As many Crowdfund Insiders know, The University of Cambridge teamed up with EY and launched the European Alternative Finance Benchmarking Survey, the largest study to date on crowdfunding, peer-to-peer lending and other forms of alternative finance in Europe. This benchmarking survey, which closed on 6 January 2015, seeks to capture the size, transactional volume and growth of the alternative finance markets across Europe. To date, according to Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge, 255 crowdfunding/ P2P lending platforms survey responses from 28 European countries have been submitted.

As many Crowdfund Insiders know, The University of Cambridge teamed up with EY and launched the European Alternative Finance Benchmarking Survey, the largest study to date on crowdfunding, peer-to-peer lending and other forms of alternative finance in Europe. This benchmarking survey, which closed on 6 January 2015, seeks to capture the size, transactional volume and growth of the alternative finance markets across Europe. To date, according to Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge, 255 crowdfunding/ P2P lending platforms survey responses from 28 European countries have been submitted.

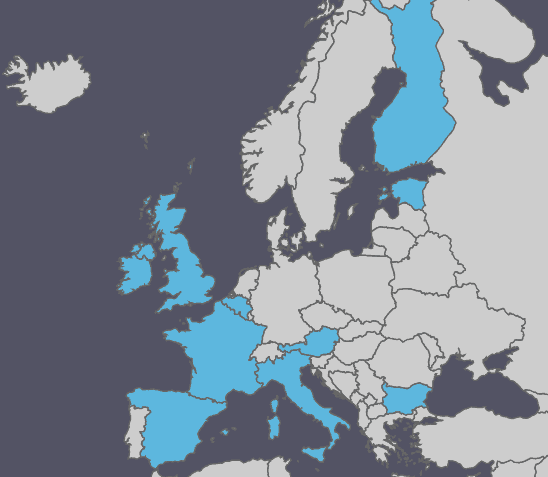

An enlightening series of interviews with influential European thought leaders from major national and regional crowdfunding associations in France, Germany, Spain, Italy, the Netherlands, the Nordic countries and the UK are participating in this groundbreaking research has complemented the research. Supported by FPF, ANACOFI and AFIP (France), the German Crowdfunding Network, the Spanish Crowdfunding Association, Crowdfunding Hub (Dutch), AISCRIS (Italy), the Nordic Crowdfunding Alliance, the UK Crowdfunding  Association, the P2P Finance Association, the European Crowdfunding Network, the European Equity Crowdfunding Association as well as the P2P Banking.com, Crowdfund Insiders have had a exposure to exclusive interviews with University of Cambridge’s Dr. Mia Gray and a formidable cadre of European crowdfunding trailblazers including: CrowfundingHub Founder and Executive Board Member of the European Crowdfunding Network, Ronald Kleverlaan; President of the Board of Asociación Española de Crowdfunding Daniel Oliver; Le Crowdfunding author, AFIP and ANACOFI crowdfunding expert Marianne IIZUKA; Coordinator of the German Crowdfunding Network and member of the European Crowdfunding Stakeholder Forum, Karsten Wenzlaff; Executive Director of Peer-to-Peer Finance Association, Sam Ridler; Head of the Nordic Crowdfunding Association, Dr. Rotem Shnoer; Abundance Co-Founder and UKCFA Director Bruce Davis; President of Financement Participatif France and Founder/ CEO of Unilend Nicolas Lesur; P2P-Banking.com and P2P-Kredite.com Publisher Claus Lehmann; and most recently, President of European Equity Crowdfunding Association and CEO of Assiteca Crowd Tommaso D’Onofrio.

Association, the P2P Finance Association, the European Crowdfunding Network, the European Equity Crowdfunding Association as well as the P2P Banking.com, Crowdfund Insiders have had a exposure to exclusive interviews with University of Cambridge’s Dr. Mia Gray and a formidable cadre of European crowdfunding trailblazers including: CrowfundingHub Founder and Executive Board Member of the European Crowdfunding Network, Ronald Kleverlaan; President of the Board of Asociación Española de Crowdfunding Daniel Oliver; Le Crowdfunding author, AFIP and ANACOFI crowdfunding expert Marianne IIZUKA; Coordinator of the German Crowdfunding Network and member of the European Crowdfunding Stakeholder Forum, Karsten Wenzlaff; Executive Director of Peer-to-Peer Finance Association, Sam Ridler; Head of the Nordic Crowdfunding Association, Dr. Rotem Shnoer; Abundance Co-Founder and UKCFA Director Bruce Davis; President of Financement Participatif France and Founder/ CEO of Unilend Nicolas Lesur; P2P-Banking.com and P2P-Kredite.com Publisher Claus Lehmann; and most recently, President of European Equity Crowdfunding Association and CEO of Assiteca Crowd Tommaso D’Onofrio.

