This past Tuesday (May 3rd), twenty members of Congress joined to ask the Secretary of the Treasury, Jack Lew, to tread lightly when it came to the emerging marketplace lending industry.

The timing of bi-partisan missive is important as Treasury has announced it will publish a report addressing the online lending industry at some point next week. Treasury officials said the white paper will provide an overview of what the Treasury heard in response to the “Request for Information” from 2015 along with research and recommendations for the online lending industry.

The timing of bi-partisan missive is important as Treasury has announced it will publish a report addressing the online lending industry at some point next week. Treasury officials said the white paper will provide an overview of what the Treasury heard in response to the “Request for Information” from 2015 along with research and recommendations for the online lending industry.

The request from elected officials to safeguard innovation and economic growth is in contrast to a more ominous letter sent to the General Accounting Office asking the agency to research, and make recommendations on the regulation of peer-to-peer/marketplace lenders. The three US Senators demanded of the GAO to tackle these questions:

- What is the authority of federal agencies to supervise and examine companies offering consumer and online small business loans? How do regulators account for risk and treat these assets on the balance sheets of financial institutions?

- What recommendations do you have to modernize consumer protection laws in response to the growth of Fintech?

The drums have been pounding for quite some time as to the growing risk of additional rules or regulations pertaining to online lenders.

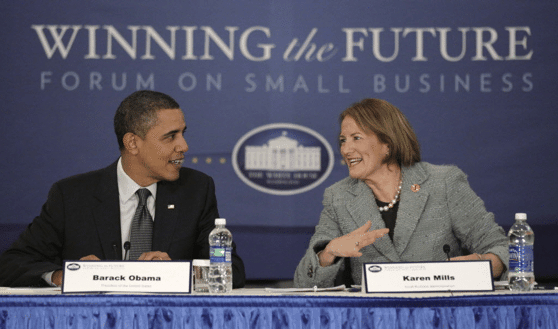

While the industry has grown rapidly, it remains a rather small segment of the overall financial industry. What many marketplace lenders have been able to provide, is access to capital, for both consumers and small businesses, where it was not available before. As Karen Mills, former head of the SBA during the Obama Administration, told Crowdfund Insider late last year, lending to SMEs does not work very well for banks. They struggle to make any money on SME loans. So why should they do it? Mills labeled online lending as “transformative,” causing traditional finance to take note, and perhaps better compete by providing improved services.

Larry Summers, former Secretary of the Treasury under President Clinton and Director of the National Economic Council under President Obama, in a speech last year called upon policy makers to;

Larry Summers, former Secretary of the Treasury under President Clinton and Director of the National Economic Council under President Obama, in a speech last year called upon policy makers to;

“Let new business models emerge. Regulators should allow new firms to operate, generate data on the outcomes created by novel business models before writing new rules.”

Summers believes;

“It will be important as the industry evolves and grows that regulators not create overhangs of uncertainty or burden excessively those attempting to innovate.”

Yet the fear remains that enterprising public officials will suffocate innovation with excessive regulatory zeal. It won’t be the first time. It won’t be the last either.

The signatories of the request to Secretary Lew concur with Ms. Mills assessment;

“even when small business lending was at its peak, from 2005 until 2007, more than 50% of small and mid-sized businesses said that credit was hard to get.”

The ensuing financial crisis only made things harder as banks were required to shore up balance sheets cutting off the SMEs that needed funding the most. In a painful act of irony, banks were compelled to limit credit to the engines of economic growth.

The letter from Congress asks of Secretary Lew;

“Given the impact online marketplace lenders have had on small business lending and given that the industry is still in early stages of development, we urge the Department to encourage the evolution of this market without dampening or delaying innovation.”

Something I would call, a fair request.

But Washington, DC works in mysterious ways. Financial innovation can clearly provide benefits to consumers and the economy overall. Former Secretary Summers is of the opinion that traditional finance has let us down.

A representative from the Consumer Financial Protection Bureau (CFPB) recently expressed his agency’s skepticism regarding online lenders stating;

“…it is simply too soon to know whether marketplace lending will be able to realize its potential as a means of delivering credit at a lower cost to consumers (and small businesses) who have the ability to repay the loans they obtain or whether the marketplace lending business model will prove unable to sustain itself through a full business cycle.”

The CFPB is perhaps best positioned, and most incentivized, to challenge the young industry with additional rules.

Alternatively, Congressional leaders strike a more optimistic tone;

Alternatively, Congressional leaders strike a more optimistic tone;

“We ultimately believe that financial innovation presents entrepreneurs and consumers bespoke credit channels that, if fairly monitored and understood, enrich the democratization of finance, further align the interests of lenders and borrowers, and unleash capital formation to strengthen our economy.”

So will Treasury adhere to the demands of the people and take a more thoughtful approach that encourages change for the better? We shall know more at some point next week.

The Bi-Partisan letter from Congress is embedded below.

[scribd id=311635304 key=key-2IMJXks3ZnL45FMF7V7O mode=scroll]