“In 5 years, we will no longer talk about “Crowdfunding,” it will just be “funding.” Crowdfunding will just be one of the ways that early stage companies and SMEs gain access to capital. Just like online trading of public securities is considered the primary way that stocks are traded by retail investors, so too will it be in the private capital markets. This is going to be a decade of massive innovation in the private capital markets and crowdfunding is the tip of the spear for that. I can’t wait to see what’s next.”

Crowdfund Capital Advisors (CCA) Co-founder and Principal Jason Best works with The World Bank, investors, governments, development organizations and entrepreneurs globally to create policy and business strategies to leverage the power of crowdfund investing. As a key partner of the U.S. State Department’s Global Entrepreneurship Program, CCA furthers diplomacy and stability through building more effective entrepreneurial and early-stage funding ecosystems. CCA authored the World Bank’s research report “Crowdfunding’s Potential for the Developing World” that included a forward by AOL Co-founder Steve Case. Best and his fellow CCA Co-founder Sherwood Neiss co-authored the texts Crowdfund Investing for Dummies and Creating a Crowdfunding Ecosystem in Chile, have appeared on CNN, BBC and CNBC and have been interviewed by the Wall Street Journal, New York Times, Washington Post, Bloomberg and Forbes.

Crowdfund Capital Advisors (CCA) Co-founder and Principal Jason Best works with The World Bank, investors, governments, development organizations and entrepreneurs globally to create policy and business strategies to leverage the power of crowdfund investing. As a key partner of the U.S. State Department’s Global Entrepreneurship Program, CCA furthers diplomacy and stability through building more effective entrepreneurial and early-stage funding ecosystems. CCA authored the World Bank’s research report “Crowdfunding’s Potential for the Developing World” that included a forward by AOL Co-founder Steve Case. Best and his fellow CCA Co-founder Sherwood Neiss co-authored the texts Crowdfund Investing for Dummies and Creating a Crowdfunding Ecosystem in Chile, have appeared on CNN, BBC and CNBC and have been interviewed by the Wall Street Journal, New York Times, Washington Post, Bloomberg and Forbes.

Readers may also be familiar with Best’s regulation initiatives, including the crowdfund investing framework that he co-authored with Neiss, a document used in the JOBS Act to legalize equity and debt-based crowdfunding in the USA. As a founding member of Startup Exemption, Best worked for 460 days to change the 78-year-old securities laws, an effort rewarded by attending the Rose Garden Ceremony at the White House on April 5, 2012, to watch President Obama sign the crowdfunding legislation.

Currently an Entrepreneur-in-Residence at UC Berkeley’s Center for Entrepreneurship and Technology and co-founder of the UC Berkeley Program for Innovation in Entrepreneurial and Social Finance to study crowdfunding globally, Best also co-founded the two leading global crowdfunding associations, the Crowdfunding Professional Association (CfPA) and the CrowdFunding Intermediary Regulatory Advocates (CFIRA). Prior to crowdfunding, Best built and led SAAS companies, working with founders and leaders to create effective structure, strategy and execution.

Currently an Entrepreneur-in-Residence at UC Berkeley’s Center for Entrepreneurship and Technology and co-founder of the UC Berkeley Program for Innovation in Entrepreneurial and Social Finance to study crowdfunding globally, Best also co-founded the two leading global crowdfunding associations, the Crowdfunding Professional Association (CfPA) and the CrowdFunding Intermediary Regulatory Advocates (CFIRA). Prior to crowdfunding, Best built and led SAAS companies, working with founders and leaders to create effective structure, strategy and execution.

This interview is part of an exclusive series in conjunction with the 2015 Americas Alternative Finance Benchmarking Survey. The Survey, a joint venture of The Centre for Alternative Finance at University of Cambridge Judge Business School, the Polsky Center for Entrepreneurship and Innovation team at Chicago Booth School of Business and new partner Crowdfund Capital Advisors, is the first comprehensive and empirical assessment of crowdfunding, P2P lending and other forms of alternative finance across North, Central and South America.

This interview is part of an exclusive series in conjunction with the 2015 Americas Alternative Finance Benchmarking Survey. The Survey, a joint venture of The Centre for Alternative Finance at University of Cambridge Judge Business School, the Polsky Center for Entrepreneurship and Innovation team at Chicago Booth School of Business and new partner Crowdfund Capital Advisors, is the first comprehensive and empirical assessment of crowdfunding, P2P lending and other forms of alternative finance across North, Central and South America.

