Mill Residential not only became the first REIT to raise funding on an equity crowdfunding site but it is claiming the first crowdfunding investment to generate accessible returns for investors with its speedy listing on the London Stock Exchange AIM.

Mill Residential not only became the first REIT to raise funding on an equity crowdfunding site but it is claiming the first crowdfunding investment to generate accessible returns for investors with its speedy listing on the London Stock Exchange AIM.

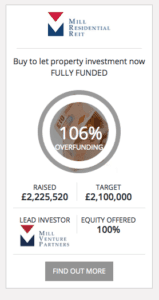

Crowdfunding on Syndicate Room, Mill Residential easily raised its funding objective this past December and then spun around and listed shares on the LSE. Investors experienced a quick pop of approximately 10% and as of today show a gain of a bit over 11% on the freely tradable shares.

SyndicateRoom co-founder and CEO Gonçalo de Vasconcelos released a statement on the achievement;

“SyndicateRoom set out to be at the forefront of financial services innovation, and we’re proud of the highly significant contribution we have made to the equity crowdfunding concept already. Our unique model offers the powerful advantages of having every funding round led by an experienced angel investor, with his or her own money in the game, ensuring a sensible valuation, the appropriate investor protections and the same deal and share class for all investors.”

“This unique approach is clearly working as we are the first equity crowdfunding platform in the UK to fund a business that goes on to successfully float on a mainstream, liquid stock market, creating the first time ever equity crowdfunding has produced accessible returns for UK investors.These are hugely important milestones for crowdfunding, giving credence and proof to the value of this concept – for investors, businesses and the economy as well.”

Investment crowdfunding remains in its infancy today. While the aggregate numbers remain small, initial results and rates of growth are encouraging. The new funding portals have filled a gaping need in the SME funding environment allowing creative young startups and more established businesses a more effective way of raising capital. The combination of transparency and engagement differ from traditional early stage funding. Crowdfunding now allows a much wider audience of investors to participate in opportunities previously only available to the very elite. While investments are very risky there is available data that indicates a portfolio approach to investing in young firms may generate substantial returns.

Investment crowdfunding remains in its infancy today. While the aggregate numbers remain small, initial results and rates of growth are encouraging. The new funding portals have filled a gaping need in the SME funding environment allowing creative young startups and more established businesses a more effective way of raising capital. The combination of transparency and engagement differ from traditional early stage funding. Crowdfunding now allows a much wider audience of investors to participate in opportunities previously only available to the very elite. While investments are very risky there is available data that indicates a portfolio approach to investing in young firms may generate substantial returns.

SyndicateRoom, launched in 2103, has assisted 25 businesses to secure needed funding, A total investment of more than £16 million has been generated by the site. SyndcateRoom has differentiated its service by partnering every funding round with an experience angel investor. All investors receive the same deal, share class, rights and protections.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!