A CATO Institute event on the status of capital markets in the US provided a bright spot to an otherwise bleak and rainy day in New York City. Amidst the libertarian rhetoric and literature, two speakers stood out with certain observations and proposed remedies to aid a crippled economy.

Keynote speaker and SEC commissioner Michael Piwowar spoke about current dysfunction in the regulatory regime and potential solutions. Although less fiery than his recent speech at the Exchequer Club of Washington, D.C., he didn’t pull any punches when it came to certain SEC ineptitude. He began wryly with “I’m with the government; I am here to help,” which was met with laughter, and continued on to describe the detachment of beltway regulators and politicians from the realities faced by main street America. While compliance with SEC and other government regulations is just one component of running a company, many regulators treat compliance as a company’s end goal in and of itself rather than the actual production of goods or services.

Piwowar also described how regulation can serve special interests rather than the indicated public policy. He used the example of Baptists and bootleggers and the Sunday closing laws for bars and taverns. While both Baptists and bootleggers were served by such regulation the actual goal of reducing alcohol consumption was not. Similarly, securities regulations may serve as barriers to entry to some potential participants or simply not serve their intended purpose.

When creating regulations, Piwowar noted the tension between drafting bright line rules versus nuanced and tailored regulations. The latter tend to be inadministrable while the former are under or over inclusive (or both).

Piwowar observed that while the name of the conference was Capital Unbound, the theme of the Securities Act of 1933 (the Act) was “capital restricted,” due to the blanket prohibition on raising capital, and that the regulations were certainly “not written with small business in mind.” The commissioner continued that the Act is so broad in fact that it restricts not only sales of securities, but merely offers of securities as well. The term “offer” is broadly interpreted to include any public statement that might “condition the market.”

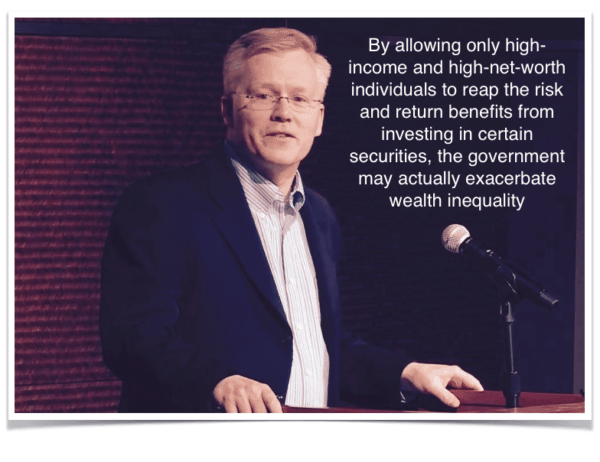

After explaining that Regulation D is the most commonly used exemption to conducting a registered offering under the Act, he zeroed in on the definition of “accredited investor” a term essential to Regulation D and used to define a person that does not need to receive the SEC mandated disclosures and protections of the Act. The Supreme Court ruled that these individuals were sophisticated enough to “fend for themselves.” In addition to reexamining the definition of accredited investor (something I am loathe to do), Piwowar advocated moving beyond the definition and thinking about who is being protected. He reminded us that prohibiting non accredited investors from investing in high risk securities also means preventing them from investing in high return securities. As a believer in portfolio theory, Piwowar noted that such regulations could actually be harming unaccredited investors.

After explaining that Regulation D is the most commonly used exemption to conducting a registered offering under the Act, he zeroed in on the definition of “accredited investor” a term essential to Regulation D and used to define a person that does not need to receive the SEC mandated disclosures and protections of the Act. The Supreme Court ruled that these individuals were sophisticated enough to “fend for themselves.” In addition to reexamining the definition of accredited investor (something I am loathe to do), Piwowar advocated moving beyond the definition and thinking about who is being protected. He reminded us that prohibiting non accredited investors from investing in high risk securities also means preventing them from investing in high return securities. As a believer in portfolio theory, Piwowar noted that such regulations could actually be harming unaccredited investors.

