Since the SEC announced the intent to implement the new Regulation A+ rules in March, there’s been a lot of hype around the potential for Regulation A+. This newly implemented offering mechanism has been heralded for its ability to bring increased opportunities to the crowdfunding industry and to the crowd of unaccredited investors. Since March, I’ve been hearing from  crowdfunding attorneys that they’ve been getting calls on a daily basis from sponsors and companies eager to take advantage of the new offering mechanism allowed under Regulation A+. Most of these potential clients, I hear, have been turned away and counseled that filing an offering under this mechanism would not be an advisable way to attain their goal.

crowdfunding attorneys that they’ve been getting calls on a daily basis from sponsors and companies eager to take advantage of the new offering mechanism allowed under Regulation A+. Most of these potential clients, I hear, have been turned away and counseled that filing an offering under this mechanism would not be an advisable way to attain their goal.

Since then, I’ve been keeping my eye on Reg A+ filings to watch for innovative uses of the offering mechanism. (Full disclosure, I’m General Counsel of Patch of Land, an indirect competitor of GroundFloor. While we consulted numerous attorneys on the possibility, ultimately, we determined that a Reg A+ filing would not help us reach the unaccredited crowd in an efficient and scalable way, unless there were further developments in how Reg A+ offerings could be structured.) While I’ll concede that the use of Regulation A+ certainly isn’t impossible (especially in the context of a fund), the continuous offering of real estate deals in a timely fashion to non-accredited investors simply didn’t seem possible under an a la carte model.

GroundFloor Announces First Approved Reg A+ Tier 1 Filing in RECF industry

On August 31, 2015, Groundfloor was approved for a Regulation A+ platform offering. Notably, GroundFloor had been vocal in advocating against federal preemption of states, a stance that attorney Sam Guzik publicly reprimanded (and then offered up Fundrise CEO Ben Miller’s testimony as more reasoned opinion). The good news is that GroundFloor’s approved went through the Tier I process, meaning they’ve been consistent in their messaging. The bad news is that if they were to ever try to file for a $20M+ offering under Tier II, they’d have to do a 180 in their stance on federal preemption.

On August 31, 2015, Groundfloor was approved for a Regulation A+ platform offering. Notably, GroundFloor had been vocal in advocating against federal preemption of states, a stance that attorney Sam Guzik publicly reprimanded (and then offered up Fundrise CEO Ben Miller’s testimony as more reasoned opinion). The good news is that GroundFloor’s approved went through the Tier I process, meaning they’ve been consistent in their messaging. The bad news is that if they were to ever try to file for a $20M+ offering under Tier II, they’d have to do a 180 in their stance on federal preemption.

Timeline

Groundfloor’s Reg A+ filing is being touted as the ‘first Reg A+’ to be approved by the SEC, giving the impression that they received a quick approval. Upon closer inspection of the company’s SEC filings, they seemed to have actually undergone a very long process beginning prior to a previous Reg A offering in April 2014. My guess is that they used the old Reg A process to get initial SEC comments in anticipation of Reg A+’s debut, whenever that might occur, and then dropped their previous filing for a new one on March 23, 2015. In total, it took them five months from the date of first filing to receive approval under the Tier 1 process. In actuality, they’d been working on and preparing their filing for probably 20 months—give or take 2 months to conduct the first audit and write the initial filing and an additional 18 of back and forth comments with the SEC. When you count the 5 or 18-month time frame for the process, the conclusion still seems to be that Reg A+ filings can and do still take a significant amount of time to gain approval.

Groundfloor’s Reg A+ filing is being touted as the ‘first Reg A+’ to be approved by the SEC, giving the impression that they received a quick approval. Upon closer inspection of the company’s SEC filings, they seemed to have actually undergone a very long process beginning prior to a previous Reg A offering in April 2014. My guess is that they used the old Reg A process to get initial SEC comments in anticipation of Reg A+’s debut, whenever that might occur, and then dropped their previous filing for a new one on March 23, 2015. In total, it took them five months from the date of first filing to receive approval under the Tier 1 process. In actuality, they’d been working on and preparing their filing for probably 20 months—give or take 2 months to conduct the first audit and write the initial filing and an additional 18 of back and forth comments with the SEC. When you count the 5 or 18-month time frame for the process, the conclusion still seems to be that Reg A+ filings can and do still take a significant amount of time to gain approval.

