BBVA Achieves Record Number of New Customer Growth in 2020 Despite COVID-19 Pandemic

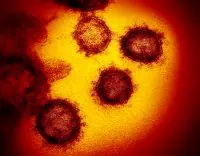

BBVA announced on Monday it achieved a record number of new customer growth in 2020, despite the COVID-19 pandemic. BBVA reported that it added a total of 7.3 million new customers worldwide, of which 2.4 million became BBVA customers through the app or the web. According… Read More

Read more in: Fintech | Tagged bbva, covid-19, pandemic, uk, united kingdom