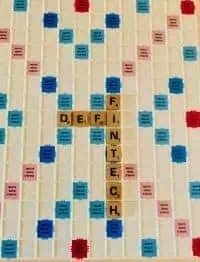

IMF Encourages Pacific Island Nations to Explore Digital Money Benefits

Pacific Island nations are poised to harness the digital money revolution to enhance their financial systems, improve financial inclusion, and counteract the decline in correspondent banking relationships, according to research conducted by the International Monetary Fund (IMF). The geographic isolation, small size, and distinct challenges… Read More

Read more in: Fintech, Global | Tagged central bank digital currencies, digital money, imf, international monetary fund