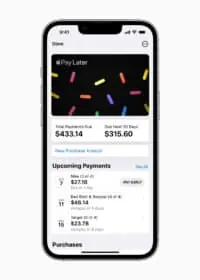

Apple Pay Later: Mega-Tech Firm Apple Offers BNPL Product

Apple (NASDAQ:AAPL), the world’s largest company by market cap and ubiquitous tech firm, announced a buy now – pay later product today alongside a solid portfolio of other updates. During the annual WWDC keynote, Apple executives revealed Apple Pay Later, a new feature of the… Read More

Read more in: Fintech | Tagged apple, apple pay, apple pay later, apple wallet, bnpl, buy now pay later, fin, financial innovation now