Calling All Would-be Angels: “Invest In America Act” Bill Could Help You Find Your Wings

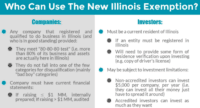

Start-ups and small businesses represent the heart of the American economy and fostering this sector is integral to continued innovation and job growth in the U.S. Access to capital however, is always a critical issue for these types of businesses and angel investors often represent… Read More

Read more in: Featured Headlines, Opinion, Politics, Legal & Regulation | Tagged anthony zeoli, eis, georgia quinn, invest in america act, legislation, seis, taxes