For those of you who have followed my articles on Crowdfund Insider over the past two years, you know that I have not been shy about voicing my concerns over the foot dragging that too often has often characterized the attitude of the Securities and Exchange Commission (SEC) toward the capital formation needs of small and emerging businesses.

A sampling of some of my articles have included a call back in February 2014 for an independent office at the SEC, whose sole function would be to advocate for the interests of small business – the first time that the proposal for an independent advocate for small business at the SEC was floated publicly. And in August 2014, I bemoaned the failure of the SEC to act on the recommendations made by the participants in the SEC’s Annual Government-Small Business Forum on Capital Formation, an  annual gathering of market participants considering regulatory changes needed to facilitate access to capital for small and emerging businesses. I had compared the Forum to Ground Hog Day, in view of the “same old same old” which traditionally characterized this annual, Congressionally mandated event, with the SEC routinely ignoring or delaying implementation of much needed regulatory reforms espoused by some of this country’s best and brightest entrepreneurs and securities professionals.

annual gathering of market participants considering regulatory changes needed to facilitate access to capital for small and emerging businesses. I had compared the Forum to Ground Hog Day, in view of the “same old same old” which traditionally characterized this annual, Congressionally mandated event, with the SEC routinely ignoring or delaying implementation of much needed regulatory reforms espoused by some of this country’s best and brightest entrepreneurs and securities professionals.

And I was not the only one to publicly call for an advocate at the SEC, or more responsiveness by the Commission to the perennial recommendations of the Annual Small Business Forum. The need for these reforms was also echoed by former SEC Commissioner Daniel M. Gallagher in two public speeches – in September 2014 and November 2014.

To be sure, there are a number of statutes on the books which focus on the needs of our SME’s, most recently the Jumpstart Our Business Startups Act of 2012- which have been dutifully implemented by the SEC. But as Congress is aware, even the very significant changes in our securities laws created by the JOBS Act, adopted with broad bi-partisan support, were not the result of innovative ideas of federal regulators. Rather, these reforms have been widely viewed as a by-product of regulatory inertia by the SEC which had gone on for all too long. And judging by the number of recommendations made year in and year out by market participants at the SEC’s Annual Government Small Business Forum, the large majority of these Small Business Forum recommendations have routinely been ignored by the Commission. So there is plenty left to be done in Washington by way of regulatory reform in the securities markets for SME’s – if only the SEC had the political will to do so.

To be sure, there are a number of statutes on the books which focus on the needs of our SME’s, most recently the Jumpstart Our Business Startups Act of 2012- which have been dutifully implemented by the SEC. But as Congress is aware, even the very significant changes in our securities laws created by the JOBS Act, adopted with broad bi-partisan support, were not the result of innovative ideas of federal regulators. Rather, these reforms have been widely viewed as a by-product of regulatory inertia by the SEC which had gone on for all too long. And judging by the number of recommendations made year in and year out by market participants at the SEC’s Annual Government Small Business Forum, the large majority of these Small Business Forum recommendations have routinely been ignored by the Commission. So there is plenty left to be done in Washington by way of regulatory reform in the securities markets for SME’s – if only the SEC had the political will to do so.

In the words of one noted commentator:

“. . . the SEC has refused to adopt reforms to ease the difficulties that small and growing companies face in obtaining financing. Many of these reforms, such as lifting constraints on entrepreneurs’ communications with potential investors, are well within the SEC’s authority. Despite studying small business capital formation for years, the SEC never seems to be able to bring itself to make meaningful changes in response to all that research.”

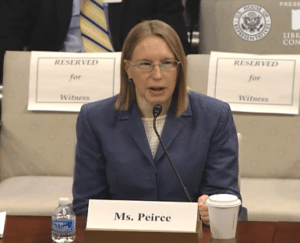

Interestingly, these words were first published on the eve of the passage of the JOBS Act, in March 2012. But perhaps more interesting is the author of these words: Hester Peirce, a former SEC Staffer, a member of the SEC’s Investor Advisory Committee, and the Republican nominee to fill the SEC Commission vacancy resulting from the departure of Daniel M. Gallagher in October 2015. Pulling no punches, Ms. Peirce bemoaned the “stubbornness” and “inaction” of the SEC in the face of “oppressive” regulatory barriers for capital formation.

Interestingly, these words were first published on the eve of the passage of the JOBS Act, in March 2012. But perhaps more interesting is the author of these words: Hester Peirce, a former SEC Staffer, a member of the SEC’s Investor Advisory Committee, and the Republican nominee to fill the SEC Commission vacancy resulting from the departure of Daniel M. Gallagher in October 2015. Pulling no punches, Ms. Peirce bemoaned the “stubbornness” and “inaction” of the SEC in the face of “oppressive” regulatory barriers for capital formation.

