In my May 2014 article, “The Bell Tolls for Title III”, I laid out the reasons why it was highly unlikely that the SEC would issue Title III rules before the November elections and predicted that should the Senate flip to Republican control, we would see legislative changes to the JOBS Act. I have been asked to describe some of the underlying political issues and context for what is occurring in the SEC and what may happen with Title III and Title IV now that Congress is in Republican hands.

The subtitle for this article could be “Why the SEC is not our enemy.” There are numerous factors affecting the delay in the release of the rules and there will be revision cycles even once the rules are issued. There are broad political issues at play. Our engagement with the SEC must reflect an appreciation for the very real risks in crowdfunding, the efforts of the SEC to craft effective regulations, and the political theater that informs this issue.

I have often been misquoted as saying that there will not be fraud in crowdfunding. This is not a perfect new market. There have been perks or donation based frauds, there is a criminal prosecution underway, there have been sanctions of platforms by the SEC for violations of 506(c) and misrepresentations to investors. What I have actually said is that regulations should be fashioned based on best available evidence to allow the intent of Congress to be enacted – which was to enable and encourage new mechanisms of finance for early stage companies.

I support a lightweight regulatory scheme that protects investors, keeps bad actors out of the market, and ensures “adequate” investor education (what adequate means keeps many at the SEC up at night). It should also take advantage of advances in technology to allow real-time monitoring of activity on platforms. One of the fundamental long-term challenges facing the SEC is learning to use technology to monitor security offerings on platforms rather than relying on disclosures and filings as the primary mechanism for investor protection.

What I have often said, but which is rarely understood, is that “crowdfunding will make sense in 10 years.” By this I mean that there will be legislative and regulatory changes – the law will evolve, and our job is to learn to work within the structures of government to help fashion a robust industry as the market dynamics evolve, and as the inevitable business and platforms failures occur, fraud is reported, and the market grows substantially. We are in this for the long haul, despite our desire to see this resolved quickly.

The Context of Conflict

To understand why there is so much conflict, let’s start by reviewing commonly arguments (many of which are wrong) for why the Title III and Title IV rules have been so delayed:

(1) The SEC is still fashioning rules and doesn’t understand the issues.

The proposed rules were for Title II were drafted months before they were released. Similarly, I would suspect that the final rules for Title III have been drafted for some time. One of the failures of our industry was to provide a large number of well-reasoned comment letters. The total number of comment letters for Title II was far greater than for Title III. The implication here is that once you subtract the letters that can be discounted immediately (“release the damn rules” “there should not be any regulation” etc.) the staff really did not have a huge amount to review. They had hoped for guidance from the industry on some sticking points, and I must commend many of the CFIRA board members and others for writing excellent comment letters, but on the whole, the SEC did not get enough assistance with their critical questions.

The proposed rules were for Title II were drafted months before they were released. Similarly, I would suspect that the final rules for Title III have been drafted for some time. One of the failures of our industry was to provide a large number of well-reasoned comment letters. The total number of comment letters for Title II was far greater than for Title III. The implication here is that once you subtract the letters that can be discounted immediately (“release the damn rules” “there should not be any regulation” etc.) the staff really did not have a huge amount to review. They had hoped for guidance from the industry on some sticking points, and I must commend many of the CFIRA board members and others for writing excellent comment letters, but on the whole, the SEC did not get enough assistance with their critical questions.

Secondly, some in the industry discount or demean the professionalism and work of the SEC staffers and commissioners. They have worked very hard to understand the issues. I have met with the SEC more than once and came away feeling that they had a very good understanding of the salient issues. There are obviously areas where many in the industry wish the SEC would change their stance. We need to remember that many of the SEC’s public comments are political in nature. Unfortunately, it is common in our toxic US political environment to demean and attack those across the aisle. If we want to work with the SEC through the inevitable changes to regulations in the next several years, we need to stop demonizing them.