I recently had the opportunity to catch up with Jason Best via email to learn more about his views on entrepreneurship, crowdfunding regulation, the future of traditional financial companies, the Ascenergy fraud and predictions for Title III’s rollout. Our interview follows:

Erin: Why did the Crowdfund Capital Advisors decide to partner with the University of Cambridge Centre for Alternative Research and University of Chicago Booth School of Business 2015 Americas Alternative Finance Benchmarking Study? How will the benchmarking research findings help the industry?

Jason Best: Since both Sherwood Neiss and I are Entrepreneurs-in-Residence at The Sutardja Center for Entrepreneurship and Technology at UC Berkeley, we understand the value and importance of the participation of academia in the formation of the crowdfunding ecosystem. We have known the Cambridge Centre since its founding and are pleased to work wit them. The data from this survey is critically important in helping the industry to meaningfully engage with governments, regulators and investors globally. Armed with data, we can have fact-based conversations with these entities about utilization, fraud, failure, funding, etc. When Woodie and I discuss “crowdfunding,” we are describing both equity and debt crowdfunding (marketplace lending).

Erin: How did you transition to the alternative finance sector?

Jason: Woodie and I both have healthcare technology backgrounds and were in leadership roles and/or co-founded companies, raising millions of dollars for them in the traditional ways. It started with a conversation a friend’s wedding about the gridlocked capital markets, that conversation moved to my dining room table as we reviewed the US SEC regulations from 1933 and 1934 that regulated how companies raised money in the age of Facebook and twitter, and then created our Startup Exemption Framework that we took to Washington DC and lobbied the US House and Senate over 460 days to legalize crowdfunding in the US. This work has included being invited to provide US House and Senate Congressional testimony 5 times. Our framework became the crowdfunding language in the USA JOBS Act and the campaign concluded the day we attended the White House Rose Garden ceremony where President Obama signed the JOBS Act into law. Since that time we have co-founded Crowdfund Capital Advisors to work with investors, governments, regulators, international organizations including The World Bank and entrepreneurs to create the global crowdfunding ecosystem. To date, we have worked in 35 countries.

Jason: Woodie and I both have healthcare technology backgrounds and were in leadership roles and/or co-founded companies, raising millions of dollars for them in the traditional ways. It started with a conversation a friend’s wedding about the gridlocked capital markets, that conversation moved to my dining room table as we reviewed the US SEC regulations from 1933 and 1934 that regulated how companies raised money in the age of Facebook and twitter, and then created our Startup Exemption Framework that we took to Washington DC and lobbied the US House and Senate over 460 days to legalize crowdfunding in the US. This work has included being invited to provide US House and Senate Congressional testimony 5 times. Our framework became the crowdfunding language in the USA JOBS Act and the campaign concluded the day we attended the White House Rose Garden ceremony where President Obama signed the JOBS Act into law. Since that time we have co-founded Crowdfund Capital Advisors to work with investors, governments, regulators, international organizations including The World Bank and entrepreneurs to create the global crowdfunding ecosystem. To date, we have worked in 35 countries.

Erin: How have you benefited from mentors in the industry? Please share your experience with mentors.

Jason: I believe that finding quality mentors are a key for success in life. Karen Kerrigan, CEO of the Small Business and Entrepreneurship Council, has been a friend and mentor in this process since Day 1. Her tireless efforts on behalf of SMEs and Entrepreneurs were instrumental in the passage of the JOBS Act and all other measures that help small business. She knows all the ins and outs of Washington DC and invaluable in our work. We continue to learn from her today. Another mentor we are grateful to have is Douglas Ellenoff, the Founder and Managing Partner of Ellenoff Grossman and Shole, a leading securities law practice in New York City. Doug brings his deep experience both public and private market transactions in his regular work with the US SEC and other global financial regulators to advocate on behalf of rational regulation that balances the needs of investor protection with capital formation. His support of the crowdfunding industry is well known and we are honored to have him as an advisor to our firm. I would also say that having a great co-founder in your business is like having another mentor. I believe that having a co-founder in your business increases your

