Helicap, Danamon Forge Strategic Partnership to Boost FinTech, Alternative Lending in Indonesia

Fintech player Helicap Pte Ltd has partnered with PT Bank Danamon Indonesia Tbk (Danamon) to establish the duo as a pivotal source of non-dilutive growth capital for fintech companies, alternative lending firms, and micro, small, and medium enterprises (MSMEs) across various sectors, including supply chain,… Read More

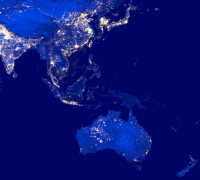

Read more in: Fintech, Asia | Tagged Bank Danamon, Danamon, digital lending, fintech, helicap, indonesia, singapore