Jirav, the Financial Planning and Analysis Solution, Acquires $20M via Series B Led by Cota Capital

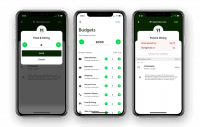

Jirav, which claims to be an all-in-one financial planning and analysis (FP&A) solution, and the “preferred” budgeting and forecasting partner of CPA.com, announced $20M in Series B funding led by Cota Capital. Jirav will use the funds “to further accelerate product development, broaden its customer… Read More

Read more in: Fintech | Tagged budgeting, cota capital, cpa.com, financial planning, forecasting, investment round, kevin jacques, small businesses, smbs, sme's