Crowdfunding, as allowed under Reg CF (created by Title III of the JOBS Act) was designed to improve access to capital for smaller firms in need of funding while providing new investment opportunities for smaller investors. For too many years the little guy has been boxed out from access to capital and early stage investments, so the story goes. As we know, oceans of money flowed into hotbeds of startups like Silicon Valley or Silicon Alley, but if you’re not located in those epicenters, you’re our of luck. Sorry. And if you were not a hotshot investor, well good luck.

Reg CF launched in May of 2016 with a decent amount of fanfare and a fair amount of optimism. Finally, the internet was going to “democratize” access to capital. It was about time.

But in the ensuing months, did this, in fact, occur? Good question.

Several weeks back, there was a closed meeting that involved members of the Securities and Exchange Commission (SEC), representatives from the North American Securities Administrators Association (NASAA) and other crowdfunding participants – including several prominent platforms. The meeting was not open to press so (as far as I am aware) all proceedings were rather hush-hush. But several participants have spoken with representatives from Crowdfund Insider sharing a more dystopic view of the emerging Reg CF ecosystem.

Several weeks back, there was a closed meeting that involved members of the Securities and Exchange Commission (SEC), representatives from the North American Securities Administrators Association (NASAA) and other crowdfunding participants – including several prominent platforms. The meeting was not open to press so (as far as I am aware) all proceedings were rather hush-hush. But several participants have spoken with representatives from Crowdfund Insider sharing a more dystopic view of the emerging Reg CF ecosystem.

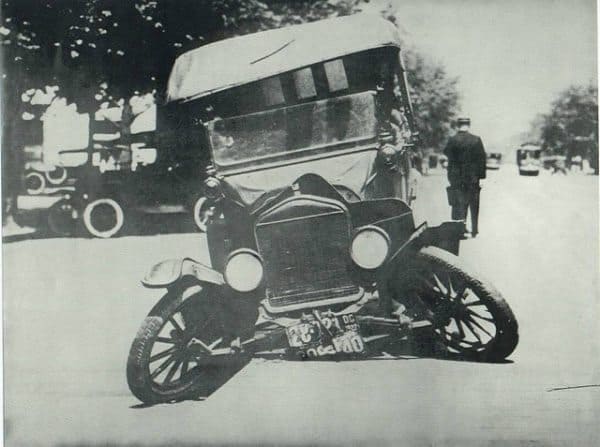

One informed individual told Crowdfund Insider the sentiment was that “the wheels have fallen off of Reg CF crowdfunding” as the exemption has not lived up to the hype.

And why would this be? The challenges have to do with the highly prescriptive nature of Reg CF. The rules, designed to protect investors, may be doing just the opposite as very high quality firms do not want to pay the associated costs nor file all of the mandated disclosures. Using Reg D is far simpler and economical.

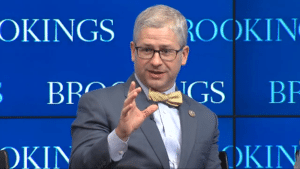

These litany of complaints are issues that several members of Congress have attempted to address. Most prominently, Congressman Patrick McHenry, the tenacious policymaker who has always been looking out for the little guy.

These litany of complaints are issues that several members of Congress have attempted to address. Most prominently, Congressman Patrick McHenry, the tenacious policymaker who has always been looking out for the little guy.

Yet time and again, his efforts to improve upon the existing Reg CF rules have been cut short, stymied by a perplexing group of malcontents and disbelievers. McHenry’s office did not participate in the NASAA / SEC powwow but that should not come as a surprise. Why would you invite someone who wants to fix what is broken?

NASAA Listens and Hears What it Wants

Speaking with one individual with knowledge of the event, they explained;

Speaking with one individual with knowledge of the event, they explained;

“The general consensus was that Reg CF was totally dysfunctional. The NASAA representatives were pushing the low quality of the [crowdfunding] deals. Market participants were pointing to the compliance costs and the challenges intrinsic to Reg CF. There was disagreement as to why the exemption was not being adopted more broadly.”