(II) FINRA is blocking Title III

It is true that FINRA worked closely with, and for a time embedded staff at, the SEC to work on the JOBS Act rules. However, we should recognize that they won the early battles. There had been talk of creating an SRO separate from FINRA in the first few weeks of the industry. Some advocated for positions that would not require the involvement of FINRA registered professionals. I cannot comment on the sentiment inside FINRA, but I would suspect that the JOBS Act is not a high priority, and that they are essentially happy with the SEC’s requirements that brokers dealers be involved. We are under their umbrella, and I don’t believe they are blocking the release of the rules.

(III) The Industry has not been active enough

There was a recent effort to pressure the SEC to issue the regulations. It was based on some comments that suggested that the SEC needed the industry to be more active and engaged. This was both absolutely true and a total ruse.

There was a recent effort to pressure the SEC to issue the regulations. It was based on some comments that suggested that the SEC needed the industry to be more active and engaged. This was both absolutely true and a total ruse.

The truth in the statement is that the industry has not been active enough. CfPA is rebounding, CFIRA has been effective, but on the whole, the number of active, informed and educated advocates for the industry has been quite small. I have counted as many as six attempts to create versions of a crowdfunding association in the US, but only CfPA and CFIRA have the respect and ear of Congress, SEC and the Administration. This mish-mash of competing organizations hurt our credibility in the early stages with the SEC.

We also have seen what all maturing industries see – the absence of major platforms from “industry” meetings. Larger platforms have essentially dropped out of the trade associations and have been having side meetings with the SEC. This is consistent with companies trying to advocate for policies that are in their best interests. However, it was too early – by not coordinating their efforts or working with the smaller industry players and associations, there has been conflicting advice to the SEC and we at times are working at cross purposes.

The ruse in the statement is that all regulators, in all agencies, will always say that they need better input and more comments from the public and interested parties. This is said to consultants, industry leaders, lobbyists, and the occasional crackpot. Being asked to write a letter or supply comments does not imply that the lack of comment letters or industry action caused any delay. Agencies are legally bound to consider input and comment letters, and will always invite parties to write letters. Staff can only act on written comments. Some in the industry took this very literally. I applaud their efforts, but never believed this in itself would lead to the release of the rules because the real battle is ….

(IV) The war between Progressives – “Warrenites” and Free Market Advocates

In the eyes of policy makers, our issues are a backdrop to a much broader and bigger struggle. Last week I was in a meeting with a US Ambassador, the former head of the 9/11 commission, a top executive from one of the world’s ten largest corporations and a former chief domestic economic policy advisory to a recent US President. We were reviewing a manuscript about US economic policy. When crowdfunding came up, the word used to describe the industry was “cute.” This week I met with former Labor Secretary Robert Reich to discuss crowdfunding. His position is the lack of access to capital is one of the least significant factors affecting the decline of entrepreneurship in the US. Secretary Reich has used KickStarter – and is a friend to the industry. The point here is that we need to situate our arguments in the context of the larger debates that are occurring, and the main concerns of the consumer protection lobby and not overestimate the importance of our issues in the eyes of Washington.

In the eyes of policy makers, our issues are a backdrop to a much broader and bigger struggle. Last week I was in a meeting with a US Ambassador, the former head of the 9/11 commission, a top executive from one of the world’s ten largest corporations and a former chief domestic economic policy advisory to a recent US President. We were reviewing a manuscript about US economic policy. When crowdfunding came up, the word used to describe the industry was “cute.” This week I met with former Labor Secretary Robert Reich to discuss crowdfunding. His position is the lack of access to capital is one of the least significant factors affecting the decline of entrepreneurship in the US. Secretary Reich has used KickStarter – and is a friend to the industry. The point here is that we need to situate our arguments in the context of the larger debates that are occurring, and the main concerns of the consumer protection lobby and not overestimate the importance of our issues in the eyes of Washington.

