Indian Insurtech Policybazaar, a Digital Insurance Platform, Is Planning to Conduct IPO at $3.5 Billion Valuation

Policybazaar, a digital insurance platform, is reportedly planning to conduct an initial public offering (IPO) next year at a valuation of more than $3.5 billion. If it’s successful, then it might potentially become the first of India’s major startups to carry out such a large… Read More

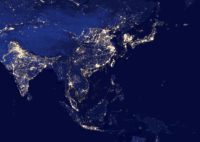

Read more in: Global, Asia, Insurtech | Tagged digital insurance, india, initial public offering, insurance technology, insurtech, ipo, mumbai, policybazaar, softbank, temasek holdings, tencent holdings, tiger global, united states, us