Well, judging by the activity on the Floor of the House of Representatives on February 1, 2016, our Congress is sick and tired of doing all of the heavy lifting when it comes to breaking down unnecessary regulatory barriers to capital formation by our SME’s. Specifically, two legislative bills came to a vote on the Floor of the House, both passing by an overwhelming bi-partisan majority, and each calculated to further energize the Commission to focus its resources on the needs of SME’s: H.R. 3784 (unanimously, by voice vote) and H.R. 4168 (390-1).

HR 3784 – SEC Small Business Advocate Act of 2016

According to the Republican Bill summary,

“H.R. 3784 would establish the Office for Small Business Capital Formation (Office) and the Small Business Capital Formation Advisory Committee (Committee) within the Securities and Exchange Commission (SEC) to help small businesses resolve problems with the SEC; analyze the potential impact of proposed rules and regulations that are likely to have a significant effect on small businesses; and conduct outreach to small businesses in order to solicit views on relevant capital formation issues. The bill also requires the newly established Office and Committee to submit certain reports to Congress.”

And according to the House Financial Services Committee, which reported the Bill out by a 56-0 vote in December 2015:

“Although the SEC’s budget is now almost four times the size it was in 2000, the SEC has given short shrift to the capital formation component of its statutory mandate – to the detriment of entrepreneurs and start-up ventures. A permanent office dedicated to small business capital formation within the SEC is a logical outcome of the JOBS Act since the SEC has taken little to no action to advance the many recommendations the agency has received from its annual Government-Business Forum on Small Business Capital Formation (Forum) to help small businesses and EGCs access the capital markets.”

In other words – time is money – and without money for entrepreneurs and growing businesses, job creation and economic growth are stymied. The SEC has taken too much time, and for too long, to adequately address the capital needs of entrepreneurs – and all this is coming at the expense of this country’s biggest job creators and would be job creatures – small business.

In other words – time is money – and without money for entrepreneurs and growing businesses, job creation and economic growth are stymied. The SEC has taken too much time, and for too long, to adequately address the capital needs of entrepreneurs – and all this is coming at the expense of this country’s biggest job creators and would be job creatures – small business.

Though the SEC currently has an Office of Small Business Policy (OSBP), its authority and power are severely limited. Unlike the OSBP, which reports to the Director of the SEC Division of Corporation Finance, the Chief of the Office of Small Business Advocate would report directly to all five SEC Commissioners. And the Bill provides a statutory mandate for this new office to report directly to both houses of Congress on an annual basis.

The Bill would also make permanent a Small Business Capital Formation Advisory Committee, to be placed under the direction of the Office of Small Business Advocate. Though the SEC does currently have a small business advisory committee, this committee reports only to the SEC Chair and the committee serves at the pleasure of the SEC Chair.

HR 4168 – Small Business Capital Formation Act

This Bill is calculated to change the character of the SEC’s Annual Small Business Forum on Capital Formation from an event more akin to Ground Hog Day to one that requires the SEC to be more responsive to the recommendations made by the participants in this annual gathering. Currently, the  SEC is not obligated to respond to the Forum’s recommendations and findings. And the Commission’s track record in responding to these recommendations has been the subject of widespread criticism. H.R. 4168 requires the SEC to assess each recommendation presented at the Forum and disclose any action it plans to take with respect to such recommendations.

SEC is not obligated to respond to the Forum’s recommendations and findings. And the Commission’s track record in responding to these recommendations has been the subject of widespread criticism. H.R. 4168 requires the SEC to assess each recommendation presented at the Forum and disclose any action it plans to take with respect to such recommendations.

While this Bill is certainly no guarantee that the Forum recommendations will be acted upon, the obligation of the Commission to respond publicly to each of the recommendations will create a visible benchmark for further Congressional action if the SEC fails to act appropriately on meritorious proposals.

Some Closing Thoughts

While both of these Bills still have a way to go before they become the law of the land, both are widely expected to have broad bi-partisan support in the Senate, especially in an election year – where job creation and the economy are major vote influencers. According to reliable sources, a companion bill to H.R. 3784 is already being drafted in the Senate, with its sister bill, H.R. 4168, also expected to find a clone on the Senate side of Capitol Hill.

While both of these Bills still have a way to go before they become the law of the land, both are widely expected to have broad bi-partisan support in the Senate, especially in an election year – where job creation and the economy are major vote influencers. According to reliable sources, a companion bill to H.R. 3784 is already being drafted in the Senate, with its sister bill, H.R. 4168, also expected to find a clone on the Senate side of Capitol Hill.

Of course, though the implementation of these bills provide no guarantees, they are certainly important steps in the right direction: A dedicated advocacy voice for small business at the SEC, and some measure of accountability in addressing the concerns of SME capital market participants.

But one thing is certain. February 2, 2016, is Ground Hog Day, and you can be sure that when that infamous critter, Punxsutawney Phil, surfaces from his burrow he will be grinning ear to ear, knowing that soon there will only be one Ground Hog Day – in Punxsutawney, Pennsylvania.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CFPA). A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CFPA). A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.