Thaya Knight, Associate Director, Financial Regulation Studies at Cato Institute, who addressed the convention in the session prior to the commissioner’s speech, agreed with his sentiment stating,

Thaya Knight, Associate Director, Financial Regulation Studies at Cato Institute, who addressed the convention in the session prior to the commissioner’s speech, agreed with his sentiment stating,

“I am thrilled that the SEC is revisiting the concept of the “accredited investor.” As both Commissioner Piwowar and I noted in our remarks, investor protection has come to mean protection not only from loss, but from the opportunity for gain. Middle class investors have been “protected” out of the market, leaving accredited investors – who are already wealthy – to reap the rewards, resulting in greater concentration of wealth.”

For those of you who follow me on this site, you know that I have a different view of the SEC’s reexamination of the definition of accredited investor, and while I agree wholeheartedly with broadening the archaic definition to include people with certain knowledge and experience sets, I am concerned that redefining (to adjust for inflation or otherwise) or removing the basic income and wealth qualifiers will remove a huge portion of potential investors and threatens to destroy one of the few functioning capital markets for small business that we have.

The commissioner went on to describe some pet peeves with the SEC, such as reliance on independent consultants to make tough adjudicatory decisions rather than taking responsibility and being accountable for such determinations, and reducing waivers which allow for reliance on forward looking statement safe harbors. The reduction of waivers seems obviously counterproductive in a regime that relies on disclosures rather than merit analysis. Piwowar’s focus of late has been on the big banks and he noted that large financial institutions especially need to provide adequate forward looking disclosure and that the granting of a waiver should hinge on the entity’s ability to produce adequate disclosure and not be a back door merit analysis.

The commissioner concluded by chiding the popular sentiment that the SEC should “promote investor confidence.” Piwowar stated the investor must always conduct their own due diligence and that if anything, the SEC should promote “investor skepticism.” Investors should practice self-reliance and ask why and how. I would like to add that the SEC should ensure that the investor has the appropriate tools to conduct such diligence – which in effect is an adequate disclosure regime.

The commissioner concluded by chiding the popular sentiment that the SEC should “promote investor confidence.” Piwowar stated the investor must always conduct their own due diligence and that if anything, the SEC should promote “investor skepticism.” Investors should practice self-reliance and ask why and how. I would like to add that the SEC should ensure that the investor has the appropriate tools to conduct such diligence – which in effect is an adequate disclosure regime.

When asked about what the SEC could do to promote crowdfunding, which seems to be lost in the SEC black box, the commissioner noted the congressional bill, which may make its way to the floor, and the movement among the many states to enact crowdfunding on a local level. The SEC could enter into memo of understanding to allow for multiple states to combine offerings in a regional crowdfunding offering, creating natural laboratories for appropriate regulation. The commissioner also noted that newly adopted Regulation A offerings might fill a certain gap.

All in all Piwowar was an advocate for capital formation and adequate (appropriate) disclosure. Now, if he could just get the SEC to listen.

Prior to Commissioner Piwowar’s speech, Thaya Knight, spoke to the conference on traditional and new forms of capital formation for small business.

Knight began with some statistics, including that half of US GDP is generated by small businesses. She then continued to lay out the dire situation for financing small business in recent years. Traditional sources of finance for small business were community banks, which in a post Dodd-Frank world have altered lending standards or are flat out prohibited from making such loans. Thus the traditional funding sources for small business have dried up. Larger commercial banks have no interest in small business, as it doesn’t move the needle on their big balance sheets. Another potential source of finance, venture capital, is only interested in a very specific business model usually in a very specific location (coastal cities), which leaves the majority of small businesses out in the cold. Similarly, angel investors and networks are primarily located in large urban areas and are simply not numerous enough to handle the financing needs on any scale.

This leaves the individual credit of the business owner. Credit cards, second mortgages and the like, all of which, are highly inefficient (and extremely expensive) ways to finance a business.

What about IPO’s? Knight explained that while 2014 was the strongest year for IPO’s for some time, the characteristics of a company conducting its initial public offering have evolved. Companies are now waiting until much later in their life cycle to IPO and have already attained multiple rounds of private financing. One reason for this is the increased regulation and ongoing compliance requirements for public companies. A small business simply does not have the resources to comply with the multitude of regulations governing a public company.

