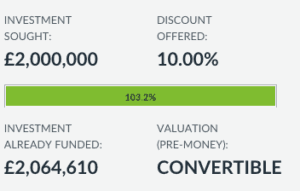

Peer to peer lender Assetz Capital recently listed a a convertible offer on investment crowdfunding platform Seedrs. The financial firm was seeking a crowdfunding round of £2 million and as of today the round is fully funded and appears to be in over-funding. The P2P lender launched in 2013 and has facilitated loans topping £62 million to date. Assetz Capital is a a secured lender that backs every loan with a tangible asset. The platform received a significant boost by partnering with RBS earlier this year where the bank will forward potential borrowers who were not accepted by RBS to Assetz Capital. Andrew Holgate, MD for Assetz Capital, noted at the time;

Peer to peer lender Assetz Capital recently listed a a convertible offer on investment crowdfunding platform Seedrs. The financial firm was seeking a crowdfunding round of £2 million and as of today the round is fully funded and appears to be in over-funding. The P2P lender launched in 2013 and has facilitated loans topping £62 million to date. Assetz Capital is a a secured lender that backs every loan with a tangible asset. The platform received a significant boost by partnering with RBS earlier this year where the bank will forward potential borrowers who were not accepted by RBS to Assetz Capital. Andrew Holgate, MD for Assetz Capital, noted at the time;

“An individual bank can’t lend to every business that applies for a loan due to the restrictions of complex banking regulations. Sometimes good, creditworthy businesses don’t meet specific requirements set out by a bank, but might be able to borrow from a peer-to-peer lender. Peer-to-peer lenders operate differently to banks in the way they are funded, which means we can be more flexible. Just like RBS, we visit each borrower in person and find a solution that gets the SME the cash it needs whilst providing appropriate returns for investors.”

Great to see @assetzcapital reach their target today on @Seedrs. Congratulations to the team and their investors!

— Seedrs (@Seedrs) February 23, 2015

The offer on Seedrs is for a 10% convertible with a valuation cap of £60 million, provided shares are issued within 12 months. If the time frame is extended the discount rate will increase at 0.8% per calendar month for a further 11 months increasing to 20% cap at 24 months. There is no maximum raise amount stated on the Seedrs page.

The offer on Seedrs is for a 10% convertible with a valuation cap of £60 million, provided shares are issued within 12 months. If the time frame is extended the discount rate will increase at 0.8% per calendar month for a further 11 months increasing to 20% cap at 24 months. There is no maximum raise amount stated on the Seedrs page.

Peer to peer lending has been the fastest growing segment of the crowdfunding space in the United Kingdom, as well as much of the world. The report just published by the University of Cambridge indicated that P2P lending for businesses was experiencing a 253% rate of growth. P2P lending for consumers was growing at a rate of 113%. In the UK, unlike the United States, P2P lenders are not required to partner with traditional banks thus creating a more compelling dynamic for banks to change or be thoroughly disrupted.

Assetz Capital proudly states on its site, “by cutting out the banks, Assetz Capital aims to provide a fairer deal for investors and borrowers alike”. With an earned gross interest rate of 9% for investors expect the dramatic growth to continue.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!