Why is there so much concern over fraud? Let’s start with a history review. The US Economy has seen unprecedented and major fraud cases in the past 20 years, notably including Enron, WorldCom, and Bernie Madoff. The scale of these frauds, the number of affected investors, and the complex interaction between accounting, audit, and the financial reporting of the firms, led to significant changes to the practice of auditing of US firms and the creation of the PCAOB. This was followed by the great recession of 2008, caused in large part by financial malfeasance by Wall Street, a lack of regulatory oversight, and the collusion of many corrupt if not criminal mortgage brokers who entered the subprime market.

Why is there so much concern over fraud? Let’s start with a history review. The US Economy has seen unprecedented and major fraud cases in the past 20 years, notably including Enron, WorldCom, and Bernie Madoff. The scale of these frauds, the number of affected investors, and the complex interaction between accounting, audit, and the financial reporting of the firms, led to significant changes to the practice of auditing of US firms and the creation of the PCAOB. This was followed by the great recession of 2008, caused in large part by financial malfeasance by Wall Street, a lack of regulatory oversight, and the collusion of many corrupt if not criminal mortgage brokers who entered the subprime market.

The Obama administration created the Consumer Financial Protection Bureau, at one time headed by Elizabeth Warren, in reaction to this. The level of scrutiny of banks and financial institutions has never been higher and in many ways has contributed to the rise of marketplace lending due to the inordinate compliance costs on banks.

The Obama administration created the Consumer Financial Protection Bureau, at one time headed by Elizabeth Warren, in reaction to this. The level of scrutiny of banks and financial institutions has never been higher and in many ways has contributed to the rise of marketplace lending due to the inordinate compliance costs on banks.

We also have had the most polarized, poisonous, divided and dysfunctional Congress in history since President Obama was elected.

On one side of this debate are the Progressives. Their current leader in the US Senate is Elizabeth Warren who was just elevated to a leadership position in the Democratic caucus in the Senate. The Warrenites, put simply, do not trust Wall Street, do not trust businesses, and believe more regulation is needed and necessary to protect consumers from predatory and unfair practices. Progressives have been very angry with President Obama for his lack of action on several social fronts including immigration, defense policy, etc., and consumer protection has emerged as a unifying theme among the Progressives – which are vying for a larger voice in the Democratic party. Many believe that the Democratic leadership intends to “drive all risk out of  financial markets.” With apologies to their well intentioned desire to protect consumers, with risk comes reward, and without risk the markets collapse. This sentiment reflects a vein of thinking in the party that is affecting this debate.

financial markets.” With apologies to their well intentioned desire to protect consumers, with risk comes reward, and without risk the markets collapse. This sentiment reflects a vein of thinking in the party that is affecting this debate.

On the other side of the debate are the free market/libertarian informed Conservatives. I hesitate to paint them as Tea Party members, because not all of them are – there is variation in their philosophy. What unites them is (a) a strong sentiment that regulations are strangling US business and competitiveness, (b) a desire to roll back regulations and many of President Obama’s initiatives, and (c) a fundamental faith in the ability of markets to be efficient and mostly self-regulating.

Readers will have discerned in this divide a preamble to the 2016 election battle. The election on November 4th set the stage for 2016 and everything in the next two years is about the next election.

Readers will have discerned in this divide a preamble to the 2016 election battle. The election on November 4th set the stage for 2016 and everything in the next two years is about the next election.

There is widespread understanding that America is in trouble. While our macroeconomic indicators are far better than many other G8 countries (despite widespread belief to the contrary by the voters), and we are outperforming most of Europe and the UK, the sense of malaise is prevalent. The rate of entrepreneurship is and has been dangerously declining for many years. Large companies are shedding jobs. Both parties are attempting to address these fundamental issues in radically different ways.

My thesis is that the delay in the release of Title III reflects several factors, most importantly being the fact that this is a political issue pitting Warrenites against Libertarians (with apologies to moderate Republicans). Title II had bipartisan support and passed out quickly. Title IV will soon be voted upon (see below) and also enjoys bipartisan support. Title III, however, is embroiled in the broader debate about investor and consumer protection.

