We caught wind of a proposed crowdfunding exemption in the State of Alabama in the fall of 2013. As any regular reader of Crowdfund Insider knows, intrastate crowdfunding exemptions are popping up left and right as of late. Just this week we reported on proposed legislation in Washington State. Earlier this month we covered an underwhelming effort in Maine. Kansas, Georgia, Wisconsin and Michigan all have exemptions on the books.

We caught wind of a proposed crowdfunding exemption in the State of Alabama in the fall of 2013. As any regular reader of Crowdfund Insider knows, intrastate crowdfunding exemptions are popping up left and right as of late. Just this week we reported on proposed legislation in Washington State. Earlier this month we covered an underwhelming effort in Maine. Kansas, Georgia, Wisconsin and Michigan all have exemptions on the books.

While states are seemingly falling over themselves to bring crowdfunding to local businesses and investors, movement at the federal level has been slow. At a House Committee on Small Business hearing last week, it became abundantly clear that the requirement of audited financials for issuers raising over $500,000 could become a major sticking point.

RELATED | House Hearing On Crowdfunding & The JOBS Act Critical Of Rules As Proposed

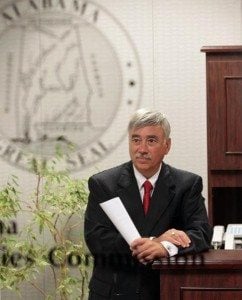

As I prepared to do my due diligence on Alabama’s proposal, I wasn’t totally prepared to cross paths with Alabama Securities Commission Director Joeseph P. Borg.

Note that I live in the State of Ohio. Our state’s Director of Securities Andrea Seidt has been named the President of the NASAA, an organization that in 2012 identified crowdfunding as an “investor threat” in a bulletin entitled “Laws Provide Con Artists with Personal Economic Growth Plan.”

This type of rhetoric always perplexed me. Crowdfunding obviously has the potential to drive capital into small and emerging business. It’s happening now overseas and through rewards-based platforms here in the states. These types of businesses are the lifeblood of our economy. The potential impact is huge and could be compounded by any returns seen by small-time investors.

The whole idea behind the crowdfunding legisation we’ve proposed is to make it easy, efficient and inexpensive.Joseph Borg – Director, Alabama Securities Commission

Having said that, there seems to be an absence of balance coming from organizations like the NASAA. (To be fair, I could argue the same on behalf of some crowdfunding industry stakeholders, but that is a topic for another post.) It’s one thing to say that crowdfund investing presents a risk to unsophisticated investors. It inarguably does, but the risk is inversely proportional to the level of sophistication among small business owners and investors alike. Shouldn’t regulators take a more active role in providing balanced educational resources – that highlight the pros and cons of participating – to their constituents in order to mitigate risk? Is the solution really to shut small investors out of the private markets altogether?

With these questions in mind, I spoke with Alabama State Senator Arthur Orr about his proposal, SB44. (embedded, bottom of article) He explained that he had actually worked with ASC Director Borg on the bill, and that Mr. Borg had crafted a proposed crowdfunding exemption years prior. It was deemed unnecessary at the time because bank lending hadn’t tightened up quite yet, so the proposal sat until the time was right.

With these questions in mind, I spoke with Alabama State Senator Arthur Orr about his proposal, SB44. (embedded, bottom of article) He explained that he had actually worked with ASC Director Borg on the bill, and that Mr. Borg had crafted a proposed crowdfunding exemption years prior. It was deemed unnecessary at the time because bank lending hadn’t tightened up quite yet, so the proposal sat until the time was right.

Upon reading the bill a few things stuck out, namely the fact that the bill didn’t explicitly require a crowdfunding intermediary’s involvement. Borg explained that much of Alabama is very rural, and he expects that investment will be localized. It will be people investing in businesses ran by people they know. For a lot of deals, due diligence will happen face-to-face, not online. Intermediaries are an option, but whether there will be enough online deal flow to support them remains to be seen.

The legislation also carefully dodges a requirement for audited financials.

“Audited financials as you know are very, very expensive for startup companies,” Borg told Crowdfund Insider. “The whole idea behind the crowdfunding legisation we’ve proposed is to make it easy, efficient and inexpensive. We do not want funds that should be used for capital to be spent on things that we do not consider necessary on the front end.”

“Audited financials as you know are very, very expensive for startup companies,” Borg told Crowdfund Insider. “The whole idea behind the crowdfunding legisation we’ve proposed is to make it easy, efficient and inexpensive. We do not want funds that should be used for capital to be spent on things that we do not consider necessary on the front end.”

“At some point in time a company will get large enough that it will switch and we’ll have to review whether or not audited financials are necessary, but at inception we think the cost is prohibitive.” Refreshingly, Borg cited an expectation that the law will have to change over time. There is a clause in the bill that gives flexibility to change requirements as necessary every five years. More invasive, “onerous” regulation will only follow fraud, not precede it.

On the topic of education, Borg is insistent upon helping issuers within his state understand what crowdfunding is and how it works. Potential issuers will have to register with his office and will be offered education ahead of going out and seeking money from the crowd. He is currently in the process of building programs to address this concern.

“Education is absolutely critical,” Borg said. “I think one of the problems with something like a crowdfunding statute. If it’s not backed up by the ability of an entrepreneur – who has never run a company, who has a great idea and has no idea how to deal with investors, stockholders, what type of reports are out there – thats why it’s important as we go forward with the bill to create training workshops. As applications come in, we’ll group them together and have some sort of a seminar or workshop where experts from the crowdfunding field, as well as those from private and government, are together helping to mentor a new entrepreneur who maybe has never had a company before, who has never had a business, but does have a good idea.”

It all adds up to a more measured, pragmatic approach to crowdfunding that may work very well for Alabama’s 4.8 million residents.

Alabama SB44 – Intrastate Crowdfunding Exemption