NOW Money Selects ThetaRay AI Tech to Prevent Financial Crime

NOW Money, the GCC’s first mobile banking solution focused on financial inclusion, and ThetaRay, a provider of AI-powered transaction monitoring technology, announced a collaboration to implement ThetaRay’s cloud-based AML solution “to monitor cross-border payments and support in the prevention of financial crimes and money laundering… Read More

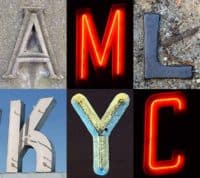

Read more in: Fintech, Asia, Regtech & Legaltech | Tagged ai, aml, anti money laundering, artificial intelligence, banking, cloud, cross-border payments, financial crimes, financial inclusion, gcc, mark gazit, mobile banking, now money, thetaray, transaction monitoring technology