British Business Bank: COVID Schemes Saved 500,000 to 2.9 Million Jobs

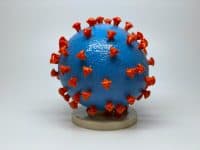

The British Business Bank is distributing an “Evaluation Report” on the impact of the COVID loan guarantees that indicates 150,000 to 500,000 businesses were saved and between 500,000 to 2.9 million jobs were maintained. The report was authored by London Economics and Ipsos. The document… Read More

Read more in: General News, Fintech, Global | Tagged bbls, british business bank, catherine lewis la torre, cbils, clbils, covid, ipsos, martin mctague, uk, united kingdom