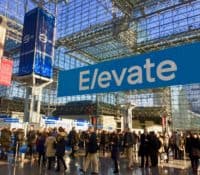

Elevate Credit CEO Resigns as Q2 Revenue Misses, Guidance Cut

Elevate Credit (NYSE: ELVT) announced the exit of CEO Ken Rees today a Q2 earnings release missed on top-line numbers and the Fintech lowered guidance for Q3. Current COO Jason Harvison was selected to be interim CEO as the firm seeks a full-time replacement. Rees… Read More

Read more in: Fintech | Tagged jason harvison, ken rees, online lending