Ning Tang, CEO Of CreditEase, Discusses Chinese P2P Regulations & Future of Online Lending

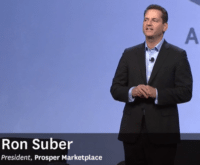

At the Continuum SF Innovation and Credit Conference in San Francisco I recently attended, those present listened to a solid lineup of speakers discuss business development and more in SF and across the Pacific in China. Speakers included SF Mayor Ed Lee; Rob Suber,… Read More

Read more in: Asia, Featured Headlines, Global, Investment Platforms and Marketplaces | Tagged chaomei chen, china, creditease, ipo, ning tang, prosper marketplace, ron suber, salesforce, san francisco, sf, yirendai