)

This is nonsense and it needs to be corrected. Besides the fact that it’s nearly impossible not to use the internet to communicate any fundraising or community organizing event, for many if not most of the entrepreneurs seeking to raise money under state crowdfunding laws, the internet represents the ideal tool to communicate a fundraising effort. It is a low cost means of disseminating information to a large number of people on a broad scale. All of the foregoing says nothing of the online interstate crowdfunding platforms such as KickStarter or Indiegogo that were built and designed to facilitate these types of transactions by providing transparency, reducing transaction costs, and providing broad choice in crowdfunding investments. These platforms are truly the perfect tools for local crowdfunding efforts.

This is nonsense and it needs to be corrected. Besides the fact that it’s nearly impossible not to use the internet to communicate any fundraising or community organizing event, for many if not most of the entrepreneurs seeking to raise money under state crowdfunding laws, the internet represents the ideal tool to communicate a fundraising effort. It is a low cost means of disseminating information to a large number of people on a broad scale. All of the foregoing says nothing of the online interstate crowdfunding platforms such as KickStarter or Indiegogo that were built and designed to facilitate these types of transactions by providing transparency, reducing transaction costs, and providing broad choice in crowdfunding investments. These platforms are truly the perfect tools for local crowdfunding efforts.

What you can do: Please either pass a simple piece of legislation to fix this or direct the SEC to clarify or fix its intrastate crowdfunding FAQs. Otherwise, by prohibiting the use of the internet in intrastate crowdfunding, the SEC is tamping down a nascent but important opportunity to cultivate local funding and entrepreneurship ecosystems before they even have an opportunity to develop.

Fix Federal Crowdfunding. Please fix Title III of the JOBS Act the federal crowdfunding provisions that require fundraisers to use intermediaries to raise funds. Startups raise funds on their own. They don’t use intermediaries. They hustle, they work hard, they build something out of nothing. And they do it themselves. They don’t have the time, resources, or, really, inclination or temperament to outsource this activity. Startup founders and CEOs pitch investors for money directly; they don’t hire brokers.

Beyond philosophical differences, it is estimated that brokers are going to charge fundraisers 810% of offering proceeds. This significantly increases the costs of a transaction that were, to date, next to zero.

Federal crowdfunding will likely fail not only for philosophical reasons but because entrepreneurs won’t want to pay a broker for something they’re inclined to do themselves.

What you can do: Please pass a law removing the requirement to use an intermediary in a federal crowdfunding and authorize entrepreneurs to raise funds directly under the federal crowdfunding act.

Regarding General Solicitation:

Reaffirm General Solicitation. Section 201 of the JOBS Act was a big help to entrepreneurs in that it allowed startups to talk publicly about their efforts to raise money (this ability to talk freely about their efforts to fundraise is known as General Solicitation). Unfortunately, the SEC put rules in place rules that discourage most companies from taking advantage of this new opportunity.

You can restore the intent of Section 201.

What you can do: Please repeal the second sentence of Section 201 of the JOBS Act and direct the SEC to allow companies to speak freely about their private securities offerings.(3)

Don’t Let the SEC Close the Door Entirely on General Solicitation. Beyond the rules that discourage most companies from general solicitation, the SEC issued additional proposed rules that will make general solicitation so cumbersome that few, if any, entrepreneurs will endeavor to try. These rules include:

- Obligations to file a Form D before the company initiates its fundraising process, as opposed to after;

- A burdensome requirement to formally file all written materials with the SEC (entrepreneurs frequently update their slides and other written materials between each meeting); and

- A penalty for violation of the rules that includes a one year prohibition on raising money. (4)

These rules would effectively repeal the JOBS Act.(5)

This is what Fred Wilson, a well known venture capitalist, had to say about the SEC’s rulemaking in this regard:

“If the SEC’s intention, with these proposed additional rules, is to neuter General Solicitation to the point that it is legal but nobody avails themselves of it, they will succeed.”

