If Amazon built a bank, would it aspire to be like Revolut? I don’t know about that, but the Revolut Premium Membership is something I want. Now.

London-based Fintech startup Revolut has launched its vision of Premium Membership in a world populated by stiff and stultifying old banks. Calling itself a “neo-bank”, Revolut wants to disrupt the international transfer space by allowing its customers to send money globally for £6.99 per month. This is a solution for the global, digital generation. Having just returned from my corner bank after being fleeced for exchanging some Euros – this is something I need. Revolut is betting their 550,000 customers spread across 42 different countries will also agree.

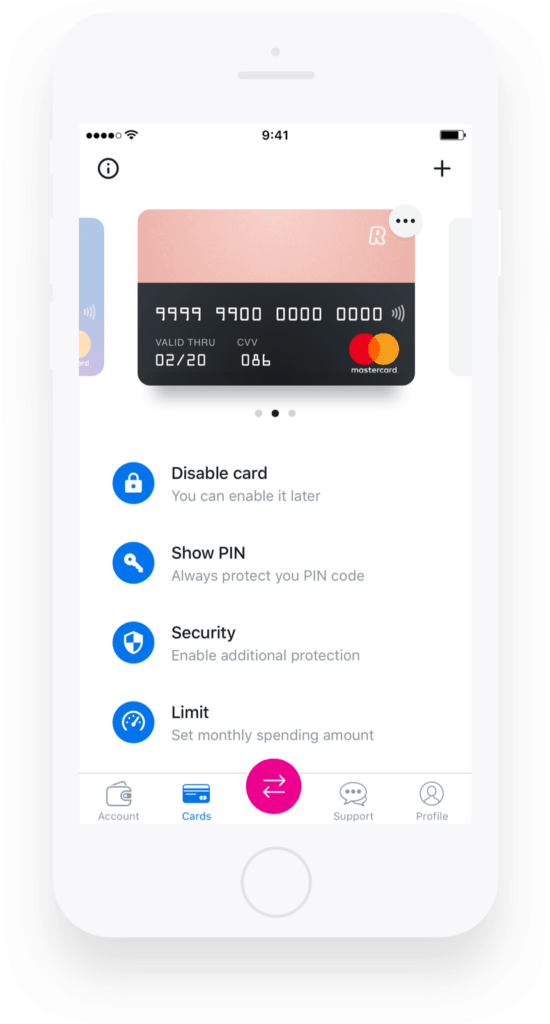

So what else do you get with a Revolut Premium account? In addition to the typical current account, with features that include spending categorisation, bill splitting, budgeting control and the ability to freeze your card anytime, Premium has some additional features:

So what else do you get with a Revolut Premium account? In addition to the typical current account, with features that include spending categorisation, bill splitting, budgeting control and the ability to freeze your card anytime, Premium has some additional features:

- Premium members can use the Revolut app & contactless MasterCard to spend, transfer & exchange an unlimited amount of money anywhere in the world at the interbank exchange rate without fees

- A new Revolut Premium Mastercard with free express delivery anywhere in the world, plus a spare card which can be activated at any time in the app

- Overseas medical insurance

- Double the ATM limit vs Revolut Basic

- 24/7 digital customer support

Revolut says the first 5,000 customers to sign up to Revolut Premium will also receive priority access to invest in the company’s forthcoming investment round on UK-based crowdfunding platform, Seedrs. The estimated £4 million crowdfund campaign is said to be part of their larger Series B round. As of this writing, additional details were not available.

Vlad Yatsenko, Revolut’s CTO, calls it Amazon Prim for banks;

“With Revolut we introduced three things: we removed exchange rate markups for travelers, we eliminated fees to transfer money globally and now we are making it unlimited, by introducing Premium with a single annual membership.”

Nikolay Storonsky, founder & CEO, Revolut, said they were on a mission to build a 21st century alternative to banks. Their vision is to create a service for a global lifestyle.

Nikolay Storonsky, founder & CEO, Revolut, said they were on a mission to build a 21st century alternative to banks. Their vision is to create a service for a global lifestyle.

“From day one we set out to revolutionize what millennials had come to expect from the incumbents, like crazy fees when you spend money abroad, and take the user experience far beyond banking,” says Storonsky. “Revolut Premium will be an all-you-can-eat membership program for a new generation of digitally-driven demanding consumers who feel disengaged from their current financial service providers.”

Revolut was launched by Storonsky and Yatsenko in July 2015. The duo sought to inject transparency and innovation into the financial services industry and they have obviously had some solid success by acquiring more than half a million customers in just 18 months. Revolut aims to cut hidden banking fees to zero.

The upcoming funding round will take place almost a year after Revolut raised £1 million from the crowd with 10,000 investors registering for the chance to back the Fintech firm. Revolut says the offer was 1000% oversubscribed with investors pledging in excess of £17 million. For this reason, Revolut has increased this year’s crowdfunding target to £4 million to give customers and new members the opportunity to invest alongside Revolut’s larger VC investors. To date, Revolut has raised over $15 million with some big names supporting their firm, including; Balderton Capital, Index Ventures, Ribbit Capital, Point Nine and Seedcamp.

The upcoming funding round will take place almost a year after Revolut raised £1 million from the crowd with 10,000 investors registering for the chance to back the Fintech firm. Revolut says the offer was 1000% oversubscribed with investors pledging in excess of £17 million. For this reason, Revolut has increased this year’s crowdfunding target to £4 million to give customers and new members the opportunity to invest alongside Revolut’s larger VC investors. To date, Revolut has raised over $15 million with some big names supporting their firm, including; Balderton Capital, Index Ventures, Ribbit Capital, Point Nine and Seedcamp.

Revolut has raised over US$15 million in investment from well-known European Venture Capital investors including Index Ventures, Balderton Capital, Ribbit Capital, Point Nine and Seedcamp. In July 2016, Revolut ran a successful £1m crowdfunding campaign which was 11x oversubscribed by 11,000 would-be investors.

This past January, the Revolut launched current accounts that allow customers to have their salaries paid into their digital account. In February, Revolut partnered with property investment platform Bricklane to offer a Property ISA product. Last week Revolut launched “instant credit” in partnership with peer-to-peer platform Lending Works.

You can follow the status of Premium Membership signups here.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!