Have Your Say: The SEC is Accepting Feedback on Update to the Definition of an Accredited Investor

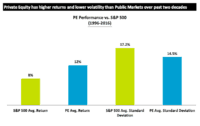

The Securities and Exchange Commission (SEC) is on the cusp of a significant update to the definition of an accredited investor (AI). Depending on the final rules, the Commission could broadly expand access to private securities offerings – a sector of the capital markets that… Read More

Read more in: Featured Headlines, Opinion, Politics, Legal & Regulation | Tagged accredited investor, jay clayton, perspective, sec, securities and exchange commission