Has Intrastate Crowdfunding in Washington State Been Washed Out by NASAA and the SEC?

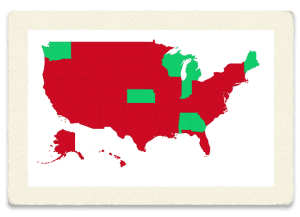

On May 5, 2014, I published an article in Crowdfund Insider highlighting recent informal “rulemaking” at the SEC Division of Corporation Finance, which in my opinion quietly dampened the efforts of three states to implement their own brand of intrastate crowdfunding: Kansas, Georgia, and most recently, Washington State.

A prominent feature of the Kansas, Georgia and recently enacted Washington State crowdfunding legislation: issuers would be able to crowdfund on their own website through general solicitation of investors – unlike JOBS Act crowdfunding, which mandates use of a licensed intermediary, and severely limits the ability of an issuer to call any attention to its crowdfunded offering outside of a licensed portal.

A prominent feature of the Kansas, Georgia and recently enacted Washington State crowdfunding legislation: issuers would be able to crowdfund on their own website through general solicitation of investors – unlike JOBS Act crowdfunding, which mandates use of a licensed intermediary, and severely limits the ability of an issuer to call any attention to its crowdfunded offering outside of a licensed portal.

However, on April 10, 2014, the SEC Division of Corporation Finance, the same division at the SEC charged with implementing Title III (crowdfunding) legislation and Title IV (Regulation A+) under the JOBS Act, cut the heart out of three states’ intrastate crowdfunding initiatives. The most recent victim – Washington State – whose legislature proudly enacted its own intrastate crowdfunding legislation in March 2014.

As prominent Washington State corporate lawyer Joe Wallin noted in his May 6 article on Crowdfund Insider, discussing the ability of Washington businesses to solicit Washington State residents under the new Washington statute:

As prominent Washington State corporate lawyer Joe Wallin noted in his May 6 article on Crowdfund Insider, discussing the ability of Washington businesses to solicit Washington State residents under the new Washington statute:

“Companies won’t be able to ‘generally solicit’ their offerings on the Internet for the whole world to see because that would be inconsistent with an intrastate exemption, according to the SEC.”

The SEC ruling at issue, C&DI 141.05. As Joe Wallin pointed out:

“C&DI No. 141.05 make[s] it clear that the SEC’s position is that use of the Internet through websites and social media ‘in a broad, indiscriminate manner…to convey information about specific investment opportunities would likely’ not be compatible with the intrastate exemption.”

In fact, under the SEC ruling, an issuer utilizing the new Washington State exemption cannot even mention it is conducting fundraising on any part of its website accessible to the general public.

The immediate impact of this informal April 2014 SEC Staff ruling is to nullify one of the more important features of the Washington statute before it even becomes effective – the ability of an issuer to communicate with the public via the Internet to call attention to its intrastate crowdfunded offering. Thus, on April 10, 2014, the SEC stopped the Washington state legislature dead in its tracks – on the eve of the implementation of the Washington state statute. Essentially, the SEC ruled that federal law prohibits this type of activity under the federal “intrastate” exemption that Washington State and two other states have relied on. Why?

The immediate impact of this informal April 2014 SEC Staff ruling is to nullify one of the more important features of the Washington statute before it even becomes effective – the ability of an issuer to communicate with the public via the Internet to call attention to its intrastate crowdfunded offering. Thus, on April 10, 2014, the SEC stopped the Washington state legislature dead in its tracks – on the eve of the implementation of the Washington state statute. Essentially, the SEC ruled that federal law prohibits this type of activity under the federal “intrastate” exemption that Washington State and two other states have relied on. Why?

In the view of the SEC staff, the so-called federal intrastate exemption, which prohibits “offers and sales” of securities by an issuer to non-residents, would be violated if an issuer did anything on its website to call attention to the offering. It would seemingly make no difference to the SEC even if the issuer cautioned the public that the offering was only available to state residents – and even if the issuer also implemented procedures to ensure that no non-resident could actually purchase securities in the intrastate offering.