The Coming Changes in Legislation to Title III

We also cannot forget the fact that the current legislation is not workable. The arbitrary division between $500K and larger raises, the lack of clarity around reporting issues and financial auditing, the ongoing costs of compliance, etc., all add up to an expensive framework with significant risk to the issuer and to the investor. The law is broken, which often happens when a rapid compromise is reached to pass a bill quickly. Congress, the administration and the SEC all know Title III in its current form needs revision.

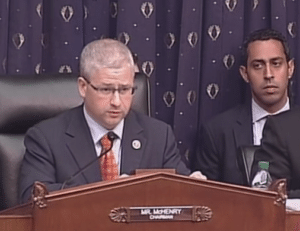

Rep. Patrick McHenry (R, NC) has presented proposed bills to correct most of these issues, but he knew that they would not be considered by the existing Senate Leadership. Now that he is Deputy Whip in the House, some variation of his bills will likely be considered.

Based on feedback from the Hill, and from several other conversations, I predict that we will see an amendment to the JOBS Act in Q2 2015. The exact nature of the amendments cannot be predicted, but broadly speaking they will return the crowdfunding act (Title III) much closer to the version that passed out of the House. Essentially, they will unwind the compromise with Sen. Harry Reid to get the bill passed quickly. This should mean higher caps on the amounts that can be raised, lower auditing requirements and probably less ongoing reporting.

Based on feedback from the Hill, and from several other conversations, I predict that we will see an amendment to the JOBS Act in Q2 2015. The exact nature of the amendments cannot be predicted, but broadly speaking they will return the crowdfunding act (Title III) much closer to the version that passed out of the House. Essentially, they will unwind the compromise with Sen. Harry Reid to get the bill passed quickly. This should mean higher caps on the amounts that can be raised, lower auditing requirements and probably less ongoing reporting.

Why won’t it be Q1? Because the first 90-100 days of the new session will lay the groundwork for the next election. The Republicans will test the resolve of the President and push him hard. Expect a flurry of subpoenas, special committees, investigations and efforts to repeal provisions of the Affordable Care Act, environmental regulation and a host of other issues that are critical to the core of the Republican base. Put another way, each side has to duke it out and see how much power they have and set the stage for 2016. Forget any possibility of bipartisan compromise, it won’t happen, everyone needs to raise funds for the next election by rallying their base.

Put frankly, fixing the JOBS act just isn’t as important as these other issues – there is no hue and cry about it and I would doubt donations are being made to either side of the aisle to move any legislator to make it a priority.

The amendment will likely be attached to a broader economic or spending bill. It is unlikely to be voted on as a separate piece of legislation. Given the tenor of discussion on the Hill, it may be Self Executing Legislation. Meaning that the amendment will specify the regulations to be imposed and strictly limit the authority or discretion of the SEC, and to the extent the SEC has discretion in this legislation, it will be severely time curtailed.

Such legislation is the equivalent of a declaration of war between a legislative body and an administrative/regulatory body. If passed, we must expect backlash from the SEC. This is not a criticism of the SEC, just a general comment on the behavior of regulatory bodies and any encroachment on their authority. When there is a significant case of fraud, or when they see the opportunity to sanction a platform or issuer for breaking crowdfunding related rules, the SEC will act aggressively.

We should also expect to see backlash from the consumer protection lobby. If Congress passes what will be described as a “weak or watered down” bill, when fraud occurs, which it will, there will be a strong push to revise the regulations to enforce a much more stringent set of rules than contemplated under the existing proposed rules for Title III.

Essentially, we are going to see an evolution of the regulations, with something of a pendulum in the requirements, for several years. Whether we arrive at an effective marketplace and thriving ecosystem depends in large part on our recognition of the real dynamics at play and also our willingness to understand the views of the interested parties.