This individual said that NASAA was firmly entrenched with the belief that Reg CF does not exempt them from state compliance, even though that was the intent of Congress. This person said “NASAA hates it.”

“They [NASAA] absolutely want to keep control over [securities] issuance … They would love to see it go away. They are happy with the current state of affairs.”

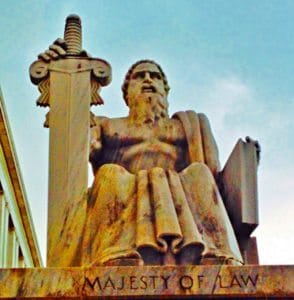

The thesis is that NASAA, a special interest group, wants issuers to use intrastate crowdfunding exemptions instead of a federal exemptions. NASAA is attempting to push Reg CF into obscurity so that companies looking to raise capital are compelled to go directly to the state. This is a question of state authority, power and money. This is a story of politics. Unfortunately the early stage company gets lost in this equation. Steamrolled by parochial politics.

Interestingly, the same individual said the SEC was more open to supporting Reg CF. Apparently, the Commission has been relieved to see that no cascade of fraud has taken place and they WANT Reg CF to be successful, recognizing the importance of capital formation for smaller firms. The SEC may even be inclined to revisit the exemption and do what they can to fix it. There was an overall willingness in the room to see crowdfunding as viable.

Interestingly, the same individual said the SEC was more open to supporting Reg CF. Apparently, the Commission has been relieved to see that no cascade of fraud has taken place and they WANT Reg CF to be successful, recognizing the importance of capital formation for smaller firms. The SEC may even be inclined to revisit the exemption and do what they can to fix it. There was an overall willingness in the room to see crowdfunding as viable.

In NASAA’s defense, the insider described NASAA’s leadership as not completely indicative of member support. Many state regulators are more supportive than NASAA executives – recognizing that economic need should trump small-minded politics. No one wants to remove NASAA’s ability to enforce anti-fraud laws. But creating an ecosystem where issuers must kiss the ring and pay the toll of 50 states – just doesn’t make sense.

While there may never be clearcut unanimity on what must be done to improve the Reg CF exemption, many industry participants believe McHenry’s first “Fix Crowdfunding Act” covered most all of the bases. Still, crowdfunding platforms continue to use the exemption with a certain amount of success. In nearly a year, almost $24 million has been raised to support entrepreneurial firms. But still more could be done as that is just a drop in the bucket.

Speaking with Kendrick Nguyen, co-founder and CEO of Republic, a mission driven crowdfunding platform that did not participate in the NASAA/SEC gathering, Nguyen believes that education and broad based information is mainly to blame;

Speaking with Kendrick Nguyen, co-founder and CEO of Republic, a mission driven crowdfunding platform that did not participate in the NASAA/SEC gathering, Nguyen believes that education and broad based information is mainly to blame;

“I am not certain the concerns about the industry traction should be blamed on the SEC. Much of it is about investor education. This is something that can be simple and effective but people are unaware of it.”

That being said, Nguyen acknowledges that simple improvements could easily be made to boost SME utilization;

“The $1 million cap is not worth it for tech companies. $5 million would be nice. Accounting requirements and the ongoing reporting is the toughest thing for us. Companies that are most attractive to investors do not want to share their financials.”

So where do we go now?

So where do we go now?

There is a Congressional push to help SMEs gain better access to capital but hurdles remain. Most elected officials have never started a company nor had to make payroll so there is a formative gap as to what it really takes. Special interest groups continue to pound the drum of investor protection to buttress their own opinions minus any actual data proving out pure speculation. While solutions to improving the crowdfunding ecosystem may seem simple to small business advocates, in our nation’s capital, political reality just delivers more regulatory challenges.