In the view of the SEC staff, the so-called federal intrastate exemption, which prohibits “offers and sales” of securities by an issuer to non-residents, would be violated if an issuer did anything on its website to call attention to the offering. It would seemingly make no difference to the SEC even if the issuer cautioned the public that the offering was only available to state residents – and even if the issuer also implemented procedures to ensure that no non-resident could actually purchase securities in the intrastate offering.

So while the U.S. Department of Justice is officially looking the other way while Washington State mom and pop retail businesses openly dispense marijuana to its residents, no Washington State business operating within the newly enacted Washington State crowdfunding statute can openly offer its securities to the public via the Internet – at least not without incurring the ire of the SEC Division of Corporation Finance. Something is wrong with this picture.

So while the U.S. Department of Justice is officially looking the other way while Washington State mom and pop retail businesses openly dispense marijuana to its residents, no Washington State business operating within the newly enacted Washington State crowdfunding statute can openly offer its securities to the public via the Internet – at least not without incurring the ire of the SEC Division of Corporation Finance. Something is wrong with this picture.

At a time when the investment crowdfunding world patiently awaits the SEC’s federal crowdfunding rules, one might ask: Why is it that Washington State residents can puff away on marijuana to their hearts’ content, in violation of federal law, while at the same time the SEC Division of Corporation Finance is putting a muzzle on Washington State’s entrepreneurs who seek to do no more than to use the Internet to reach out their residents for needed working capital? Seems to me that being “laid back” has a higher priority at some quarters in Washington, D.C. than being “laid off.”

Time for a Step Forward at the SEC for Crowdfunding in the Internet Age – Not a Step Backwards

Perhaps the folks at the SEC’s “Corp Fin” ought to step back, take a deep breath, “inhale” and reconsider their April 10 position.

Perhaps the folks at the SEC’s “Corp Fin” ought to step back, take a deep breath, “inhale” and reconsider their April 10 position.

The last time that the Staff of the Division of Corporation Finance visited the issue of the utilization of the Internet in cross-border transactions, and espoused a restrictive view which parallels the view adopted in April 2014, was in 1998. Significantly, however, in 1998 the Staff noted that this restrictive policy on utilization of the Internet to solicit offers and sales would be revisited in the future – with a view towards expanding the ability of an issuer to broadcast the availability of an offering in an offer with geographical limitations:

In the context of broader Securities Act reform, we have been considering whether the current general solicitation and other offering communications restrictions on issuers and other offering participants should be modified to create greater flexibility. To the extent that we reform those restrictions on offering communications in the future, we also will consider the implications of those changes for . . . Internet offerings”

Congress finally spoke in the affirmative on the expanded use of general solicitation in unregistered offerings in 2012, allowing the use of general solicitation in private placements to accredited investors, whether on or off the Internet. So one would have thought that 16 years after this change in policy was suggested by the Division of Corporation Finance, the Staff at the Division of Corporation Finance would put pen to paper – allowing capital starved small businesses to use the Internet to reach out to prospective investors in intrastate offerings.

Yet at exactly the same time when the hoped for change in policy by the SEC would have allowed the Washington State legislature to have its way – with intrastate crowdfunding – by allowing issuers to solicit investors on the Internet – the SEC publicly stood its ground on an outmoded 16 year old policy.

Why is the SEC Division of Corporation Finance Quietly Stepping on State Crowdfunding Legislation?

So the question is why did this “C & DI” come out when it did, on April 10, 2014, at a time when the SEC is by all accounts overwhelmed with rulemaking tasks and understaffed – witness the 2+ year delay in implementing federal investment crowdfunding? And just in the knick of time to stop the Washington State legislature dead in its tracks?

Thus far, the answer to this question remains unknown – as this informal rulemaking by the Division of Corporation Finance falls outside the normally transparent formal rulemaking SEC rulemaking procedures. But for me, this gratuitous informal SEC rulemaking raises some red flags that do not bode well for small business, at least at the SEC.

What has Changed at the SEC in 2014?

