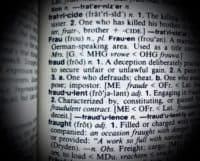

Fraud Prevention: FiVerity Supports Banks with Anti-Fraud Collaboration Platform

FiVerity, the provider of Anti-Fraud Collaboration solutions, today announced new platform features designed to help the financial industry fight back against fraud. FiVerity also announced it is “opening the network to an initial 200 small and medium-sized financial institutions, providing approved businesses with free access… Read More

Read more in: Regtech & Legaltech, Artificial Intelligence, Fintech, Global | Tagged ai, anti fraud solutions, artificial intelligence, financial services, fraud, fraud prevention, product update