There is strong lobbying opposing Title III in Congress and at the SEC. This lobbying is more effective, better organized, and more knowledgeable than the crowdfunding industry so far. In part this is due to the camps within crowdfunding who don’t see eye-to-eye. There are a large number of highly entrepreneurial individuals, people with experience in startups, web marketing, SEO, etc., who see this as a significant opportunity and address the issues through the optics of market opportunity and entrepreneurship. There is another camp of attorneys, CPAs, and broker dealers who see this as a complex industry within a regulated financial market. Policy makers and SEC see it as the latter.

Antagonist and Protagonist in Title IV

If the SEC is to vote on any part of the JOBS Act this year, it will be Title IV. There is significant chatter that Title IV may emerge soon. The antagonists and protagonists in this debate are different. It is essentially a battle over Federalism, with the State Security Regulators up in arms over state preemption. They believe that the SEC overstepped its authority when it defined “qualified purchasers” as anyone. This makes Reg A+ exempt from state registration. Sam Guzik and others have pointed out that the intention of Title IV was specifically to preempt the States.

If the SEC is to vote on any part of the JOBS Act this year, it will be Title IV. There is significant chatter that Title IV may emerge soon. The antagonists and protagonists in this debate are different. It is essentially a battle over Federalism, with the State Security Regulators up in arms over state preemption. They believe that the SEC overstepped its authority when it defined “qualified purchasers” as anyone. This makes Reg A+ exempt from state registration. Sam Guzik and others have pointed out that the intention of Title IV was specifically to preempt the States.

The battle here is over this definition and the power of NASSA. If it becomes an accredited investor, then it in many ways defeats the purpose of Title IV. If it is anyone, then it preempts the States. The question is one of the appropriate balance. NASSA has been very vocal about protecting the authority of its members – the State Security Regulators. I expect to see Title IV pass quickly, but cannot predict what balance the SEC will design.

Summary and Predictions

If the crowdfunding industry does not pay equal attention to the regulatory and political landscape as it does the potential for technological and social innovation, we will ultimately arrive at an industry that is hamstrung by onerous regulation. Context and civility are often missing from discussions.

If the crowdfunding industry does not pay equal attention to the regulatory and political landscape as it does the potential for technological and social innovation, we will ultimately arrive at an industry that is hamstrung by onerous regulation. Context and civility are often missing from discussions.

Given the overwhelming victory of the Republicans, it is highly likely Title III will be changed. The SEC has long known this and the likely outcome of the Senate race was predicted by many insiders months ago. Title IV will be voted on soon.

Should a progressive democrat win in 2016, it is likely that we will see a retrenching of many of the regulations that the Republicans will likely change in the next few months.

Let’s be clear, there are important and broad ongoing debates about economic policy, the CFPB, regulation in general, the authority of the Executive Branch, and banking policy. We are caught in these debates. The effectiveness of the industry is in large part dependent on our ability to frame our suggested rules and policy recommendations within this context, and use arguments informed by evidence and data to bolster their credibility

__________________

Richard Swart, PhD., is the Director for the Program for Innovation in Entrepreneurial & Social Finance at the Fung Institute at UC Berkeley. Swart leads a research team that is studying how crowdfunding and other forms of alternative finance are changing the world of startup funding, SME finance, and investing opportunities created by P2P and P2B models. He has become one of the most sought after advisors for financial institutions, foundations, universities and governments. Swart is also a partner at Crowdfund Capital Advisors Group (CCA) – a group that has been involved with the crowdfunding movement since day one.

Richard Swart, PhD., is the Director for the Program for Innovation in Entrepreneurial & Social Finance at the Fung Institute at UC Berkeley. Swart leads a research team that is studying how crowdfunding and other forms of alternative finance are changing the world of startup funding, SME finance, and investing opportunities created by P2P and P2B models. He has become one of the most sought after advisors for financial institutions, foundations, universities and governments. Swart is also a partner at Crowdfund Capital Advisors Group (CCA) – a group that has been involved with the crowdfunding movement since day one.