House of Representatives Passes FinCEN Bill that Targets Virtual Currencies

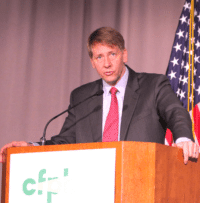

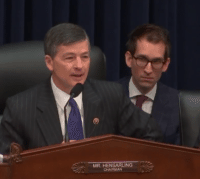

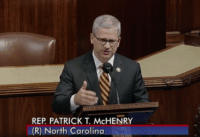

The House of Representatives has approved the “FinCEN Improvement Act of 2018,” sponsored by Rep. Ed Perlmutter (HR 6411). The bill was passed on a voice vote indicating strong bi-partisan support in the House. The legislation requires the Department of the Treasury’s Financial Crimes Enforcement Network (or… Read More

Read more in: Blockchain & Digital Assets, Politics, Legal & Regulation | Tagged ed perlmutter, fincen, hr 6411, jeb hensarling