What has changed since 1998 at the SEC – since it promised to reconsider broadening the use of the internet by an issuer to solicit investors? Well, perhaps not coincidentally, on February 21, 2014, Rick Fleming took office as the first Chief of the Office of Investor Advocacy at the SEC, courtesy of Section 915 of the Dodd-Frank Act of 2010. Yes, this is the same Rick Fleming who served as the North American Securities Administrators Association’s (NASAA) legal counsel before moving into his new quarters at the SEC. Yes – the same Rick Fleming who was employed by the State of Kansas when Kansas enacted the very first intrastate crowdfunding statute in 2011 – the same Kansas statute that, but for this 2014 ruling, would allow issuers to solicit offers on their own Internet portals or other social media pursuant to the Kansas intrastate crowdfunding exemption.

What has changed since 1998 at the SEC – since it promised to reconsider broadening the use of the internet by an issuer to solicit investors? Well, perhaps not coincidentally, on February 21, 2014, Rick Fleming took office as the first Chief of the Office of Investor Advocacy at the SEC, courtesy of Section 915 of the Dodd-Frank Act of 2010. Yes, this is the same Rick Fleming who served as the North American Securities Administrators Association’s (NASAA) legal counsel before moving into his new quarters at the SEC. Yes – the same Rick Fleming who was employed by the State of Kansas when Kansas enacted the very first intrastate crowdfunding statute in 2011 – the same Kansas statute that, but for this 2014 ruling, would allow issuers to solicit offers on their own Internet portals or other social media pursuant to the Kansas intrastate crowdfunding exemption.

Well, this is the same Rick Fleming who was listed as the NASAA contact person on a January 17, 2014 letter penned by NASAA on the eve of his appointment at the SEC. The NASAA letter, addressed to an association of the 50 state legislatures, urged state legislatures to be mindful of a whole host of federal laws which, in their opinion, would constrict the ability of states to craft their own intrastate legislation. Included in the NASAA letter was a citation to the 1998 SEC Release.

Well, this is the same Rick Fleming who was listed as the NASAA contact person on a January 17, 2014 letter penned by NASAA on the eve of his appointment at the SEC. The NASAA letter, addressed to an association of the 50 state legislatures, urged state legislatures to be mindful of a whole host of federal laws which, in their opinion, would constrict the ability of states to craft their own intrastate legislation. Included in the NASAA letter was a citation to the 1998 SEC Release.

And it is not likely that Mr. Fleming was a big fan of the 2011 Kansas crowdfunding exemption – at least not after, according to public reports, he was unceremoniously dismissed by then Kansas Securities Commissioner, Aaron Jack, the architect of the Kansas intrastate exemption.

Washington State Comes to Washington – Courtesy of NASAA

And then, something else to think about. William Beatty, the chief securities administrator for the State of Washington, and President-Elect of NASAA, was a regular visitor to Washington, D.C. in the Spring of 2014. Perhaps his most visible appearance was to testify on behalf of before the House Financial Services Committee Subcommittee on Capital Markets – against Congressman Patrick McHenry’s draft 2014 crowdfunding bill – on May 1, 2014.

Seems that this was not the only appearance by the Washington State Securities Administrator in Washington, D.C.:

- On April 7, 2014, Mr. Beatty and five other NASAA representatives met with SEC Commissioner Luis Aguilar to discuss the SEC’s proposed regulations under Title IV of the JOBS Act.

- And on April 9, 2014, Mr. Beatty and seven other NASAA representatives met with the Chair of the SEC, Mary Jo White, Keith Higgins, Director of the Division of Corporation Finance and other SEC officials to discuss proposed regulations under Title IV of the JOBS Act.

- And on April 29, 2014, Mr. Beatty and four other NASAA representatives participated in a telephone conference with SEC Commissioner Michael S. Piwowar to discuss proposed regulations under Title IV of the JOBS Act (Regulation A+)

- And on May 9, 2014, Mr. Beatty and seven other NASAA representatives met with the Staff of the SEC to discuss proposed regulations under Title IV of the JOBS Act (Regulation A+).

And for those of you whose imaginations run wild with conspiracy theories (like mine occasionally does), you will never guess who reached out to me on May 6, one day after I published by May 5 article on Crowdfund Insider questioning who was behind the April 10, 2014 SEC ruling? A gentleman by the name of Rex Staples. According to his LinkedIn bio, he served for 10 years at the Washington State Securities Division before joining – you guessed it – NASAA – serving for seven years as their General Counsel.