Jason: I believe that finding quality mentors are a key for success in life. Karen Kerrigan, CEO of the Small Business and Entrepreneurship Council, has been a friend and mentor in this process since Day 1. Her tireless efforts on behalf of SMEs and Entrepreneurs were instrumental in the passage of the JOBS Act and all other measures that help small business. She knows all the ins and outs of Washington DC and invaluable in our work. We continue to learn from her today. Another mentor we are grateful to have is Douglas Ellenoff, the Founder and Managing Partner of Ellenoff Grossman and Shole, a leading securities law practice in New York City. Doug brings his deep experience both public and private market transactions in his regular work with the US SEC and other global financial regulators to advocate on behalf of rational regulation that balances the needs of investor protection with capital formation. His support of the crowdfunding industry is well known and we are honored to have him as an advisor to our firm. I would also say that having a great co-founder in your business is like having another mentor. I believe that having a co-founder in your business increases your  chances for success. I’m very lucky to have a great co-founder at CCA, and have learned a lot from Woodie over our 20 year friendship and 5 years of working together as business partners.

chances for success. I’m very lucky to have a great co-founder at CCA, and have learned a lot from Woodie over our 20 year friendship and 5 years of working together as business partners.

Erin: What advice do you have for fellow crowdfunding investors?

Jason: This is high risk investing. Investing in SMEs and startups should only be done with a very small portion of your investable capital (discuss what is right for you with your investment advisor). Invest in businesses that you really understand and in people that you know and trust. It is also very important to know the difference between when a business fails (that can happen often) and when a business is a fraud (which happens much less often).

Erin: In a recent video, you aver that providing access to capital is an imperative, especially when a country’s economy is slowing. How can governments better stimulate job growth, create entrepreneurship opportunities and sustain innovation through alternative finance?

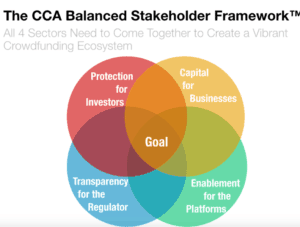

Jason: The UK Treasury Department report in July 2015, really sums it up with national data: a majority of companies that crowdfund both increase their sales and hire more employees. When communities come together to invest in businesses they use every day or in entrepreneurs they believe in, it creates meaningful economic impact. Also in places where early stage capital does not exist (e.g. 95+% of the world), this opportunity can unlock opportunities for innovation and economic development that have not existed before. At CCA, we have developed The Balanced Stakeholder Framework to help governments, regulators, investors and entrepreneurs to understand and balance the sometimes competing needs of each audience in creating a viable and sustainable crowdfunding ecosystem. The 4 elements that regulators/governments are required to balance to achieve this are:

Jason: The UK Treasury Department report in July 2015, really sums it up with national data: a majority of companies that crowdfund both increase their sales and hire more employees. When communities come together to invest in businesses they use every day or in entrepreneurs they believe in, it creates meaningful economic impact. Also in places where early stage capital does not exist (e.g. 95+% of the world), this opportunity can unlock opportunities for innovation and economic development that have not existed before. At CCA, we have developed The Balanced Stakeholder Framework to help governments, regulators, investors and entrepreneurs to understand and balance the sometimes competing needs of each audience in creating a viable and sustainable crowdfunding ecosystem. The 4 elements that regulators/governments are required to balance to achieve this are:

- Provide prudent protection for investors

- Deliver capital in an efficient and low friction manner to businesses

- Ensure transparency for regulators to monitor the ecosystem in a data intensive and prescriptively light manner

- Provide “oxygen” to the crowdfunding ecosystem to ensure the crowdfunding platform and related services have the opportunity to grow/succeed in a rational regulatory environment.

Erin: I understand you are launching a fund to invest in crowdfunding companies. Any updates?

Jason: Stay tuned! We are excited about the opportunities we see globally, on a daily basis that are delivering innovation and disruptive technology to the private capital markets.

Erin: Do you agree with former Barclay’s Group CEO Antony Jenkins, who believes that the number of branches and people employed in the financial services sector may decline by as much as 50% over the next ten years? Can traditional banking be saved? How can banks evolve? How is alternative finance instigating this transformative shift in finance?

