Bee Mortgage App Extends RegCF Raise Through Crowdfunding Platform Fundopolis

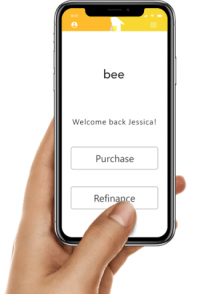

Bee Mortgage App, a U.S.-based mortgage mobile app, announced on Thursday it has extended its RegCF raise on Fundopolis, a recently approved funding portal. Founded in 2019, Bee Mortgage App claims to be the first eMortgage mobile app powered by VLO, a virtual loan officer…. Read More

Read more in: Offerings, Fintech, Real Estate | Tagged bee mortgage app, fundopolis, investment, mobile app, mortgage, regcf, u.s., united states