An Interview with Orchard Platform’s CEO Matt Burton

Founded in 2013, the tech company Orchard Platform enables Direct Lending originators and institutional investors to  optimize and scale Direct Lending at a global level. The Orchard Platform Advisors, LLC (a wholly owned subsidiary of Orchard Platform (Orchard App, Inc)) is a Registered Investment Advisor with the SEC and is committed to promoting transparency and understanding of the space as well as creating technology that facilitates further product innovation and investment in direct lending.

optimize and scale Direct Lending at a global level. The Orchard Platform Advisors, LLC (a wholly owned subsidiary of Orchard Platform (Orchard App, Inc)) is a Registered Investment Advisor with the SEC and is committed to promoting transparency and understanding of the space as well as creating technology that facilitates further product innovation and investment in direct lending.

Orchard Platform’s team combines experience from startups and established companies including Admeld, Google,  Bloomberg, offerpop.com, American Express, oyster.com, Citibank, Sun Microystems, IBM, GE and Twitter. No wonder Orchard is backed by Spark Capital, Canaan Partners, Brooklyn Bridge Ventures, Conversion Capital and socialleverage, as well as prominent industry veterans and angel investors Doug Atkin of Guggenheim Partners, Jennifer Hyman, CEO, Co-Founder Rent the Runway, Vikram Pandit (former chief executive at Citigroup) and Tom Glocer (former CEO of Thomson Reuters).

Bloomberg, offerpop.com, American Express, oyster.com, Citibank, Sun Microystems, IBM, GE and Twitter. No wonder Orchard is backed by Spark Capital, Canaan Partners, Brooklyn Bridge Ventures, Conversion Capital and socialleverage, as well as prominent industry veterans and angel investors Doug Atkin of Guggenheim Partners, Jennifer Hyman, CEO, Co-Founder Rent the Runway, Vikram Pandit (former chief executive at Citigroup) and Tom Glocer (former CEO of Thomson Reuters).

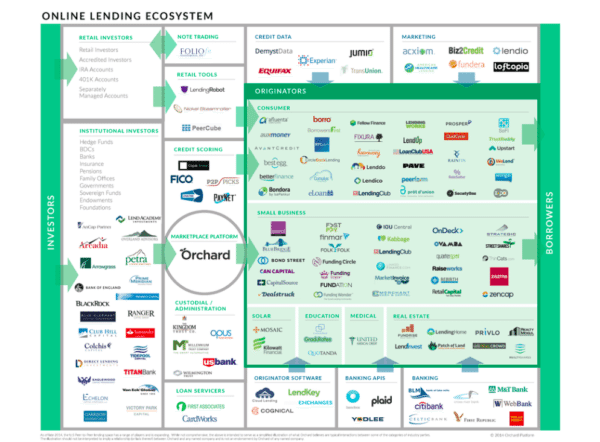

The startup’s technology is being used by many of the industry’s top institutional investors and is enabling them to invest in loans with intelligence, speed and at scale. Marketplace lending, or peer-to-peer lending, creates opportunities for individuals and small businesses to access credit in new ways and often at lower costs. For more information, readers may check out the Orchard blog. The company also recently created a “Lendscape” to help make sense of the space.

I recently had the pleasure of catching up with Orchard Platform’s CEO Matt Burton via email:

Erin: How is Orchard using advanced algorithms to create a platform layer to facilitate its institutional P2P lending?

Matt Burton: Orchard was created on the thesis that institutional investors looking to deploy large amounts of

capital would benefit from a platform that allows for programmatic connectivity and advanced analytics. It’s actually quite simple—our platform (and by default our algorithms) helps institutional investors assess loan performance data and support technology solutions that automate investment, back office procedures, and portfolio management in marketplace lending.

Erin: Is Orchard only catering to institutions? What is the value add proposition generated for these institutions?

Matt: We have multiple clients in the following categories: hedge funds, credit funds, alternative funds, banks, BDCs, family offices and wealth managers. The overall complexion of this space has changed radically over the past 18 months. In early 2012 there were virtually no institutional investors interested in this space. Now, marketplace lending has benefitted from investors looking to grow their portfolios beyond consumer loans. They are in search of investments in multiple categories that can be marketplace funded — small business loans, real estate, and higher education. We have also seen an expanded ecosystem of service providers that are focused on servicing marketplace loans. See below for value adds we provide our customers.

Erin: Please describe the services Orchard offers. Is there fully automated trading? How quick are the transactions? What is the average transaction size?

Matt Burton: Orchard helps institutional investors deploy capital in marketplace lending at scale while providing operational efficiency, advanced analytics, and strategic access to supply. We offer investors automated, data-driven loan acquisition in milliseconds.

Our offering to investors includes investment strategy, operational automation, customized web-based reporting and analytics, and access to supply.

We also help loan originators automate their investor marketplace through access to diversified funding sources, streamlined distribution, and market-ready technology,.

The majority of our transactions are for whole loans. On the consumer side, the average loan size is around $15K and for small business it is around $75K.

Erin: What is Orchard’s fee structure for services? How much revenue is Orchard generating?

Matt Burton: We charge a fee that is based on outstanding principal to investors using our platform. We are a private company and don’t share specific data about revenue.

Erin: How many customers is Orchard currently servicing? Please share who some of your current customers are.

Matt Burton: Orchard is currently serving many of the leading investors in marketplace lending, across a wide variety of institutional investor types. We do not publicly disclose the names of our clients.

Erin: How does Orchard Platform fill a needed niche in the P2P lending market?

Erin: How does Orchard Platform fill a needed niche in the P2P lending market?