Alessandro M. Lerro is the General Counsel and Manager of the European Equity Crowdfunding Association, a business association that collect more then 50 founding members from across 16 countries of the Europe. Lerro’s legal expertise focuses on technology and business creation, in particular advising startups and small/medium sized companies dealing with information technology, healthcare, biotechnology and media. He recently wrote two books on equity crowdfunding, Equity crowdfunding. Investire e finanziare l’impresa tramite internet and Italian Equity Crowdfunding Legislation: Laws and Regulations, writes articles and speaks internationally about crowdfunding platforms and crowdfunded companies and projects. In addition Lerro serves as Board Member and C.E.O. in several companies involved in the tech industry and venture capital. As an AISCRIS Board Member and Senior Partner at Lerro&Partners, Lerro provides his esteemed perspective on equity crowdfunding in Italy, establishing education programs to ignite growth, supporting “mumtrepreneurs” and working toward a balanced relationship between regulatory and protective strategies. Our informative interview follows:

Alessandro M. Lerro is the General Counsel and Manager of the European Equity Crowdfunding Association, a business association that collect more then 50 founding members from across 16 countries of the Europe. Lerro’s legal expertise focuses on technology and business creation, in particular advising startups and small/medium sized companies dealing with information technology, healthcare, biotechnology and media. He recently wrote two books on equity crowdfunding, Equity crowdfunding. Investire e finanziare l’impresa tramite internet and Italian Equity Crowdfunding Legislation: Laws and Regulations, writes articles and speaks internationally about crowdfunding platforms and crowdfunded companies and projects. In addition Lerro serves as Board Member and C.E.O. in several companies involved in the tech industry and venture capital. As an AISCRIS Board Member and Senior Partner at Lerro&Partners, Lerro provides his esteemed perspective on equity crowdfunding in Italy, establishing education programs to ignite growth, supporting “mumtrepreneurs” and working toward a balanced relationship between regulatory and protective strategies. Our informative interview follows:

Erin: Why has the European Equity Crowdfunding Association decided to participate in the Cambridge-EY European Alternative Finance Benchmarking Research?

Alessandro: It is commonly acknowledged that the European alternative finance market is raising dramatically, nevertheless no objective and reliable research exists to scientifically benchmark and track the evolution of the market yet. This is why the European Equity Crowdfunding Association proudly supported the Finance Benchmarking Research launched by the University of Cambridge and PWC.

Erin: The rapid growth of the various sectors indicate that peer to peer lending is clearly leading the charge – yet equity crowdfunding is rather small but growing rapidly. How do you explain this phenomenon? What about peer to peer lending?

Erin: The rapid growth of the various sectors indicate that peer to peer lending is clearly leading the charge – yet equity crowdfunding is rather small but growing rapidly. How do you explain this phenomenon? What about peer to peer lending?

Alessandro: Peer to peer lending has an antidote to the biggest issue of equity crowdfunding, which is the liquidity problem: you still enjoy the emotion of supporting new projects picked up from a wide selection, you can take advantage of high financial returns and get a periodic payback for your investment; sometimes, you might also be granted a subscription option, if the loan is convertible. Instead, when you invest in equity crowdfunding, your investment becomes illiquid remaining stuck in the issuer company for a long time, until you can have a good exit or the business becomes profitable. I think that this is the biggest difference that drives more interest to lending based crowdfunding at the moment.

Erin: Following “Restart Italia” at the end of 2012 by a task force of experts for the Minister of Economic Development, the Italian Parliament issued a law on startups including equity crowdfunding that was finally made possible by CONSOB (the Italian Authority on Financial Markets) with the regulation n° 18592 of June 26th, 2013 for raising risk capital by “innovative start-ups” through on-line portals. Has Italy “restarted” during its first year of equity crowdfunding?

Alessandro: Restart Italia aimed at building a favorable framework for innovation and new business, of which equity crowdfunding was just one of the tools. Thanks to the efforts of the Government, the bundle of regulations and initiatives has hit the target, as more than 3,000 new companies have started operations and a new culture is being widely spread. In a country where innovation is in the people’s DNA, but where early stage venture capital and angel investing are far below the average, equity crowdfunding is a new tool that might help driving funds on valuable opportunities.

Erin: What are your thoughts on Crowdfund Insider contributor and board member of Italia Startup and the Italian Startup Association Marco Bicocchi Pichi’s comment, “2015 is the year of the Global Entrepreneurship Congress and EXPO in Milan, and it will be an important year in the history of Equity Crowdfunding in Italy?”

Alessandro: Milan EXPO is the center of many initiatives and hopes, it could grant more visibility to the country and leverage interest in innovation.

Erin: What can the United States learn from Italy and Europe?

Alessandro: Provided that SEC and FINRA really open the US market, I would suggest 3 topics concerning retail equity crowdfunding:

1) The maximum limit set by the JOBS Act for retail investments is not adequate to companies which have real growth opportunities, fitting only with very small businesses of local impact.

2) Liquidity is already a problem; preventing the sale of the shares for 2 years does not make much sense other than creating troubles to investors.

