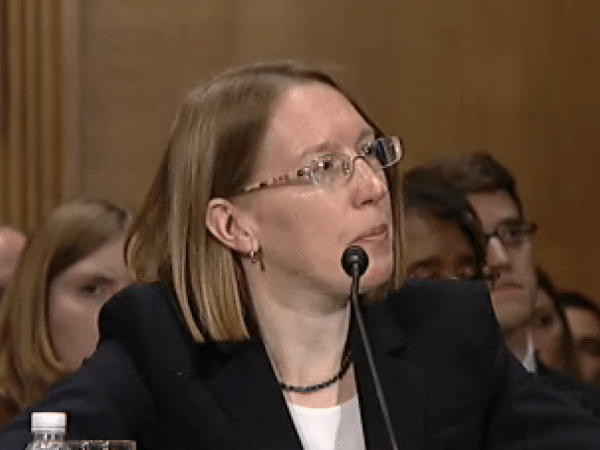

SEC Commissioner Hester Peirce has posted a dissenting opinion regarding the rule proposal addressing SPACs.

As was previously reported, the Securities and Exchange Commission has issued a 372-page proposal for new rules pertaining to Special Purpose Acquisition companies [SPACs]. SEC Chairman Gary Gensler described the proposal as enabling greater disclosure and improving investor protection but Commissioner Peirce believes the proposal goes too far and is designed to destroy the SPAC market.

Commissioner Peirce stated:

“The proposal – rather than simply mandating sensible disclosures around SPACs and de-SPACs, something I would have supported – seems designed to stop SPACs in their tracks. The proposal does not stop there; it also makes a lot of sweeping interpretations of the law that are not limited in effect to the SPAC context. Accordingly, I dissent.”

Commissioner Peirce explains that the proposal goes beyond additional disclosures that would enhance investor understanding by imposing burdens that appear to be “designed to damn, diminish, and discourage SPACs because we do not like them.”

Peirce posits that the proposal seems to indicate the SEC believes that SPACs are creating public firms that are not good for investors, instead of investors making their own investment decisions.

She states:

“As I have previously argued, we could use this moment to ask whether the SPAC revival of recent years reveals shortcomings with the traditional IPO process and to consider ways to calibrate properly the rules governing IPOs, SPACs, and direct listings. Instead, today’s proposal assumes that the traditional IPO process works just fine as is, that it provides the optimal level of investor protection, and that it generates the right number and the right type of public companies. I look forward to hearing from commenters not only about SPACs, but about whether the traditional IPO process could be improved.”

You may read Commissioner Peirce’s entire statement here.