UK P2PFA Releases Q3 Lending Data. Updates Platform Operating Principles

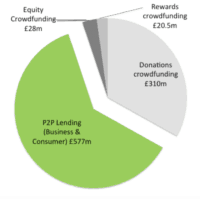

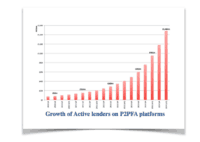

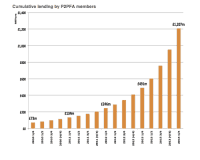

The Peer to Peer Finance Association (P2PFA), the trade group that represents P2P lending platforms in the UK, has published data reflecting member loans for Q3 of 2015. The P2PFA represents over 90% of loan volume in the UK and is highly representative of industry… Read More

Read more in: Global | Tagged christine farnish, p2p, p2pfa, peer to peer, uk, united kingdom