Jason: Traditional financial companies (e.g. banks) will survive and many will thrive – but in different forms than they do now. One point of comparison is the travel industry and how travel agents and travel in general was revolutionized by the Web in the early 2000s. The financial firms that dig in now, figure out this market, create models that work for themselves and implement bold strategy, will succeed. Others that continue to ignore debt and equity crowdfunding, think crowdfunding is a fad or not “real,” will do so at their own peril.

Erin: What are your thoughts on the Ascenergy fraud? How does this impact the industry?

Erin: What are your thoughts on the Ascenergy fraud? How does this impact the industry?

Jason: The system worked. The SEC has many tools at its disposal for finding and prosecuting fraud and they will do so vigorously. This is a good thing. Companies that adhere to the law and work hard have an honest shot at raising capital via crowdfunding. Those who think this is an opportunity to commit fraud will be discovered via a combination of the SEC oversight, technology innovation and crowd-diligence.

Erin: Any predictions for Title III’s mid-2016 roll out?

Jason: Like previous new securities opportunities, the market will need time to digest this new tool. There will be much excitement but 2016 will be a gradual start to this market. 2017 will be the year we see much more significant growth as the market hits significant stride. This ramp up period is normal and a good thing and I hope will create a vibrant, sustainable and rational market.

Erin: Where do you see the crowdfund investing industry in the next 3 years? 5 years?

Jason: In 5 years, we will no longer talk about “Crowdfunding,” it will just be “funding.” Crowdfunding will just be one of the ways that early stage companies and SMEs gain access to capital. Just like online trading of public securities is considered the primary way that stocks are traded by retail investors, so too will it be in the private capital markets. This is going to be a decade of massive innovation in the private capital markets and crowdfunding is the tip of the spear for that. I can’t wait to see what’s next.

Due to a positive response, the Survey’s deadline has been extended until Friday, January 15.

Main benchmarking survey link:

-

https://www.surveymonkey.com/r/AltFinAmericas

- For Spanish version: https://es.surveymonkey.com/r/AltFin_Spanish

- For Portuguese version: https://pt.surveymonkey.com/r/AltFin_Portuguese

- For Canadian Platforms: https://www.surveymonkey.com/r/AltFin_Canada

The study is supported by the Inter-American Development Bank (IDB), Business Development Bank of Canada (BDC), KPMG and a number of leading industry research partners.

Crowdfund Insider has joined with The University of Cambridge, University of Chicago Booth School of Business and Crowdfund Capital Advisors to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and alternative finance industry pioneers from the collaborating associations.

Crowdfund Insider has joined with The University of Cambridge, University of Chicago Booth School of Business and Crowdfund Capital Advisors to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and alternative finance industry pioneers from the collaborating associations.

For benchmarking research enquiries please contact:

Dr. Robert Rosenberg, Chicago Booth School of Business (Robert.Rosenberg@ChicagoBooth.edu)

Tania Ziegler, Cambridge Centre for Alternative Finance, Cambridge Judge Business School (tz285@cam.ac.uk)

About the University of Cambridge, the University Chicago and Crowdfund Capital Advisors

University of Cambridge

This research is led by the Cambridge Centre for Alternative Finance, Cambridge Judge Business School. The Cambridge Centre for Alternative Finance is an international, interdisciplinary, academic research institute, dedicated to the study of alternative finance, which includes financial channels and instruments that emerge outside of the traditional financial system (i.e. regulated banks and capital markets).

Examples of alternative finance channels are online ‘marketplaces’ such as equity and rewards-based crowdfunding, peer-to-peer consumer/business lending, and third-party payment platforms. Alternative instruments include SME mini-bonds, private placements and other ‘shadow banking’ mechanisms, as well as social impact bonds and community shares used by non-profit enterprises and alternative currencies. The mission of the University of Cambridge is to contribute to society through the pursuit of education, learning and research at the highest international levels of excellence.

University of Chicago Booth School of Business

The University of Chicago Booth School of Business is consistently ranked among the top five business schools in the world. The school’s faculty includes renowned scholars and its graduates occupy key positions in the US and worldwide. The Chicago Approach to Management Education is distinguished by how it leverages fundamental knowledge, its rigor, and its practical application to business challenges.

The school offers full and part-time MBA programs, a PhD program, open enrollment executive education and custom corporate education with campuses in Chicago, London, and Hong Kong.