3) The personal investment limit sounds more as a violation of personal freedom than as investor protection. Italy chose not to set a limit, either annual or per deal, and preferred to regulate crowd-investing as any other investment opportunity, under the MIFID system: each investment is allowed only where the investor’s proclivity to risky investments, adequately checked, matches with the high risk profile of equity crowdfunding. This approach involves broker-dealers and investment processes that might sound complicated but that ultimately offer an adequate protection to the investors.

Moreover, in Italy smaller investments are allowed outside the MIFID scheme, through a fast and lean process, up to certain thresholds (500€ for individuals and 5,000€ for organizations), which indeed should be further raised.

Apart from such topics, the Italian solution to use the MIFID system allows Italian platforms to collect foreign investment through the EU Passport regulation, so enhancing scalability and exploiting the power of the web better then other countries.

Erin: How has the Italian government’s approach, both elected and regulatory, acted as a catalyst to propel crowdfunding and P2P? How are regulations evolving?

Alessandro: P2P in Italy is very different from the rest of the world: businesses are not allowed to borrow and lenders cannot chose whom to lend. So, far from disintermediating, it is a typical bank scheme which loses any appeal in terms of crowd engagement, project sharing, story telling.

To take off, Italian market needs a disruptive approach and a fresh regulation. Equity crowdfunding has been wisely regulated, through a solution that entitles Italian platforms to collect money throughout the European Union; nevertheless, the Italian solution is still too tightly administered and requires some changes, first of all the extension to any kind of business, while it’s now limited to innovative start-ups.

Erin: In its findings regarding the role of women in alternative finance, the recent Nesta-Cambridge report states that women make up the majority of fundraisers in both donations based and rewards based crowdfunding. How will women move to match the predominantly male P2P and equity crowdfunding sector? What about other under-served segments of the population?

Alessandro: Among other business, I am honored to be in the advisory board of Mums Mean Business, a brilliant crowdfunding platform from Norway, now expanding to Europe and entering in the investment arena with the development of their new 2.0 platform due to launch this spring. MMB’s CEO, Babou Olengha-Aaby, is devoting a lot of energy to a platform which is expressly designed around the unmet funding needs of women-led enterprises. Interestingly, the platform has seen an almost equal gender split in regards to its funder base. Perhaps due to Babou’s insistence that MMB is by no means a platform which advocates that women only invest in women. Its message has since its inception been about engaging everyone around why investing in women’s economic empowerment through entrepreneurship makes for smart economics, makes business sense but why it’s also a win-win for all. And it would seem that MMB’s economic-centered rhetoric is resonating with funders on both sides of the gender spectrum. MMB should not sound as an exceptional case or an example, or maybe it is, only time will tell. But it remains a fact that most investment platforms are managed by men, and I don’t think that anybody has a credible explanation for this situation.

Erin: In order for alternative finance to grow, the Nesta-Cambridge report explicitly notes “the industry needs to continue innovating, educating users and addressing the various concerns consumers and SMEs have about alternative finance.” What will be done in Italy and in Europe to engender such growth further?

Alessandro: The European Equity Crowdfunding Association will develop specific education programs and will start projects involving local business associations and operators. At the moment, I have not yet seen a large investment on communication, which is pretty obvious as all the equity platforms are start-ups themselves.

Governments should contribute in communicating what crowd-investment means, as any country will largely benefit from the shifting to alternative finance solutions. Fiscal benefits are good incentives, but they might be understood by a few professional investors or interested angel investors only. I would stress the need of a wider education effort, in order to target the real crowd.

Erin: Who do you identify as the trailblazing this path?

Alessandro: Anybody who will understand the power of communication and user experience, beside investment opportunities. The former is not less important than the latter, as one might be offering shares in the new Facebook, but nevertheless raising no money, if one does not communicate adequately, or if the investors find it too stressful or complicated putting money on the table. Then a successful exit would widely benefit the concept of alternative finance and explain it better than a thousand words.

Erin: How do you see crowdfunding evolving in Italy and across Europe?

Alessandro: In Italy the number of authorized platforms is rising, and most of them will start operations in the first quarter of 2015. This means that the communication effort might enjoy more contribution from the industry. The same is happening in most European countries. The key success factor might be a balanced relationship between regulatory and protective strategies and the opportunity to actually participate in crowd-investment projects. But I am concerned that crowd-investing will not properly take off until cross-border transactions are accepted, as a single market has not scalability enough for this kind of fundraising.

Crowdfund Insider has joined with The University of Cambridge to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and crowdfunding industry pioneers from the collaborating associations.

Crowdfund Insider has joined with The University of Cambridge to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and crowdfunding industry pioneers from the collaborating associations.

For benchmarking research enquiries please contact Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge via email zz251@cam.ac.uk or twitter @BryanZhangZ or Robert Wardrop, Research Fellow at the Judge Business School, at The University of Cambridge at rhw40@cam.ac.uk