Knight explained that amidst this need for innovation and new sources of capital, the JOBS Act was passed with much promise. She noted that each of the sections or “titles” of the JOBS Act focused on a different type of capital raise and arguably different stage in the life cycle of a company, which was a good thing. Knight emphasized that existing securities laws were not written with small business in mind, because traditionally small businesses have accessed community banks for necessary capital. She continued to provide a tutorial of the JOBS Act, outlining each title and the current status of the SEC regulations promulgating it.

When speaking about Title III of the JOBS Act, the crowdfunding provision, Knight astutely pointed out that there is a distinct mismatch between the rules as drafted which seem geared toward large SEC reporting companies, and the realities of small business. As an example, the requirement of audited GAAP financials for a small or start up business raising less than $1,000,000 makes little sense. For one thing, the cost of such an audit and GAAP preparation is cost prohibitive and for another, such financial statements would be of little use to a potential investor in a small or early stage company. Therefore even with all the promise of the crowdfunding provisions of the JOBS Act, they may ultimately prove unworkable. When asked about this by a member of the audience, Knight, similar to Piwowar, noted that the bright spot may be the state initiatives in crowdfunding and a more popular type movement.

When speaking about Title III of the JOBS Act, the crowdfunding provision, Knight astutely pointed out that there is a distinct mismatch between the rules as drafted which seem geared toward large SEC reporting companies, and the realities of small business. As an example, the requirement of audited GAAP financials for a small or start up business raising less than $1,000,000 makes little sense. For one thing, the cost of such an audit and GAAP preparation is cost prohibitive and for another, such financial statements would be of little use to a potential investor in a small or early stage company. Therefore even with all the promise of the crowdfunding provisions of the JOBS Act, they may ultimately prove unworkable. When asked about this by a member of the audience, Knight, similar to Piwowar, noted that the bright spot may be the state initiatives in crowdfunding and a more popular type movement.

At the end of the day, with two DC insiders turning to intrastate crowdfunding, I have to wonder if this signals the death of federal retail crowdfunding on any meaningful level.

Georgia P. Quinn is a securities attorney specializing in crowdfunding at the firm of Ellenoff, Grossman & Schole. Quinn is also the co-founder and CEO of LawBot, a new legal technology company focused on the disclosure needs of small business and startup entrepreneurs and the changing legal landscape. Quinn was recognized in 2014 as a Top Female Attorney in New York City by Thomson-Reuters. Earlier this year she was joined by other honored attorneys in a special section about “Super Lawyers” featured in the New York Times. She is on the advisory board for the American Banker Lending and Investing Conference. Wealthforge, an early entrant in the crowdfunding space, has called Quinn one of the top influencers in the private placement industry. Quinn has spoken to the Securities and Exchange and Commission, Congressional staff-members, leaders of UK crowdfunding portals and the Small Business Administration Roundtable; chaired a panel on crowdfunding for the ABA; presented to the Canadian Equity Crowdfunding Alliance, the Council of Development Finance Agencies, the Crowdfund Global Expo in San Diego and New York, the New York State Bar Association.

Georgia P. Quinn is a securities attorney specializing in crowdfunding at the firm of Ellenoff, Grossman & Schole. Quinn is also the co-founder and CEO of LawBot, a new legal technology company focused on the disclosure needs of small business and startup entrepreneurs and the changing legal landscape. Quinn was recognized in 2014 as a Top Female Attorney in New York City by Thomson-Reuters. Earlier this year she was joined by other honored attorneys in a special section about “Super Lawyers” featured in the New York Times. She is on the advisory board for the American Banker Lending and Investing Conference. Wealthforge, an early entrant in the crowdfunding space, has called Quinn one of the top influencers in the private placement industry. Quinn has spoken to the Securities and Exchange and Commission, Congressional staff-members, leaders of UK crowdfunding portals and the Small Business Administration Roundtable; chaired a panel on crowdfunding for the ABA; presented to the Canadian Equity Crowdfunding Alliance, the Council of Development Finance Agencies, the Crowdfund Global Expo in San Diego and New York, the New York State Bar Association.