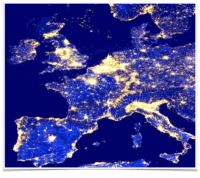

Digital Bank bunq Reports New Funding with Plans for US Expansion

Digital bank bunq has reported a net profit of €53 million for 2023 as part of its annual report. bunq also revealed that it acquired additional funding of €29 million from its existing backers. This is reportedly part of Bunq’s efforts for expanding business operations… Read More

Read more in: Fintech, Global | Tagged banking, bunq, digital bank, uk, united kingdom