Limited Dollar Amount of Securities Offered

Limited Dollar Amount of Securities Offered

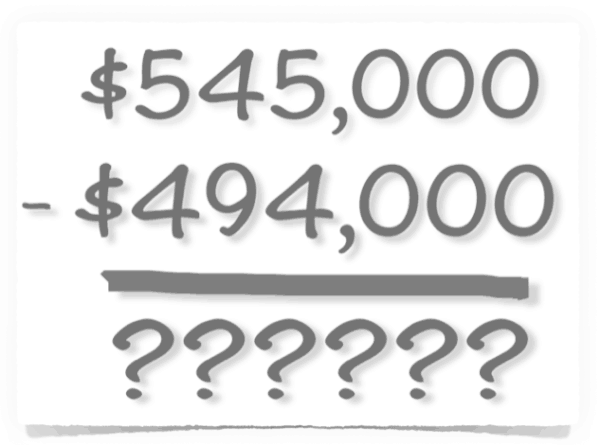

Groundfloor’s initial offering is limited to a humble $545,000 worth of securities on 7 pre-identified loans on properties, ranging in ratings from A-E on their grading system (the range of the entire system is A-E). The fact that they had to pre-identify the properties suggests that they cannot merely add more loans or properties to the list—they’d have to file another Reg A+ once the initial $545,000 gets sold out. While they are able to offer these securities to unaccredited investors (subject to certain income limitations), the relatively small dollar amount of the offerings means the securities will probably get scooped up quickly (minutes? hours?) and they’ll have to spend more time, resources, and energy on a subsequent filing for another offering that’ll debut in, probably, slightly less than 5 months. This means that GroundFloor’s borrowers will likely have to wait 5 months to get access to capital (unless they have already made the underlying borrower loan and plan to just hold the loans on their balance sheet for 5 months).

Limited Number of States Where Securities Are Sold

Groundfloor has also only chosen to sell in 9 states (though they may be planning on adding more). Keep in mind that many states have recently chosen to hike up blue skies fees (and sue the federal government). The dust in that fight hasn’t settled yet, but it seems unlikely—and quite costly—to be able to sell these securities nationwide. Investors in the other 41 states—accredited or not—will not have access to these offerings.

High Cost

The question of cost is a perplexing one in this filing. Groundfloor’s disclosures indicate that they spent $30,000 on auditing fees, $458,000 in legal fees, and $6,000 in blue skies fees. Those figures don’t include, for example, filing fees on Edgar or the internal costs or resources required to submit such a filing. So, for the luxury of being able to sell about half a million dollars in securities, they spent … half a million dollars. Granted, the legal costs for each subsequent Reg A+ filing probably won’t be so high, but the costs are eyebrow-raising enough to wonder how GroundFloor is going to continue offering securities to non-accredited investors without going into the hole themselves. And if they do drive themselves into hole, who’s going to be around to manage assets and take care of their investors? While their offering does give them the temporary ability to sell to non-accredited investors, the bigger question lies in how they plan to build a sustainable business model.

The question of cost is a perplexing one in this filing. Groundfloor’s disclosures indicate that they spent $30,000 on auditing fees, $458,000 in legal fees, and $6,000 in blue skies fees. Those figures don’t include, for example, filing fees on Edgar or the internal costs or resources required to submit such a filing. So, for the luxury of being able to sell about half a million dollars in securities, they spent … half a million dollars. Granted, the legal costs for each subsequent Reg A+ filing probably won’t be so high, but the costs are eyebrow-raising enough to wonder how GroundFloor is going to continue offering securities to non-accredited investors without going into the hole themselves. And if they do drive themselves into hole, who’s going to be around to manage assets and take care of their investors? While their offering does give them the temporary ability to sell to non-accredited investors, the bigger question lies in how they plan to build a sustainable business model.

