The European Alternative Finance Benchmarking Survey deadline has been extended until 6 January 2015.

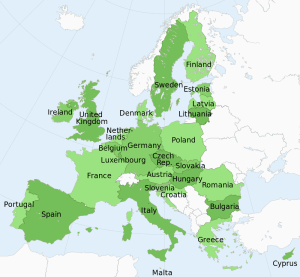

In late November The University of Cambridge teamed up with EY, the global professional services organization, and launched the European Alternative Finance Benchmarking Survey with the support of major European industry associations. As readers may know, this is the largest study to date on crowdfunding, peer-to-peer lending and other forms of alternative finance in Europe. This benchmarking survey, which opened on 25 November has been extended to 6 January 2015, aims to capture the size, transactional volume and growth of the alternative finance markets across Europe. To date, according to Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge, there have been 188 survey responses from 26 European countries.

To recap, major national and regional crowdfunding associations in France, Germany, Spain, Italy, the Netherlands, the Nordic countries and the UK are participating in this groundbreaking research. This benchmarking survey is supported by FPF, ANACOFI and AFIP (France), the German Crowdfunding Network, the Spanish Crowdfunding Association, Crowdfunding Hub (Dutch), AISCRIS (Italy), the Nordic Crowdfunding Alliance, the UK Crowdfunding Association, the P2P Finance Association, the European Crowdfunding Network, the European Equity Crowdfunding Association as well as the P2P Banking.com. Crowdfund Insider initiated the exclusive interviews with The University of Cambridge’s Dr. Mia Gray and her esteemed colleague Bryan Zhang, who helped ignite this exciting nascent series.

European crowdfunding mavericks interviewed to date include CrowfundingHub Founder and Executive Board Member of the European Crowdfunding Network, Ronald Kleverlaan; President of the Board of Asociación Española de Crowdfunding Daniel Oliver; Le Crowdfunding author, AFIP and ANACOFI crowdfunding expert Marianne IIZUKA; Coordinator of the German Crowdfunding Network and member of the European Crowdfunding Stakeholder Forum, Karsten Wenzlaff; Executive Director of Peer-to-Peer Finance Association, Sam Ridler; and most recently, Head of the Nordic Crowdfunding Association, Dr. Rotem Shnoer.

My next interviewee is Bruce Davis, Director of the UK Crowdfunding Association and Co-Founder and Joint MD of Abundance, the renewable energy crowdfunding platform which has raised over £8.1 million since its launch. Davis is also currently a Visiting Research Fellow at the Bauman Institute, Leeds University, School of Sociology and Social Policy. While a freelance ethnographic researcher and brand consultant, Davis created of Monkey Shoulder whisky, co-founded of Zopa.com, and conducted ethnographic research projects in UK, Russia, Europe, Australia and the US. As the Director of the UK Crowdfunding Association, Davis helps lead influential members to its mission: “Promote Crowdfunding as viable  method to raise funds, Be the voice for all Crowdfunding businesses in the UK and Publish a Code of practice.” Crowdfunding platform members include Abundance, AngelsDen, Bank to the Future, Bloom, BuzzBnk, CoFunder, Crowd for Angels, CrowdBank, Crowdcube, Crowdfunder, CrowdMission, CrowdPatch, CrowdProperty, CrowdShed, FundingEmpire, FundingKnight, FundingTree, FutSci, Gambitious, GamCrowd, GrowthFunders, hubbub, indiegogo, InvestingZone, InvestUp, LandBay, Lending Crowd, LendInvest, Mamawatta, MicroGenius, Money & Co, Property Crowd, Property Moose, Quid Cycle, Rebuilding Society, Seedrs, ShareIn, SquareKnot, Syndicate Room, Trillion Fund, Volpit and Yimby.

method to raise funds, Be the voice for all Crowdfunding businesses in the UK and Publish a Code of practice.” Crowdfunding platform members include Abundance, AngelsDen, Bank to the Future, Bloom, BuzzBnk, CoFunder, Crowd for Angels, CrowdBank, Crowdcube, Crowdfunder, CrowdMission, CrowdPatch, CrowdProperty, CrowdShed, FundingEmpire, FundingKnight, FundingTree, FutSci, Gambitious, GamCrowd, GrowthFunders, hubbub, indiegogo, InvestingZone, InvestUp, LandBay, Lending Crowd, LendInvest, Mamawatta, MicroGenius, Money & Co, Property Crowd, Property Moose, Quid Cycle, Rebuilding Society, Seedrs, ShareIn, SquareKnot, Syndicate Room, Trillion Fund, Volpit and Yimby.

Recently I had the opportunity to connect with Davis via email. Our interview follows:

Erin: Why has the UK Crowdfunding Association decided to participate in the Cambridge-EY European Alternative Finance Benchmarking Research?

Bruce: The UK leads the world on the development of new crowdfunding models and platforms are actively looking to expand in the European market. In many ways the EU has more potential than than US for the expansion of crowdfunding.

The rapid growth of the various sectors indicate that peer to peer lending is clearly leading the charge – yet equity crowdfunding is rather small but growing rapidly. How do you explain this phenomenon? What about peer to peer lending?

Both sectors tap into a simple but powerful consumer need, to take control over our money when trust in traditional

institutions is at an all time low. We like to call it ‘democratic finance’ and it is all about giving people the power to decide how their money is invested. The industry is also exploiting developments in technology, on the back of the massive growth of the social internet, to deliver real cost savings that mean better returns for investors.