What you can do: Please order the SEC to not issue its proposed rules on Reg D and Form D.

D and Form D.

Finally the tax changes:

Allow Startups to More Easily Share Equity with Workers. In the startup ecosystem, particularly for many early startups, cash is scarce. Instead many entrepreneurs offer their employees equity in the company as a form of compensation. There are a number of different taxrelated legal hurdles that make it hard for companies to share equity with workers. Some straightforward changes could make equity sharing easier and allow entrepreneurs to grow their businesses more effectively:

First, Repeal or Remove the Imposed Tax Withholding on Stock Transfers. The Internal Revenue Code requires companies to withhold income and employment taxes when a company transfers stock to an employee. This despite the fact that under the securities laws the stock cannot be sold. This makes it very, very difficult for companies to issue stock to workers. The workers can’t afford to pay the taxes, and neither can cashstrapped startup companies.

What you can do: Repeal the law imposed income and employment taxes on non-cash transfers of stock to workers.

Second, Repeal Section Revenue Code Section 409A Related to Startups. Internal Revenue Code Section 409A was enacted to curb abuses where executives of large corporations were deferring taxes on millions of dollars of cash compensation.

This is good. However, the IRS applies the same rules it applies to multimillion dollar cash compensation packages to startup stock options. This is absurd and it doesn’t reflect the reality of startup economics.

Section 409A makes it more difficult for companies to share equity with their workers. Please repeal Section 409A as it applies to startups. Sometimes laws that are broadly applicable, across large and small, work. Sometimes they don’t. This is a case in which Section 409A works well for large companies but not for small ones. There’s no reason that startups should be hindered in transferring stock to employees. Repealing Section 409A makes employees better off and allows them to hire and retain better talent.

What you can do: Repeal Section 409A as it applies to startup and early stage company stock options and other worker equity incentives.

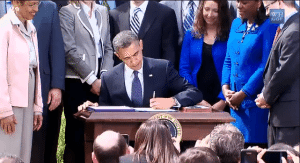

Renew the 100% Qualified Small Business Stock Tax Benefit. U.S. Code Section 1202 excludes from gross income a portion of the gain recognized on the sale or exchange of qualified small business stock that is held more than five years. This tax code section is a significant inducement for investing in startup companies.

President Obama convinced Congress to make the 100% exclusion, but the 100% exclusion expired at the end of 2013. It would really help startups if this 100% exclusion was made permanent.

President Obama convinced Congress to make the 100% exclusion, but the 100% exclusion expired at the end of 2013. It would really help startups if this 100% exclusion was made permanent.

What you can do: Make the 100% exclusion from capital gains for investments in qualified small business stock held for more than 5 years permanent.

Shorten the Holding Period Under Section 1202. The holding period to qualify for the reduced capital gains tax rate under Section 1202 is five years. This an very long holding period to qualify for a tax incentive that is supposed to encourage investments in startup company. The regular long term capital gains holding period is 1 year. A more appropriate holding period for the tax incentive to invest in startups under Section 1202 would be 2 years.

What you can do: Shorten the holding period to qualify for the reduction in the capital gains tax rate for investments in qualified small business stock to 2 years.

Extend the Rollover Period on Qualified Small Business Stock. Years ago Congress passed a tax code section, Section 1045, that was designed to encourage investments in qualified small businesses. Section 1045 allows a taxpayer to roll over their investment in a qualified small business stock into other qualified small business stock. tax free. Section 1045 is to startups what Section 1031 is to real estate However, Section 1045 has a very short window in which to make the rollover investment: 60 days.

This is great for small businesses because investments in one business can be reallocated to another business tax free. However, investors need time to transition investments from one place to another. Your typical angel investment takes months to find. Finding a rollover investment opportunity in 60 days is unrealistic.

What you can do: Extend the rollover period under Section 1045 to 270 days.

