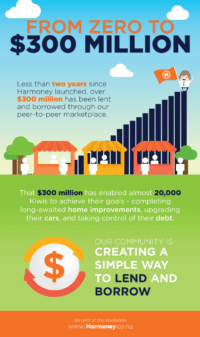

New Zealand Online Lender Harmoney Achieves $500 Million Milestone in Under Three Years of Operation

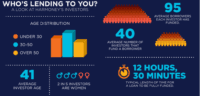

New Zealand-based peer-to-peer lending marketplace Harmoney announced on Friday it has officially achieved $500 million transaction milestone in just under three years of operation. The online lender reported that 30,000 Kiwis have joined its community and have two challenger NZ owned banks, TSB and Heartland,… Read More

Read more in: General News, Investment Platforms and Marketplaces | Tagged harmoney, neil roberts, new zealand, nz, online lending