And Lots and Lots of Disclosures

Lastly, Groundfloor has had to disclose a lot of juicy information to their competitors in the filing process. For example, aside from their normal financial statements, they disclosed this information about their convertible note/seed round: Convertible promissory notes with aggregate principal value of $915,000 converted into 276,391 shares of Series Seed Preferred Stock. 246,393 shares were sold at $5.205 per share for aggregate proceeds of approximately $1,282,500. More details on pages 85 and 86 of their filing. Maybe they’re fine with this, but it’s a hefty price to pay for the limited sale of $545,000 worth of notes.

Conclusion

In sum, they’ve spent several months and half a million dollars on the sale of half a million dollars, to the consternation of probably many of us in the industry, to prove how unscalable Regulation A+ can be. I have to assume GroundFloor’s founders understood this and were really just trying to ride off the hype of being the first real estate crowdfunding platform to get a Regulation A+ through, but half a million dollars is a lot of publicity and marketing money that could be better spent elsewhere and frankly leaves them without a real, scalable business model. The real winner in this offering isn’t GroundFloor (based on its … rather perplexing business decision to make this filing) or the borrowers (who may have had to wait 5-20 months to get access to capital) or the crowd (who will likely have the opportunity to buy this security for a couple minutes, and then must sit on the backburner for several more months for another bite at the apple). No, the real winner here is the law firm that represented them in this filing and earned $458,000 in legal fees. Go figure.

In sum, they’ve spent several months and half a million dollars on the sale of half a million dollars, to the consternation of probably many of us in the industry, to prove how unscalable Regulation A+ can be. I have to assume GroundFloor’s founders understood this and were really just trying to ride off the hype of being the first real estate crowdfunding platform to get a Regulation A+ through, but half a million dollars is a lot of publicity and marketing money that could be better spent elsewhere and frankly leaves them without a real, scalable business model. The real winner in this offering isn’t GroundFloor (based on its … rather perplexing business decision to make this filing) or the borrowers (who may have had to wait 5-20 months to get access to capital) or the crowd (who will likely have the opportunity to buy this security for a couple minutes, and then must sit on the backburner for several more months for another bite at the apple). No, the real winner here is the law firm that represented them in this filing and earned $458,000 in legal fees. Go figure.

Amy Wan is Patch of Land’s General Counsel and leads corporate strategy and tactical legal initiatives. She brings extensive experience in legal innovation and rethinking the delivery of legal services. In 2014, she was named one of the top ten women to watch in legal technology by the American Bar Association Journal. Prior to joining Patch of Land, worked in enforcement and compliance at the U.S. Department of Commerce, where she represented the United States at the WTO and participated in free trade agreement negotiations on regulatory coherence and technical barriers to trade. Amy also spent time at the U.S. Department of State and U.S. Department of Transportation. She was one of only 3.6% of over 9000 applicants appointed to the prestigious Presidential Management Fellows program. Amy holds an LL.M. in Public International Law from the London School of Economics and Political Science, a JD from the University of Southern California Gould School of Law, and a BA in Biological Sciences from the University of Southern California.

Amy Wan is Patch of Land’s General Counsel and leads corporate strategy and tactical legal initiatives. She brings extensive experience in legal innovation and rethinking the delivery of legal services. In 2014, she was named one of the top ten women to watch in legal technology by the American Bar Association Journal. Prior to joining Patch of Land, worked in enforcement and compliance at the U.S. Department of Commerce, where she represented the United States at the WTO and participated in free trade agreement negotiations on regulatory coherence and technical barriers to trade. Amy also spent time at the U.S. Department of State and U.S. Department of Transportation. She was one of only 3.6% of over 9000 applicants appointed to the prestigious Presidential Management Fellows program. Amy holds an LL.M. in Public International Law from the London School of Economics and Political Science, a JD from the University of Southern California Gould School of Law, and a BA in Biological Sciences from the University of Southern California.