And for those of you whose imaginations run wild with conspiracy theories (like mine occasionally does), you will never guess who reached out to me on May 6, one day after I published by May 5 article on Crowdfund Insider questioning who was behind the April 10, 2014 SEC ruling? A gentleman by the name of Rex Staples. According to his LinkedIn bio, he served for 10 years at the Washington State Securities Division before joining – you guessed it – NASAA – serving for seven years as their General Counsel.

And what do you think Mr. Staples did when we met for lunch two weeks later at a midtown Manhattan restaurant? He pressed his smart phone into action midway through our lunch, to confirm a face-to-face meeting with one of his former subordinates, Rick Fleming, at his new digs at 100 F Street in Washington, D.C.

And what was the outcome of the meeting between Staples and Fleming two weeks later? I contacted Mr. Staples via email the day after his meeting with Chief Investor Advocate, Rick Fleming to ask him that very question.

Staples’ response: Fleming was too busy setting up his new office at the SEC to focus on anything of substance.

My response: “not too busy to squeeze out a CDI.” Staples’ response: “Touche”

So who was the Wizard of Oz behind the curtain at the SEC on the April 2014 Staff ruling. As I indicated in my May 5 article, I requested a meeting with SEC Commissioner Daniel M. Gallagher, in part to raise my concerns about this 2014 ruling. And so we met on June 23. On this issue Commissioner Gallagher politely referred me to the Head of the Division of Corporation Finance, Keith Higgins – who officially presided over the April 2014 ruling.

So who was the Wizard of Oz behind the curtain at the SEC on the April 2014 Staff ruling. As I indicated in my May 5 article, I requested a meeting with SEC Commissioner Daniel M. Gallagher, in part to raise my concerns about this 2014 ruling. And so we met on June 23. On this issue Commissioner Gallagher politely referred me to the Head of the Division of Corporation Finance, Keith Higgins – who officially presided over the April 2014 ruling.

I will withhold judgment on this matter, at least until I get an official answer to my question from the Division of Corporation Finance: When is the Division of Corporation Finance going to revisit this issue as it promised to do in 1998? – of great importance to over 40 state legislatures around the country considering the contours of state crowdfunding legislation – and undoubtedly of great importance to NASAA as well.

Draw your own conclusions – I’ve drawn mine. It appears that NASAA has landed in force at the headquarters of the SEC – replete with “boots on the ground” in the persona of Rick Fleming and a cadre of loyal constituents. If true, this does not bode well for small business – most immediately, in terms of implementation of the JOBS Act – as many of us anxiously await implementation of JOBS Act crowdfunding and Regulation A+ by the SEC – on the heels of a massive lobbying effort by NASAA in Congress and at the SEC.

Draw your own conclusions – I’ve drawn mine. It appears that NASAA has landed in force at the headquarters of the SEC – replete with “boots on the ground” in the persona of Rick Fleming and a cadre of loyal constituents. If true, this does not bode well for small business – most immediately, in terms of implementation of the JOBS Act – as many of us anxiously await implementation of JOBS Act crowdfunding and Regulation A+ by the SEC – on the heels of a massive lobbying effort by NASAA in Congress and at the SEC.

More on this in the coming days and weeks, as the search for truth and justice for small business in Washington, D.C. continues.

____________________________

Samuel S. Guzik, a recognized authority on the JOBS Act including Regulation D private placements, investment crowdfunding and Regulation A+, writes a regular column, The Crowdfunding Counselor, for Crowdfund Insider. A consultant on matters relating to the JOBS Act, he recently led a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy. He is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.

Samuel S. Guzik, a recognized authority on the JOBS Act including Regulation D private placements, investment crowdfunding and Regulation A+, writes a regular column, The Crowdfunding Counselor, for Crowdfund Insider. A consultant on matters relating to the JOBS Act, he recently led a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy. He is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience. He is admitted to practice before the SEC and in New York and California. Guzik has represented a number of public and privately held businesses, from startup to exit, concentrating in financing startups and emerging growth companies. He also frequent blogger on securities and corporate law issues at The Corporate Securities Lawyer Blog.