Matt Burton: Orchard is unique in terms of the capabilities it provides to both investors and originators. Investors have largely come to us looking for automated solutions, in depth analytics and access to unique supply. Originators come to us looking to scale their lending business by gaining access to a diversified pool of capital. Please refer to the Orchard Lendscape.

Anytime there is fragmentation on either side of a transaction, in marketplace lending there are many investors and many loan origination platforms, it makes sense to have a specialized, infrastructure player in the middle. The role of this marketplace participant is to facilitate efficient connections between parties on either side and create standards that everyone can agree on, so that the overall market grows. This is the role that Orchard is playing.

Erin: Who do you see as Orchard Platform’s peers and how do you see Orchard Platform as a catalyst for other P2P lending platforms?

Matt: Orchard embraces technology, efficiency and scale. We hope that encourages others in the ecosystem to do the same. We sit in a unique place and are focused on moving the industry forward and creating tools that help institutional investors deploy capital efficiently and origination platforms operate a marketplace for selling their loans.

Erin: What are relationships with other P2P platforms, such as Prosper & Lending Club? What’s your take on Marketplace Lending and “Screen Scrapers?”

Matt Burton: Orchard values the partnerships we have with loan origination platforms. They serve an important role for borrowers and investors. We’ve analyzed and written about both companies in the past and respect them enormously. The ability to scale is a key foundational component for loan originators. The efficiencies we provide help them focus on their business while building upon their addressable marketplace. As more lenders move to embrace a marketplace funding model for their loans, many are using Orchard’s technology to do so with efficiency.

Erin: Orchard is on the cutting edge, applying institutional, computer trading to peer to peer lending. What are your thoughts on the next two or three years for P2P lending? How and where will Orchard further expand? Where do you see Orchard in five years? ten years?

Matt Burton: Orchard is applying insight to marketplace lending. We’ve already seen radical changes take place as

institutional investors have recognized the potential of this market. We’ve also seen the market move from one primarily supporting consumer loans to one now being used to fund small businesses, real estate, and education. This type of diversification will certainly continue. As for Orchard, we’ll continue to expand the scope of our offerings, with secondary trading and additional supply channels on the near-term agenda. At the end of the day, all of these developments and advances point to a new future for credit. Understanding and meeting the needs of that future is where we are focused.

Erin: Discuss the importance of Orchard’s articulate and engaging blog, i.e. the relevance of semantics and loan performance to predict risk?

Matt Burton: The company has evolved organically from what began as a small circle of friends with unique perspectives and complementary skills. We were all driven by the same interests, and a desire to make a difference in the alternative lending space. Orchard includes experts from both the financial and technology space. We believe in working together as a team to build great products, serve our clients with excellence, and help shape the very nature of next-generation financial services. The blog is our opportunity — as individuals and as an organization — to explore and share the issues we believe will shape the future of this industry.

Erin: In Orchard’s blog, your colleague and Co-Founder David Snitkof states, “As marketplace lending  evolves, so will the technology and data available to investors. Machine-based text analysis is another example of taking a process that was once time-intensive and could only be done by human beings and using modern resources to make it scalable and more accurate. Ultimately, the ability to rapidly and accurately assess risk using a diverse set of data will lead to greater liquidity for consumers and businesses as well as the more efficient allocation of capital across our economy.” How will Orchard move ahead with this info?

evolves, so will the technology and data available to investors. Machine-based text analysis is another example of taking a process that was once time-intensive and could only be done by human beings and using modern resources to make it scalable and more accurate. Ultimately, the ability to rapidly and accurately assess risk using a diverse set of data will lead to greater liquidity for consumers and businesses as well as the more efficient allocation of capital across our economy.” How will Orchard move ahead with this info?

Matt Burton: We are at a unique time in history where there is a greater quantity and breadth of data available than ever before. We’ve built our analytics and automated investment platform to support this reality and give our investors the ability to use a wide variety of highly-sophisticated investment strategies. Our platform also supports 3rd-party modelers that investors may hire to build custom algorithms.

Erin: Describe how your experience as the #7 employee at Admeld ($400 million dollar exit to Google in 2011) shaped who you are, early leadership lessons and your management approach.

Matt Burton: Admeld afforded me the ability to enter a company at its founding stages and experience first-hand how

success is earned. I was fortunate that we were able to provide clear and efficient solutions that worked for the online ad market. After the Google acquisition, I had the opportunity to try something new and find like-minded people who were interested in marketplace lending. My management approach has come out of the notion that it’s always best to surround yourself with people smarter than yourself. Let them do what they do best and provide a common goal and direction.

Erin: How would you describe the synergy of your team, Jonathan Kelfer, Philip Rosen, David Snitkof, Angela Ceresnie, Jeff Schwab, Bill Ullman, Sarah Masters and Anton Eremenko?

Matt Burton: As mentioned above, we are a team of passionate experts who work well together and understand how technology can disrupt an established market. Our team is a combination of sheer intellectual horsepower, procedural elegance and a chemistry that binds us all together.

Erin: Doug Atkin of Guggenheim Partners, Jennifer Hyman, CEO, Co-Founder Rent the Runway,  Vikram Pandit (former chief executive at Citigroup) and Tom Glocer (former CEO of Thomson Reuters) have invested in Orchard. How did you secure these investors and how are they involved with Orchard?

Vikram Pandit (former chief executive at Citigroup) and Tom Glocer (former CEO of Thomson Reuters) have invested in Orchard. How did you secure these investors and how are they involved with Orchard?

Matt Burton: They are all veteran investors who recognized that Orchard is doing something different in terms of the how credit is being democratized. We’re all passionate about the same things — making a difference….