Fix Section 83(b). Currently Internal Revenue Code Section 83(b) allows founders of companies to make a favorable tax election so that they are not taxed when their founder shares vest as they continue to work for their startup. The trouble is that Section 83(b) only allows this election to be made by filing a form within 30 days of receiving stock. This is a difficult and unnecessary administrative time trap for founders. A simple change to the law could make the election deemed made rather than requiring it to be made at all.

What you can do: Please either extend the period for filing the 83(b) election to allow more than 30 days (say, allow 270 days) or reverse the presumption so that no filing is required if not tax is owed.

CONCLUSION

Startups are a key and increasingly important part of the economic engine that powers the American economy and, most importantly, creates jobs for US citizens. By making some straightforward requests, changes, amendments, and even public statements, related to a few key issues you can help make it easier for these important economic dynamos to continue to do what it is that they do so well: grow and create jobs.

Please take action to help America’s startups, small businesses, and entrepreneurs!

Thank You,

Entrepreneurship Supporter

______________

Joe Wallin is a startup and corporate transactions attorney in Seattle at the firm of Davis Wright and Tremaine. His practice falls into three broad categories: Startups & Emerging Companies, Angel & Venture Financings &Mergers & Acquisitions. He represents companies from inception to exit, and provides general counsel services along the way. He also represent investors in companies, as well as executives and founders. Wallin has been a frequent commenter and advocate of equity crowdfunding in the State of Washington.

Joe Wallin is a startup and corporate transactions attorney in Seattle at the firm of Davis Wright and Tremaine. His practice falls into three broad categories: Startups & Emerging Companies, Angel & Venture Financings &Mergers & Acquisitions. He represents companies from inception to exit, and provides general counsel services along the way. He also represent investors in companies, as well as executives and founders. Wallin has been a frequent commenter and advocate of equity crowdfunding in the State of Washington.

Dan Lear is currently the Director of Industry Relations for Avvo the leading legal online marketplace. We make legal easier by connecting consumers and lawyers. He is a technology lawyer, facilitator, and blogger. He is the cofounder of the Seattle Legal Technology and Innovation MeetUp, a self–styled “legal hacking” group that meets regularly to explore, identify, and implement unconventional solutions to law’s problems, big and small. He’s also blogged and written extensively about the profession and its evolution on his blog Right Brain Law and for other online and print publications. Dan practiced law for six years and has worked in the legal and high tech industries for more than ten. He received his BA in International Studies from Brigham Young University, and his JD and MBA from Seattle University.

Dan Lear is currently the Director of Industry Relations for Avvo the leading legal online marketplace. We make legal easier by connecting consumers and lawyers. He is a technology lawyer, facilitator, and blogger. He is the cofounder of the Seattle Legal Technology and Innovation MeetUp, a self–styled “legal hacking” group that meets regularly to explore, identify, and implement unconventional solutions to law’s problems, big and small. He’s also blogged and written extensively about the profession and its evolution on his blog Right Brain Law and for other online and print publications. Dan practiced law for six years and has worked in the legal and high tech industries for more than ten. He received his BA in International Studies from Brigham Young University, and his JD and MBA from Seattle University.

________________

1 See http://www.kauffman.org/whatwedo/research/firmformationandgrowthseries/theimportanceofstartupsin jobcreationandjobdestruction 2 The SEC’s guidance is available here: http://www.sec.gov/divisions/corpfin/guidance/securitiesactrulesinterps.htm#14103 http://www.sec.gov/divisions/corpfin/guidance/securitiesactrulesinterps.htm#14104 http://www.sec.gov/divisions/corpfin/guidance/securitiesactrulesinterps.htm#14105 3 For more information, please see this blog post: http://joewallin.com/2013/04/07/bespecificgeneralsolicitation/ 4 You can find these rules here: http://www.sec.gov/rules/proposed/2013/339416.pdf 5 See this blog post by Fred Wilson: http://avc.com/2013/08/somethoughtsonthesecsrulemakingongeneralsolicitation/