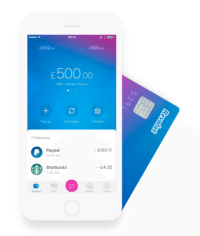

A World Beyond Banking: Revolut Offers Premium Membership, Preps for Crowdfunding Offer on Seedrs

If Amazon built a bank, would it aspire to be like Revolut? I don’t know about that, but the Revolut Premium Membership is something I want. Now. London-based Fintech startup Revolut has launched its vision of Premium Membership in a world populated by stiff and… Read More

Read more in: Global, Featured Headlines, Fintech, Offerings | Tagged banking, challenger bank, lending works, revolut, seedrs, uk, united kingdom, vlad yatsenko