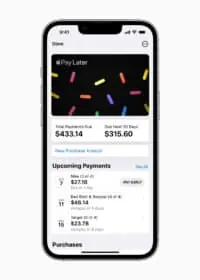

BNPL: Apple Pay Later Gains Traction

Apple (NASDAQ:AAPL), one of the largest Fintechs in the world, is gaining traction with its new Buy Now Pay Later (BNPL) product. Released this past March but announced months prior, Apple says that Apple Pay Later wants to support its users financial health. The credit… Read More

Read more in: Fintech | Tagged apple, apple pay later, bnpl, buy now pay later