The roots of peer to peer lending come from the examination of new markets forming online, such as eBay and Facebook. The original P2P lender, Zopa.com was known as the eBay for money when it launched.

Erin: What can the United States learn from the UK? What is your opinion on the regulatory environment in the US for P2P Lending?

Bruce: The US regulator and its approach to regulating P2P lending is shortsighted at best. It has failed to appreciate what this innovation means for both the resilience, transparency and fairness of the financial system as a whole. It has led to an over complex, rules based system which will not provide the customer protection needed to grow the sector – instead the US seems to be characterised by ‘old money’ dressed up as new. The US would do well to look at how the UK approach encourages innovation and transparency in the relationship between the market and the regulator with overall better outcomes being delivered for UK consumers.

Erin: Please elaborate on your comment: “People’s savings languishing inside Cash ISAs paying less than inflation, despite the tax breaks and despite inflation being at relatively low levels, is a national scandal. While ISAs are an important encouragement to savings and investment in this country, the banks are cynically using the carrot of tax relief to attract £ billions, only to ‘reward’ customers with pathetic returns which leave millions of people’s savings falling in value month after month.”

Bruce: It means what it says. Traditional banks are taking our savings and our apathy towards money for granted.

It is costing savers (and the economy) millions in lost value to inflation. This is why the P2P and debt crowdfunding sector have been campaigning hard and successfully to bring new assets into the purview of ISA and generate inflation beating returns without undue increase in risk on people’s money.

Erin: How has the UK government’s approach, both elected and regulatory, acted as a catalyst to propel crowdfunding and P2P? How are regulations evolving?

Bruce: The UK government has been very supportive of the sector as a whole both in terms of co-investing public funds, providing much needed funding for lending to SMEs and addressing policy issues of competition to ensure a level playing field between the challengers and incumbents.

Since the formation of the FCA, we have seen a marked contrast in approach from the less approachable and arguably less engaged FSA. This has resulted in regulation that encourages innovation in the interests of the consumer rather than stifling it with rules. It has also resulted in unprecedented openness and communication between the market and the regulator which means the regulator has better information upon which to base decisions and the market has a clear framework in which to innovate.

Erin: In its findings regarding the role of women in alternative finance, the recent Nesta-Cambridge report states that women make up the majority of fundraisers in both donations based and rewards based crowdfunding. How will women move to match the predominantly male P2P and equity crowdfunding sector? What about other under-served segments of the population?

Bruce: The shift towards more female investors and beneficiaries will continue into the investment and P2P sector as

confidence in the sector grows. It is no coincidence that 50% of the UKCFA board are female representing debt, peer to peer and equity platforms.

Erin: In order for alternative finance to grow, the Nesta-Cambridge report explicitly notes “the industry needs to continue innovating, educating users and addressing the various concerns consumers and SMEs have about alternative finance.” What will be done in the UK to engender such growth further?

Bruce: We will see a big rise in investment in advertising and marketing in 2015 from the sector while the development of ISA and Sipp propositions will continue to cement our role in mainstream financial services. P2P will be on a TV near you soon.

Erin: Who do you identify as the trailblazing this path? Interviewees have cited the UK as the leading the way; what responsibilities does such leadership entail?

Erin: Who do you identify as the trailblazing this path? Interviewees have cited the UK as the leading the way; what responsibilities does such leadership entail?

Bruce: Big brands such as Zopa, Ratesetter and Funding Circle are being joined by the likes of Abundance, Trillion Fund, Seedrs and Crowdcube in developing new products and reaching out to new markets of consumers including the growing ethical finance sector. We should be setting the standards for the sector in terms of transparency, innovation and customer service.

Erin: How do you see crowdfunding evolving across Europe? How do you compare this evolution to what is occurring in the UK?

Bruce: Abundance operates across the 43 countries of the European Economic Area. Equity platforms are also expanding their operations in Europe. Currently there is a lack of consistent interpretation of the existing rules which should allow crowdfunding to operate across borders but the Capital Markets Union is an opportunity to bring the less enlightened regulators into line with the rest of Europe.

Erin: What central topics were debated during UK Crowdfunding’s fall conference that are igniting further disruption and/or innovation in crowdfunding in the near and distant future?

Bruce: The big conversation was all about ISA, which is on track for launch in the second half of 2015. Longer term we will see significant growth on the back of increasingly well funded platforms seeking to grow their brands and businesses.

_____________________________________________________________

Crowdfund Insider has joined with The University of Cambridge to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and crowdfunding industry pioneers from the collaborating associations.

Crowdfund Insider has joined with The University of Cambridge to be the exclusive media partner on this benchmarking research. This interview is one of a series that includes multiple, in-depth interviews with international thought leaders and crowdfunding industry pioneers from the collaborating associations.

Please find the link to the benchmarking survey below:

https://www.surveymonkey.com/s/cambridge-ey-europeanaltfinbenchmarkingsurvey

For benchmarking research enquiries please contact Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge via email zz251@cam.ac.uk or twitter @BryanZhangZ or Robert Wardrop, Research Fellow at the Judge Business School, at The University of Cambridge at rhw40@cam.ac.uk

For benchmarking research enquiries please contact Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at The University of Cambridge via email zz251@cam.ac.uk or twitter @BryanZhangZ or Robert Wardrop, Research Fellow at the Judge Business School, at The University of Cambridge at rhw40@cam.ac.uk