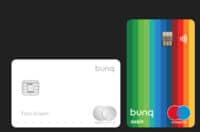

Revolut Business Introduces Revolut Reader, Moving into In-Person Payments

Revolut, the super-app with over 18 million retail customers globally and more than 500,000 corporate clients, is offering Revolut Reader in the United Kingdom and Ireland. A “fast” and ‘powerful” lightweight card reader, the new product is designed “to allow merchants of all kinds to… Read More

Read more in: Fintech, Global | Tagged europe, financial services, fintech adoption, fintech app, fintech trends, in-person payments, ireland, payments, revolut, revolut business, super app, uk, united kingdom