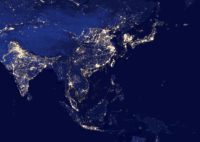

How New P2P Regulations Make the Industry Safer for Investors in Southeast Asia

Digital lending platforms have made strong inroads in Southeast Asia over the past few years. In 2016 alone, peer-to-peer (P2P) business lending generated US$115.01 million—more than half of Southeast Asia’s total alternative financing market that year. This growth can be attributed to a combination of… Read More

Read more in: Featured Headlines, Asia, Fintech, Global, Opinion, Politics, Legal & Regulation, Strategy | Tagged asia, indonesia, marketplace, milena naitoh, online lending, p2p, peer to peer, perspective, regulation, singapore, singapore fintech association, southeast asia, thailand, validus, vietnam